2020 Payroll Calendar

Content

This will result in smaller employee checks each payday, countered by an extra paycheck at year’s end. Employers electing this option should ensure compliance with the federal Fair Labor Standards Act and any relevant state wage laws, Trabold said. hile February typically has 28 days, in leap years—such as 2020—it sprouts a 29th. That can be a headache for HR and payroll professionals—resulting in an extra payday in the calendar year, depending on when and how employees are paid. The 2020 leap year adds an extra day of pay to the year and increases the chance of an extra pay period, bumping the number from 26 to 27 for salaried employees paid biweekly .

The first and most commonly applied option is to make no changes and continue to pay the same amount on each payday, recognizing one extra paycheck in the year. Over the course of five to six years , this anomaly results in the accrual of seven additional days.

Employee Pay Workshop: Compliance Advice

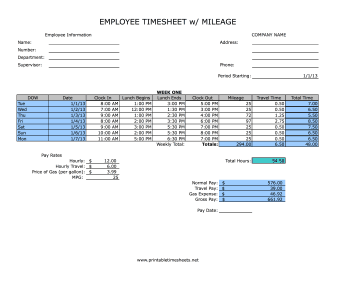

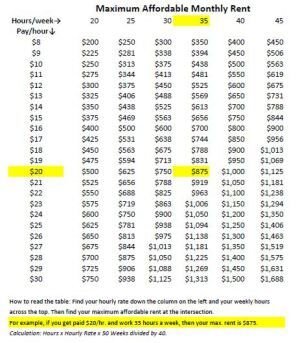

Over time, those extra fractions add up, resulting in 53 paydays for weekly paid employees and 27 paydays for biweekly paid employees. Therefore, the potential for an extra payday is present in both nonleap and leap years. Biweekly Pay Period Calendar 2021 Adp – The pay period is the interval of time between an employee’s paychecks. The employee’s working time is tracked to determine how much they are paid. Common intervals for pay periods include weekly, bi-weekly, monthly, and semi-monthly. Jerry is a salaried employee paid $28,000 a year, on a bi-weekly pay basis.

With a weekly pay period, the employee receives 52 paychecks each year. Weekly paychecks are often paid one week in arrears, meaning that employees are paid for each pay period on the week after it is completed. Paying in arrears gives the employer’s payroll clerk enough time to calculate pay properly. The new Form is available in YES and HRIS training has been updated. All new employees first paid after 2020 must use the redesigned form. Similarly, any other employee who wishes to adjust their withholding must use the redesigned form.

You’ll most likely have to adjust the amount to account for the extra pay period or suppress it in the additional paycheck. Also be mindful of potentially over-funding 401, HSA and FSA accounts beyond the annual limit, in which case you’ll have to return the money to the employee. And they’re not every 11 or 12 years, when there are 27 biweekly pay periods. Employees paid weekly experience an extra pay period every five or six years. The 27th/53rd pay period phenomenon is real and can cause havoc if you’re not prepared. If you pay weekly or biweekly on one of those days, you’ll have an extra pay period that year.

Whether your company will have an extra pay date depends on when you issued your first employee paychecks this year. If you use a weekly or bi-weekly payroll frequency and issued the first paychecks of 2020 on January 2, a 53rd or 27th payday will occur on Thursday, December 31. This likely will affect many companies, as the most common weekly and bi-weekly payday is Friday.

Why Are There 26 Pay Periods In A Year?

An extra paycheck may result in negative tax consequences if those caps are exceeded. This also could be an issue for employers who utilize an accrual system for paid time off. For weekly pay periods, divide the annual salary by 53 instead of 52.

Each pay period during a “normal” year of 26 pay periods, he receives $1076.92. But if there is an extra pay period in a year, he would receive an extra paycheck, more than his actual salary. If your payday falls on one of these “extra” days in the calendar year, you could have 53 weekly pay periods instead of 52, or 27 biweekly pay periods instead of 26. In addition to pay, this throws a wrench in things like payroll deductions for benefits.

If you get to choose a payroll schedule, it’s important to consider all angles before deciding for your small business. With a biweekly schedule, there is consistency for all parties involved; employees know when they’ll get paid, and you know when you need to process payroll. With a semi-monthly payroll schedule, it may be more challenging for employees to budget based on payday changing and it could make running payroll slightly more confusing. From a time spent on payroll aspect, semi-monthly can take longer if you have hourly employees, and with biweekly, you have to account for time spent on the extra paycheck a few times a year. Employers also should consider the possible impact on employer and employee benefit contributions. For example, employees who contribute a percentage of each paycheck to a 401 or flexible spending account program are limited by annual caps.

Payroll Calendar

Semi-monthly is twice a month, resulting in 24 payments in a year, while bi-weekly is every other week, resulting in 26 payments in a year. Likewise, the human resources team should work alongside payroll to adequately prepare the department for the extra pay date. Either way, keep a close eye on payroll taxes, wage garnishments and employee benefit deductions.

Is a month 3 or 4 weeks?

If the Month has 30 Days, then it has 4 Weeks and 2 Days. If the Month has 31 Days, then it has 4 Weeks and 3 Days. February has exactly 4 weeks, except in a Leap Year it has 4 weeks and 1 Day.

Whichever option you choose, be sure to inform your employees upfront so they know what to expect. Also, consider the impact of the extra payday on paycheck deductions, such as payroll taxes and voluntary benefits. To minimize errors, make sure your payroll system is configured to account for leap years.

How To Pay Employees During A Year With 27 Pay Periods

For biweekly pay periods, divide the annual salary by 27 instead of 26. This will slightly decrease employees’ paychecks, but it should even out to their normal salary at the end of the year. So if your salaried employees are paid weekly or biweekly on a Wednesday or Thursday, they might get an extra paycheck.

For example, if your employee benefits contributions are scheduled biweekly, you could over-deduct if you don’t block deductions during the extra pay period. However, if your employee benefits deductions are taken twice per month, you won’t need to make any changes for an additional pay period. count the number of pay periods you’ll have each year, regardless of whether it’s a leap year or not. If you have an extra period, you may choose to adjust employee paychecks and deductions. See our table below for the number of days in 2019, 2020, and 2021 to help you plan accordingly.

If you run the payroll weekly, you could have 53 pay periods in one year even when it isn’t a leap year. The number of pay periods depends on which specific day of the week you pay employees.

In most cases, your employees’ benefits deductions are calculated based on 26 or 52 pay periods. In years with 27 or 53, these deductions will have to be recalculated or blocked in the additional pay period.

Does It Matter Which Day Of The Week I Choose?

Under this schedule, employees typically have higher paychecks compared to a biweekly pay period. It’s important to note that these employees aren’t actually paid more, and employees with a biweekly schedule will “make up” that money in the months with three paydays. As a result, weekly or biweekly salaried employees paid on either of these days will experience an extra pay period. Exempt employees’ annual salary ordinarily is divided by either 52 or 26 paydays, and W-2 income is their stated salary plus any additional compensation (bonuses, taxable fringe benefits, etc.). While a leap year doesn’t guarantee an additional payday for your employees, it does increase the chances.

We generally calculate employees’ salaries, contributions and deductions based on a 52-week calendar year, not bothering to count the leap year. But it’s not simply a matter of adding a pay period when leap year rolls around every four years. In fact, companies with biweekly pay periods will have 27 pay periods only every 11 years, and companies with weekly pay periods will have 53 every 5-6 years. If you pay employees bi-weekly, you normally have 26 pay periods a year. True, an extra pay period isn’t exclusive to leap years, sometimes it just depends on which day of the week you pay your employees. But regardless of when it occurs, it can cause headaches for HR and payroll administrators who aren’t prepared.

- Whether your company will have an extra pay date depends on when you issued your first employee paychecks this year.

- The first and most commonly applied option is to make no changes and continue to pay the same amount on each payday, recognizing one extra paycheck in the year.

- This likely will affect many companies, as the most common weekly and bi-weekly payday is Friday.

- Along the same lines, if you normally pay on Wednesdays, but due to the Jan.1, 2020 holiday, issued payroll on Jan 2, 2020 instead, a 53rd or 27th payday will occur on Wednesday, December 30th.

- Over the course of five to six years , this anomaly results in the accrual of seven additional days.

- If you use a weekly or bi-weekly payroll frequency and issued the first paychecks of 2020 on January 2, a 53rd or 27th payday will occur on Thursday, December 31.

Along the same lines, if you normally pay on Wednesdays, but due to the Jan.1, 2020 holiday, issued payroll on Jan 2, 2020 instead, a 53rd or 27th payday will occur on Wednesday, December 30th. An additional pay period isn’t going to impact your hourly folks, because they will be paid for every hour worked regardless of the number of pay periods. You should, however, make sure that your payroll system recognizes February 29, 2020 as a legitimate day. Before you decide how to compensate employees in a year with an extra pay period, review offer letters and other documents regarding compensation. Collective bargaining agreements are especially specific about pay periods and wages, so check them carefully. If these documents only state an annual salary, you can choose any of the above options to reach that amount.

However, if the documents state that employees will be paid in weekly or biweekly checks of equal amounts, you must comply and choose Option 1. If you pay employees semi-monthly or monthly, instead of weekly or biweekly, you’ll have 24 or 12 pay periods. Employees will receive larger paychecks less frequently, but their total salary will remain unchanged and you won’t have to deal with an extra pay period. You’re not required to pay salaried employees more than their annual salary in years when you have extra pay periods. Some employers choose to reduce pay across all paychecks for the year to adjust for the extra payday. When following a semi-monthly payroll schedule, employees are consistently paid twice per month. While the specific dates will stay the same each month, such as paying on the 5th and 20th of every month, the actual “payday” will vary.

The IRS has a webpage to assist employees in understanding the changes, this includes the IRS Tax Withholding Estimator for individuals. This causes a slight difference in the tax calculation but there is no need for alarm. Two kinds of pay periods for salaried employees are often confused. The pay for these employees is annual pay, paid monthly, semi-monthly, or bi-weekly.

Adding an extra paycheck requires prorating each paycheck downward during the year, which could negatively affect morale. That’s why in years with an extra pay period it’s important to inform employees that their annual salary will come out the same despite slightly smaller paychecks for each pay period.