2021 Irs Form W

Content

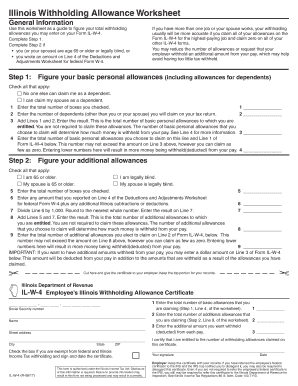

The IRS also posted FAQs about the changes incorporated in the revised form. Another non-seasonal form in PDFfiller’s annual review of tax forms, IRS Form W4 is needed for calculating employee withholding allowance. This section applies to employees who have more than one job or are married and filing jointly with a working spouse. The IRS offers some guidance here for employees to determine whether they need to complete this step and where to look for additional instructions. Option provides the most privacy for the employee’s information, according to the IRS, as well as the most accurate calculations. That’s why having a current, correct and complete beneficiary designation on file is important to prevent delays or errors in your arrears payment.

If an employer does not receive a completed Form W-4 from an employee, they are authorized to withhold federal income tax at the Single – No Deductions rate. The FFCRA credit offsets the Social Security tax component of federal payroll taxes. Eligible employers could claim the credits on their employment tax returns or benefit faster by reducing their federal payroll tax deposits. Due to the federal tax law changes made by the 2018 Tax Cuts and Jobs Act, effective January 1, 2020, all employers must use the new W-4 Form for New Employees. The IRS does not require all current employees to complete the revised form.

Changes made since the last draft include minor edits and added language on page 2 under “Your Privacy.” The W4 form is fairly simple and straightforward to fill out for yourself. If you require assistance, you can usually ask your company’s HR department. Be careful that you have double checked all of your information is correct and complete on the form. Otherwise, you may end up owing additional income tax at the end of the year.

The form has been revised to comply with the federal tax law changes that took place in 2018. Employees are not required to complete the new form at this time but may elect to submit a new form.

Get The Free W4 Form 2020 Pdf

At the end of the tax year, the withheld funds will be released to the IRS. Then, depending on your individual tax return information to the IRS, you will either receive a refund from the IRS or have the opportunity to pay any extra taxes. All new employees need to fill out the new Form W-4, Employee’s Withholding Certificate once they are hired. Filling out the form accurately is the responsibility of the employee, and the employer must accept the completed form as it is filled out.

Anyone hired after Jan. 1, 2020, must complete the 2020 Form W-4, Employee’s Withholding Certificate and the K-4, Kansas Employee’s Withholding Allowance Certificate for state withholdings, if applicable. Again, until the update HRIS is complete, paper forms will need to be submitted to HCS payroll. The 2020 Form W-4 is available as a PDF at irs.gov/pub/irs-pdf/fw4.pdf. Please consult with a tax advisor and review IRS Publication 15-T if you have any questions regarding the updated form.

The IRS reminds taxpayers that this draft Form W-4 is not for current use, but is a draft of the form to be used starting in 2020. Employees who have submitted a Form W-4 in any year before 2020 will not be required to submit a new form merely because of the redesign.

Make Payroll A Breeze

The only two steps required for employees submitting a new form are Step 1, where they enter personal information such as their name and filing status, and Step 5, where they sign the form. The 2020 Form W-4 is presented on a single, full page, followed by instructions, worksheets and tables. In place of withholding allowances, the new W-4 includes a process with five possible steps for declaring additional income, so employees can adjust their withholding with varying levels of accuracy, privacy and ease of use. As before, employees’ tax liability is based on combined income from all sources, including second jobs, investment income and a spouse’s earnings.

If an employee hired prior to 2020 chooses to not complete the new form, the employer will continue to calculate withholding based on the information provided on the most recently submitted W-4 form. If a current employee who has completed a previous W-4 wants to make changes to their 2020 withholding tax, the new form must be used. Employees can use the IRS Tax Withholding Estimator to help them complete the new Form W‑4. The calculator, updated in August with several new functions, is designed to help employees estimate any additional withholding.

- If you choose not to complete a new W-4 form, payroll tax withholding in 2020 will continue to be based on the most recent W-4 form submitted.

- The form has been revised to comply with the federal tax law changes that took place in 2018.

- “Generally, the new Form W-4 is an improvement for employees,” said Pete Isberg, vice president of government relations at payroll and HR services firm ADP.

- Employees are not required to complete the new form at this time but may elect to submit a new form.

To receive this payment, your AOP beneficiary will need to send us a claim form. When we receive word of your death, this claim form will be sent in a condolence package to the AOP beneficiary you designated for your account. Employees that have questions can contact their servicing human resource office, payroll office and/or customer service representative. Retirees are advised to contact their tax preparer or financial advisor. • If your total income will be less than $71,201 ($103,351 if married filing jointly), enter “1” for each eligible dependent. • If your total income will be less than $71,201 ($103,351 if married filing jointly), enter “4” for each eligible child.

Payroll And Tax Compliance Office

Form W-4 should be filled out by every new employee preferably on their first day of employment, but no later than their first week. You do not need to file your employees’ W-4 forms with the IRS, but they should be kept on file with other personnel records for a minimum of four years. Payroll software providers often offer options for the employee to complete this paperwork entirely online — and often before their first day so you can get to training right away. Single taxpayers with an income of $200,000 or less ($400,000 if married filing jointly) are now eligible for the child tax credit as a result of the TCJA as well. Your employee will enter their personal information including name, address, and their filing status. Note that for any employee who does not have a completed W-4 on file, you will calculate withholdings at the higher “Single” rate. As an employer, you can answer some general questions about W-4s for employees, but you can not fill out the form for your employee, nor can you suggest what impact their selections will have on their taxes.

Claim Dependents has been added to the form which will allow employees to directly enter their expected full-year tax credits. A worksheet to help taxpayers with the new form “will not be provided to the employer, further assuring privacy,” Trabold noted. If Steps 2, 3 or 4 apply to employees and they choose to provide that information, their withholding will more accurately match their tax liability if they complete them. Employees, however, can adjust their withholding in Step 4 without sharing additional information. All new employees hired as of Jan. 1, 2020, must complete the new form. On Dec. 5, the IRS released the long-awaited final version of the 2020 Form W-4, retitled Employee’s Withholding Certificate, with major revisions designed to make accurate income-tax withholding easier for employees starting in 2020.

Again, current K-State employees are not required to complete the new Federal 2020 Form W-4. Currently, HCS and Information Services Office are in the process of testing the new 2020 Form W-4 and will update HRIS Self Service as soon as the testing is complete. Until these updates are completed, a paper W-4 and K-4 will be required for anyone wanting to change their federal or state tax status. There are many life events that can result in the need to change your tax withholding. Taking on a second job, a spouse getting a new job, and investment income, these are all reasons you may want to increase your withholding.

“Additional tax may be due at the time of filing if withholding is not sufficient to meet tax obligations,” Barber explained. So employees may want to make adjustments to reflect these additional incomes, deductions and credits. If a newly hired employee in 2020 does not complete a 2020 Form W-4, the employer instructions state that employers should treat them as a single filer with no other adjustments. “The primary goals of the new design are to provide simplicity, accuracy and privacy for employees while minimizing burden for employers and payroll processors,” IRS Commissioner Charles Rettig said.

Although this may lead to too much withholding for some taxpayers, “it will help address concerns of those who prefer to get a refund check every year or who may have had to unexpectedly pay tax when filing this year.” Not requiring employees to submit the new W-4 will ease HR’s burden, but it also means that “employers will need to program their payroll system to accommodate the existing withholding calculation, as well as the new method,” Barber said. However, “companies’ payroll software will not necessarily require two different systems for the two different forms, since the same set of withholding tables will be used for both,” he explained. The space below step 4 is used for employees to identify that they are nonresident aliens or are exempt from paying taxes. “If you use an electronic form, developers are instructed to provide a place to enter the information, such as a check box,” Jacobsohn said.

Getting married, having a child, and increases in tax deductions are potential reasons to decrease your withholding. Other Income and Adjustments has been added to allow employees to enter the estimated full-year, non-wage income such as rental income, interest and dividends. The section also allows employees to enter full-year deductions such as mortgage interest and charitable contributions.

“Employers can ask employees hired before 2020 to use the new form, but are not required to do so,” said Jon Barber, senior vice president of tax policy and research at Ayco, a financial counseling and investment management firm. Employers should, however, “explain that withholding will continue based on the form they previously submitted and may not be as accurate as using the new W-4.” Current employees are not required to complete a new form but can choose to adjust their withholding based on the new form. Businesses with employees need form W-4 in order to take the right amount of federal taxes out of their pay. Employees will need a new Form W-4 each year, or when their personal or financial situation changes. For example, if you have a child during the year you will want to fill out a new W-4 to account for the child as a dependent. People with major life changes, such as a marriage or a new child, should also check their withholding.

Employers can continue to compute withholding based on the information from the employee’s most recently submitted Form W-4. The IRS expects to release a near-final draft of the 2020 Form W-4 in mid-to-late July to give employers and payroll processors the tools they need to update systems before the final version of the form is released in November. To make additional improvements to this initial draft for 2020, the IRS is now accepting comments for 30 days. To facilitate review of this form, IRS is also releasing FAQs about the new design. The Department of Taxation’s forms and instructions, as well as many brochures, newsletters, and reports are provided as pdf files. The only two steps required for all employees is Step 1 which includes personal information and filing status and Step 5, where the employee signs and dates the form.

If you choose not to complete a new W-4 form, payroll tax withholding in 2020 will continue to be based on the most recent W-4 form submitted. “Generally, the new Form W-4 is an improvement for employees,” said Pete Isberg, vice president of government relations at payroll and HR services firm ADP. This sample document provides instructions on how to complete 2020 W-4 federal tax withholding certificate if an employee has evaluated their tax situation and determined that claiming exempt is appropriate for their situation. Forms should simply be kept on file for the IRS to review if necessary. They are mostly used by businesses to calculate the correct tax withholding amount. IRS Form W4 helps employers to withhold the correct amount of federal income tax from your pay.

The employee completes this form to notify his/her employer of the amount of Arizona withholding to be taken from his/her paycheck. If an employee hired in 2020 and beyond, does not complete the new form, the employer will withhold at the highest rate of Single with no adjustments for dependents or other income.