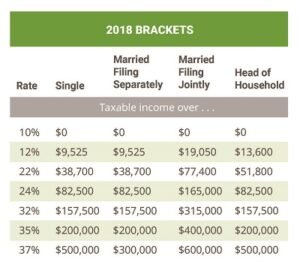

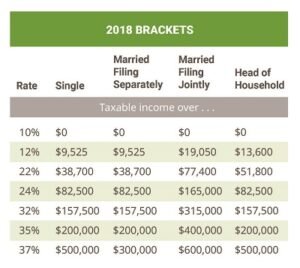

2021 Tax Brackets

Content

The amount you set aside is treated as an employer contribution to a qualified plan. An elective deferral, other than a designated Roth contribution , isn’t included in wages subject to income tax at the time contributed. However, it’s included in wages subject to social security and Medicare taxes. For those who are responsible to run payroll, here’s a guide to help you comprehend the concept of federal taxable wages.

Generally, the employee’s gross wages will be equal to the taxable wage base. Typically, an employer will handle this calculation and withhold the correct amount of taxes from each of the employee’s paychecks; however, the employee is still responsible for reporting the tax. The City Wage Tax is a tax on salaries, wages, commissions, and other compensation. The tax applies to payments that a person receives from an employer in return for work or services. All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

You claimed the standard deduction on your 2019 federal income tax return. In 2020, you received a refund of your 2019 state income tax. Don’t report any of the refund as income because you didn’t itemize deductions for 2019. Payments received under FECA for personal injury or sickness, including payments to beneficiaries in case of death, aren’t taxable. However, you’re taxed on amounts you receive under FECA as continuation of pay for up to 45 days while a claim is being decided.

What’s The Standard Deduction For 2020 Vs 2021?

This is key to understanding the kinds of income that are taxed as well as to be able to report an employee’s taxable wages on form W-2, which can impact your company’s qualified business income deduction . The taxable wage base is the maximum amount of earned income that employees must pay Social Security taxes on.

Report this income on line 1 of Form 1040 or 1040-SR. Also, pay for sick leave while a claim is being processed is taxable and must be included in your income as wages.

If both you and your employer pay for the plan, only the amount you receive that is due to your employer’s payments is reported as income. However, certain payments may not be taxable to you. For information on nontaxable payments, see Military and Government Disability Pensions and Other Sickness and Injury Benefits, later in this discussion. If you transfer a nonstatutory stock option without a readily determinable value in a non-arm’s-length transaction , the option isn’t treated as exercised or closed at that time. You must include in your income, as compensation, any money or property received.

Minimum retirement age is generally the age at which you can first receive a pension or annuity if you aren’t disabled. The payment is also treated as wages for figuring your social security and Medicare taxes and your social security and Medicare benefits.

This publication discusses many kinds of income and explains whether they are taxable or nontaxable. It includes discussions on employee wages and fringe benefits, and income from bartering, partnerships, S corporations, and royalties. It also includes information on disability pensions, life insurance proceeds, and welfare and other public assistance benefits. Check the index for the location of a specific subject.

Don’t include them in the total dividends received. If you’re covered by certain kinds of retirement plans, you can choose to have part of your compensation contributed by your employer to a retirement fund, rather than have it paid to you.

You can claim a refund of any tax paid on the excludable amount by filing an amended return on Form 1040-X for each previous year during the retroactive period. You must include with each Form 1040-X a copy of the official VA determination letter granting the retroactive benefit. The letter must show the amount withheld and the effective date of the benefit. If the amount of the premiums was included in your income, you’re considered to have paid the premiums and any benefits you receive aren’t taxable. In most cases, you must report as income any amount you receive for personal injury or sickness through an accident or health plan that is paid for by your employer.

- Supreme Court ruled that “money remuneration” is “currency issued by a recognized authority as a medium of exchange,” and that employee stock options aren’t “money remuneration” subject to the Railroad Retirement Tax Act .

- The timing, type, and amount of income inclusion depend on whether you receive a nonstatutory stock option or a statutory stock option.

- Tier 1 and Tier 2 taxes aren’t withheld when employees covered by the RRTA exercise stock options.

- If, in a previous year, you received a bonus payment by a state or political subdivision because of service in a combat zone that you included in your income, you can file a claim for refund of the taxes on that income.

- Your employer can tell you which kind of option you hold.

- Federal income tax must still be withheld on taxable compensation from railroad employees exercising their options.

To recover Additional Medicare Tax on the repaid wages or compensation, you must file Form 1040-X for the prior year in which the wages or compensation were originally received. You paid 2019 estimated state income tax of $4,000 in four equal payments. In 2020, you received a $400 tax refund based on your 2019 state income tax return. You claimed itemized deductions each year on Schedule A . If you retired on disability, you must include in income any disability pension you receive under a plan that is paid for by your employer. You must report your taxable disability payments as wages on line 1 of Form 1040 or 1040-SR until you reach minimum retirement age.

Unemployment Benefits, Income

Supreme Court ruled that “money remuneration” is “currency issued by a recognized authority as a medium of exchange,” and that employee stock options aren’t “money remuneration” subject to the Railroad Retirement Tax Act . Tier 1 and Tier 2 taxes aren’t withheld when employees covered by the RRTA exercise stock options. Federal income tax must still be withheld on taxable compensation from railroad employees exercising their options. The timing, type, and amount of income inclusion depend on whether you receive a nonstatutory stock option or a statutory stock option.

Your employer can tell you which kind of option you hold. If, in a previous year, you received a bonus payment by a state or political subdivision because of service in a combat zone that you included in your income, you can file a claim for refund of the taxes on that income. In most cases, you must file your claim within 3 years after the date you filed your original return or within 2 years after the date you paid the tax, whichever is later. See the Instructions for Form 1040-X for information on filing that form. If your former employer provided more than $50,000 of group-term life insurance coverage during the year, the amount included in your income is reported as wages in box 1 of Form W-2. Box 12 will also show the amount of uncollected social security and Medicare taxes on the excess coverage, with codes M and N. You must pay these taxes with your income tax return.

At the time of the exercise, the transferee recognizes no income and has a basis in the stock acquired equal to the FMV of the stock. Financial counseling fees paid for you by your employer are included in your income and must be reported as part of wages. Fees for tax or investment counseling are miscellaneous itemized deductions and are no longer deductible. If you’re an eligible individual, you and any other person, including your employer or a family member, can make contributions to your HSA. Contributions, other than employer contributions, are deductible on your return whether or not you itemize deductions. Contributions made by your employer aren’t included in your income. Distributions from your HSA that are used to pay qualified medical expenses aren’t included in your income.

How To Pay

For more information, see the Instructions for Forms 1040 and 1040-SR. These payments are treated as wages and are subject to income tax withholding, but not FICA or FUTA taxes. In most cases, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options. You can receive income in the form of money, property, or services.

Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. If you had to repay an amount that you included in your wages or compensation in an earlier year, and on which Additional Medicare Tax was paid, you may be able to recover the Additional Medicare Tax paid on the amount.

However, these payments aren’t treated as social security and Medicare wages if you’re a household worker or a farm worker. Gross income, however, can incorporate much more—basically anything that’s not explicitly designated by the IRS as being tax-exempt. Tax-exempt income includes child support payments, most alimony payments received after Dec. 31, 2018, compensatory damages for physical injury, veterans’ benefits, welfare, workers’ compensation, and Supplemental Security Income.

The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018.

These sources of income are not included in your gross income because they’re not taxable. Any payments made to you by an employer during the time you’re performing service in the uniformed services are treated as compensation. These wages are subject to income tax withholding and are reported on Form W-2. See the discussion under Miscellaneous Compensation, earlier. Dividends you receive on restricted stock are treated as compensation and not as dividend income. Your employer should include these payments on your Form W-2. If they are also reported on a Form 1099-DIV, you should list them on Schedule B , with a statement that you have included them as wages.

Get 3 Months Free* When You Sign Up For Payroll Processing Today

H&R Block employees, including Tax Professionals, are excluded from participating. Unemployment benefits must generally be included on your federal and state income tax returns as taxable income. Unemployment income includes any money and the value of any other assistance received under the unemployment laws of the United States or of a particular state. The government will send you a Form 1099-G showing the total amount they paid you. If your employer pays for you to relocate and the moving expenses would have been deductible if you had paid them yourself, you do not have to include the paid moving expenses as taxable income.