4 Ways To Use Adp For Payroll

Content

The key to accurately figuring double-time pay lies in determining when workers are entitled to the increased rate. This all depends on your company’s overtime and double time policy, and your employer should follow any overtime or double time rules that your state has. Your overtime and double time rates will also be calculated depending on the start of your work week. I would suggest speaking with your supervisor so you can understand what policy your business follows. You can find out if you get overtime and if you get double time for the hours that you work.

On the seventh consecutive day of work in a workweek, one and one-half times the employee’s regular rate of pay for the first eight hours of work. Double the regular rate of pay for all hours worked over eight. Managing payroll presents a challenge for businesses of all sizes. Larger companies tend to earn the spotlight here, with their high numbers of employees requiring accurate, timely paychecks.

Some states require overtime pay in additional circumstances and at different rates. The first step for calculating double-time pay is to determine when the higher rate should apply. For example, company policy might require double time when an employee works on a federal holiday. If his regular hourly rate is $15, the double-time rate equals $30 per hour. Exempt salaried employees don’t receive double-time pay. An hourly worker can be paid at double her usual rate of pay. A non-exempt salaried worker can be eligible for double time, because the salary is based on an hourly rate.

At the end of the year, ADP creates and issues W-2s and 1099s to your employees and contractors. Unfortunately, payroll is one of those things you can’t let just anyone handle. You need someone who understands the various withholding taxes – including federal, state, and local – as well as tracking employee time, leave balances, overtime, and more. Payroll administrators can calculate employee time card hours and minutes worked per week or pay period.

How Do You Pay Employees With Multiple Pay Rates?

In addition, ADP files and deposits your organization’s payroll taxes, and even guarantees their accuracy so long as the data you provide is accurate. You can also use the software to manage employee benefits , and create posters to hang in the workplace to ensure compliance with state and federal statute. It also ensures you remain compliant by filing relevant paperwork on new hires.

With this tier, you’ll get everything from the previous tiers plus a few options to give you a more complete solution. The Complete tier will get you a number of HR tools, the employee handbook wizard, and the document vault. This is a great option for small businesses that find themselves spending hours or days on complicated payroll and HR issues. Plan costs vary according to which service you choose and the number of employees you have. The basic package starts at $10 per employee, per month, with fees typically paid each time you pay your employees (bi-monthly, every two weeks, etc.). More advanced plans cost around $23 per employee, per month.

Hourly employees who work long shifts or long weeks might be entitled to double time compensation. For employers, multiple pay rates add another level of complexity to the payroll process—particularly once overtime becomes a factor.

When an employee works seven consecutive days, the employee is entitled to double time pay after the first 8 hours on that seventh workday. One and one-half times the employee’s regular rate of pay after the eighth hour worked through the twelfth hour worked in any workday. Double the employee’s regular rate of pay for all hours worked in excess of 12 hours in a workday. Double-time pay is a pay rate that is twice the employee’s normal rate of pay. Employees might be eligible for double-time pay when they work overtime hours, or holiday pay for employees working on federal holidays. This professional payroll service keeps track of your employees hours, salaries, time off, taxes, benefits, and anything else that has to do with paying your employees.

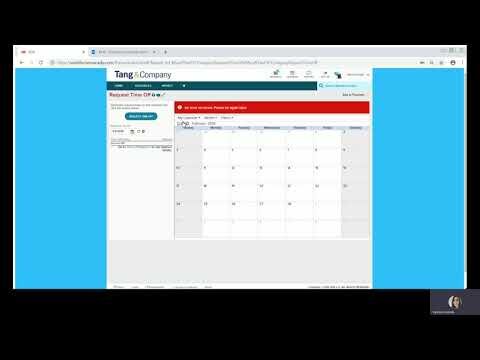

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. First, you’ll want to check to see what your state’s overtime policies are. Once you know that, then you can calculate your hours. Double time simply means an employee is paid at twice her regular hourly rate for certain hours worked.

- Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

- First, you’ll want to check to see what your state’s overtime policies are.

- Then click “Enter Paydata” and select “Paydata” from the popup menu.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

Hours.” Enter the number of regular hours each employee worked. The system will automatically calculate the gross salary, deductions and net salary for the pay period. Click on the “save” button frequently to save data you have entered. When you are done, click on the “done” button.Enter the number of overtime hours in the “O/T Earnings” column. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period. Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to.

Adp Streamline Payroll

This will override the Automatic Pay for the employee for this pay period. This is the process for entering data for your salaried and hourly employees who are not set up for Automatic Pay. You enter paydata in batches, which are groups of employees. You can use previously-created batches, or you can create and customize new batches.Click on “Process” in the task bar at the top of the page. In the pop-up menu, under “Payroll,” select “Payroll Cycle.” You will be directed to the Payroll Cycle page.

Punches are automatically generated from calculations, and no punches come from clocks, the Time Entry module, or ODI. Hours are calculated baed on salaried hours and the number of allocated days in the Employee Maintenance module. I am forced to work overtime and at times over 12 hour days plus 2 hour lunch. When i go over 12 hours the company refuses to pay double time. California state labor law provides for double-time pay in two situations that you should be aware of if you hire employees in this state. First, if an employee works seven consecutive days, she must be paid double time for time worked in excess of eight hours on the seventh day.

How Does Adp Payroll Work?

The FSLA does not require double-time pay, but some state labor laws do. A union contract may call for double-time pay in some circumstances. Even when laws or labor contracts do not mandate double time, employers sometimes offer it as part of their policy. Typically, employers pay double time to employees who work on holidays or Sundays. In some instances, employers pay double time for overtime hours instead of the lower time and one-half rate required by federal law. If you select this option, TimeSaver displays regular and total pay by position, department, and site . Because paid hours impact only salaried employees, TimeSaver does not calculate overtime or double-time hours for these employees.

Second, if an employee works more than 12 hours in the same day, she is entitled to double time for the time worked in excess of 12 hours. If the employee works eight hours on a holiday, you have $30 times 8 , which equals $240. If he worked 32 hours the rest of the week, this is 32 times $15, or $480. Add the regular and double-time pay together, and submit the information to your payroll department. In this example, you have $240 plus $480, for a total of $720. Employees are often paid more when they work extra hours or work at times when other workers are taking time off. For example, the federal Fair Labor Standards Act says hourly workers receive time and one-half pay for working more than 40 hours in a week.

When employees work through the end of their workday and into the next, they might not get double time even after working over 12 hours. This is because working into the next day effectively creates 2 shifts on two different workdays.

For most companies, the cost of ADP payroll processing is going to depend on the number of employees and the type of services/features you need. From managing employees to monitoring finances, you may find that you’re doing dozens of jobs in one. The last thing you want to do is stress over payroll and human resource management. Payroll tax withholding is calculated automatically and deducted from employee pay.

The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck. However, sometimes you need to make one-time changes. Input the appropriate salary information in the paydata grid.

Manually Entering Paydata

In this situation, the employee could work 7 hours in the evening and 6 hours in the morning, cutting off the workday. If the employee doesn’t have another evening shift, the employee wouldn’t get double time. An every other day on/off schedule could cause the employee to not get double time. The Fair Labor Standards Act requires employers to pay non-exempt employees 1.5 times their “regular rate of pay” for all hours worked over 40 in a workweek.

For example, an employee will work 8 hours in a given workday, paid at the regular rate of pay. All the time after 8 hours but before 12 will be paid at time and a half. After the 12th hour, time needs to be paid at double the employee’s rate of pay. For employees who work consecutive 12 hour days, the time of the workday doesn’t really matter. If the employee works 7 hours in the morning, takes the afternoon off, and then works another 6 in the evening, the employee would still get double time pay. The workday might be an issue for an employee who works over 12 hours from one workday into the next and then is not scheduled for another shift that day.

Paid time off for holidays and holiday pay are given to employees based a decision made by the boss. In other words, it’s up to your boss how you’re paid for working on holidays. If they choose to pay double time, then you’re in luck. If they only pay regular for holiday work, then you will only get regular pay. If an employee works seven consecutive days, they are entitled to double time pay after the first 8 hours on that seventh workday. When the hours worked in one day exceed 12, employees are paid double time for every hour worked thereafter.