A Beginner’s Guide To Imputed Income

Content

In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options. Examples of this include the receipt of sporting event tickets, awards of merchandise, and prizes. The amount of a taxable fringe benefit reported on the employee’s Form W-2 is the fair market value of the item. A taxable fringe benefit provided on behalf of an employee is taxable to the employee even if the benefit is subsequently given to another person, such as the employee’s spouse, child, or friend. Independent contractors are workers you hire for a specific job.

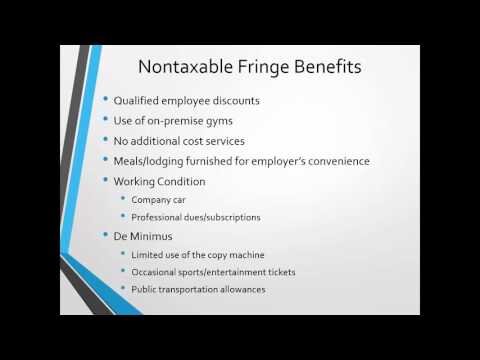

When making this decision, it’s important to understand which fringe benefits are taxable and which are not to avoid any surprises when tax time rolls around. If your employees are unionized, they’ll likely have to pay for their membership and any taxable benefits offered through the union. Other types of job expenses that can be deducted from payroll include uniforms, meals and travel. Some people assume these perks are given and received free from taxation, but this isn’t always the case. In general, fringe benefits are taxable to the employee and are subject to withholding and employment taxes, but there are exceptions. To avoid any surprises at tax time, it’s important to understand which fringe benefits are taxable and which benefits are nontaxable. Why not opt for the easier of the two and let your payroll service do the heavy lifting?

“Fringe benefits,” also known as “imputed income,” is a form of non-cash payment that employers remit to employees, often as incentives, for the performance of services. Imputed income is generally taxable, and must be included in the total amount you report on W-2s. Some fringe benefits are not part of a worker’s taxable compensation.

Many fringe benefits are considered tax-free by the IRS and can be a great value-add for your employees. Taxable fringe benefits paid by an employer are typically subject to withholding when they are made available to the employee. Employees are required to claim the fair market value of all taxable fringe benefits on their annual personal income tax return. Although fringe benefits are typically taxable, some are nontaxable. Taxable fringe benefits can include personal use of a company car, bonus pay, and paid time off.

You give your employees the option between receiving cash benefits or a health savings account . Your employee chooses to have an HSA and contribute $100 per pay period. Their contributions to this account are taken out of their wages before taxes, lowering their taxable income and reducing their tax liability. For federal income tax withholding, you can either add the value of the fringe benefits to the employee’s regular wages, or you can withhold at the fringe benefit tax rate of 22% . Withhold FICA tax on the fringe benefits added to the employee’s wages. There are certain benefits you can provide as an employer that are exempt from taxation.

Unlike your employees, you do not include independent contractors on your payroll or take out taxes. However, you still pay them for the work they do in regular wages and even fringe benefits.

Taxable fringe benefits are usually subject to withholding when they are made available. Employers and employees are required to claim the fair market value of taxable fringe benefits. This may differ from the amount an employer paid for the benefit because companies may receive corporate discounts. As a small-business owner, you may choose to provide your workers with fringe benefits on top of their normal pay rate. Fringe benefits are a form of compensation given in exchange for the performance of services, and can be provided to full- and part-time employees, independent contractors, and partners. Generally, you must include in gross income everything you receive in payment for personal services.

Taxes

A taxable fringe benefits are certain noncash fringe benefits received from an employer whose value are considered part of an employee’s compensation. An employer generally must withhold income tax on these benefits from an employees regular pay for the period the benefits are paid or considered paid. Anytime an employer provides an employee a fringe benefit, that fringe benefit is subject to federal income taxes unless the law specifically excludes it. Fringe benefits for employees can take the form of property, services, cash, or some cash equivalent . Generally speaking, fringe benefits are taxable to the employee and must be included as supplemental income on the employee’s W-2 form. These fringe benefits are also generally subject to withholding and employment taxes. An employee “fringe benefit” is a form of pay other than money for the performance of services by employees.

The IRS is cracking down on employers that don’t properly report their employees’ wages. Many employers and employees may think that certain fringe benefits don’t have to be included in wages – and therefore subject to federal income tax withholding and employment taxes – but this can be a costly error to make. specifies the many non-taxable fringe benefits you do not need to include in a calculation of the recipient’s pay. Some benefits are negligibly small (known as “de minimis”), or exist on site and can only be used by employees (for example, in-office gyms), or are incidental to the employer’s main business .

- A taxable fringe benefits are certain noncash fringe benefits received from an employer whose value are considered part of an employee’s compensation.

- An employer generally must withhold income tax on these benefits from an employees regular pay for the period the benefits are paid or considered paid.

- Fringe benefits for employees can take the form of property, services, cash, or some cash equivalent .

- Anytime an employer provides an employee a fringe benefit, that fringe benefit is subject to federal income taxes unless the law specifically excludes it.

Any fringe benefit provided to an employee is taxable income for that person unless the tax law specifically excludes it from taxation. Taxable fringe benefits must be included as income on the employee’s W-2 and are subject to withholding. Other fringe benefits are tax-free and need not be included in the employee’s compensation. While every employer has the responsibility to properly report its employees wages, each individual is ultimately responsible for correctly reporting their income to the IRS. If you receive any of the benefits described above, ask questions. The best place to start is with your company’s payroll department. Make sure that you report the value of any taxable fringe benefits as income on your tax return, whether or not your employer correctly includes them in W-2 wages.

Think Adp® Is Too Big For Your Small Business? Think Again

In order to properly account for this benefit, you need to add $150 to Shannon’s taxable income. Adding this total will ensure that taxes are calculated and paid accurately. Remember, you only want to add the value of the fringe benefit to your employee’s total taxable income. Any fringe benefit that’s considered exempt should not be included in the employee’s gross wages. If you offer or plan to offer your employees various fringe benefits, you need to know which benefits are exempt, and which need to be reported as taxable income. Taxable fringe benefitsare not included in the Total Gross, so you must add them to your Total Gross pay. If you have taxable fringe benefits, they will be listed in the Hours and Earnings section of your pay statement.

Taxable fringe benefits must be included as income on the employee’s W-2 and are subject to withholding. Taxable fringe benefits are included in gross income and subject to federal income tax, Social Security tax, Medicare tax, and FUTA. This type of fringe benefit includes property or services that, had you paid for it, would have been deductible on your tax return as an unreimbursed business expense. The IRS allows you to choose the schedule you wish to use when reporting taxable fringe benefits. However, you are still responsible for paying the appropriate amount of withholding taxes based on when the benefit is paid. Let’s say you decide to establish a cafeteria plan at your business.

Although some fringe benefits are considered a part of taxable income for employees, there is a lengthy list of common fringe benefits that are excluded from an employee’s taxable compensation. First, fringe benefits that fall under the definition of de minimis benefits are not taken into consideration when determining taxable income. De minimis benefits are those that hold such a minimal amount of value that employers would have a difficult time accounting for them. Any fringe benefit offered as a bonus to an employee from an employer is considered taxable income, unless it falls under a specific list of excluded benefits as determined by the IRS. Taxable fringe benefits must be included on an employee’s W-2 each year, and the fair market value of the bonus is subject to withholding. A working condition fringe benefit is tax free to an employee to the extent the employee would be able to deduct the cost of the property or services as a business or depreciation expense if he or she had paid for it.

Taxable fringe benefits are generally subject to withholding when they are made available. Employees can elect to treat taxable fringe benefits as paid in a pay period (quarterly, semi-annually, or annually), but all benefits must be treated as paid by December 31 of the calendar year in which they were provided. What are fringe benefits and which of them should be consideredpart of an employee’s taxable pay? In the following FAQs, we answer questions most often asked by employers regarding fringe benefits, often considered compensation beyond the employee’s normal wages. What are fringe benefits and which of them should be considered part of an employee’s taxable pay? Line of business limitations is a federal income tax rule applied to fringe benefits that employers provide their employees.

In addition, a bonus that falls under the category of a working conditions benefit, such as a mobile phone or company car, can be considered taxable if used outside of business. You can also look at fringe benefit as a form of pay other than money for the performance of services by your employees. For example, group term life insurance is a fringe benefit, and so are company-sponsored meals during business travel. Fringe benefits cover a wide array of things and some are tax free, and other are considered taxable by the IRS.

Additionally, a number of taxable fringe benefits are withheld up to a certain dollar value. Commuter passes, for example, don’t count as fringe benefits as long as they’re under $260 in tax year 2018. Not all of the compensation employees receive arrives in their paycheck.

Retirement Plans

Payroll applications such as OnPay and Paychex Flex can easily manage imputed income and fringe benefit reporting, provide imputed income tax totals, as well as include those totals on employee W-2s at year end. If this were all you needed to consider, Shannon’s gross wages would be $1,150, which is the total that would be used to calculate withholding taxes. However, Shannon’s employer also provides her with a company car, which has a fair market value of $150 per week.

Some nontaxable fringe benefits include group-term life insurance up to $50,000 and employee discounts. You can receive income in the form of money, property, or services. This section discusses many kinds of income that are taxable or nontaxable. It includes discussions on employee wages and fringe benefits, and income from bartering, partnerships, S corporations, and royalties. The information on this page should not be construed as all-inclusive. Other steps may be appropriate for your specific type of business.

The resulting amount is the total taxable value of the fringe benefits you provided your employee, which is their imputed income. Enter that into your payroll system so it will show up on their W-2 and they can pay taxes correctly.

But the value of any personal use of a working condition fringe benefit must be included in the employee’s compensation, and he or she must pay tax on it. The employee must meet any documentation requirements that apply to the deduction. However, there are also many “typical” fringe benefits that are considered taxable.

That means the benefits might not be subject to federal income tax withholding, FICA, and FUTA tax. In most cases, they are not included on the employee’s Form W-2. Common fringe benefits provide employees total compensation above and beyond their typical wages or salaries. Health insurance premiums, child care, transportation vouchers, and retirement account matching contributions are among the most common fringe benefits.

Don’t Miss Out On These Employee Perks And Fringe Benefits

These are called nontaxable fringe benefits, and are not subject to federal income tax withholding, are excluded from gross income, and are not reported on Form W-2. As a small business owner, it’s entirely up to you to decide what, if any, fringe benefits you will offer your employees.

To take advantage of an employer’s fringe benefits in the most effective way, it is important for employees to understand how common fringe benefits are considered for taxation purposes. Fringe benefits is the umbrella term for any benefits, from health insurance to paying for weekly team lunches, that an employer provides to an employee, contractor, board member, or business partner.