Accounting for Gyms

For a business owner or an individual, a gym expense typically falls under “operating expenses” or personal expenses, respectively. Secrecy Shields for Financial Fortitude Maintaining client confidentiality is paramount when entrusting someone with your gym’s financial matters. Your chosen bookkeeper should have an unwavering commitment to upholding this trust. Gym liabilities could include loans taken out to start or improve the business, money owed to suppliers, unpaid wages, and accrued expenses. Regular repairs and maintenance not only help prolong the lifespan of equipment but also ensure member safety. Keeping a logbook for all maintenance activities helps monitor expenses incurred for servicing various machines or fixtures within the facility.

Importance of Maintaining Accurate Records and Financial Statements

Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Whether you’re trying to determine the best accounting system for your business, learn how to read a cash flow statement, or create a chart of accounts, QuickBooks can guide you down the right path. If you’re like most modern business owners, odds are you didn’t become one so that you could practice professional-level bookkeeping.

Tracking gym equipment purchases, depreciation, maintenance costs, etc.

Your general ledger should be up to date so that your bookkeeping software is able to provide functionality that you can navigate easily. QuickBooks is an excellent option for novice and seasoned digital bookkeepers alike. Those baby steps can help you manage your organization on a new and improved system. Small steps also give everyone time to familiarize themselves with the new bookkeeping software.

What features should the best accounting management software for gyms have?

Exercise.com’s integration with accounting software, like QuickBooks, is beneficial for gyms as it provides a comprehensive solution for managing both gym operations and finances. This integration facilitates accurate financial reporting, simplifies the billing process, and ensures seamless financial management. Exercise.com, while not an accounting software itself, complements accounting functions with its robust gym management features, making it an ideal choice for gyms seeking efficient operational and financial management. Kashflow is an online accounting solution accessible 24/7 for small businesses, including gyms and fitness centers.

By having access to this data, businesses of all sizes and ages can make strategic plans and develop realistic objectives. When it’s finally time to audit all of your transactions, bookkeepers can produce accurate reports that give an inside look into how your company delegated its capital. The two key reports that bookkeepers provide are the balance sheet and the income statement.

We deliver tax-ready financials

Gym owners should consult legal counsel or tax experts for guidance in classifying workers correctly based on relevant guidelines and criteria set forth by governmental agencies. Accurate payroll management is crucial, not just for your employees’ satisfaction, but for tax purposes too. Regular bookkeeping will help you stay on top of your finances and will make tax time much easier. The structure of your business, such as whether it’s a sole proprietorship, partnership, LLC, or corporation, can have significant implications for your accounting and tax requirements. It’s important to select a structure that suits your business needs and provides the appropriate level of liability protection. If you’re unfamiliar with local and federal tax codes, doing your own bookkeeping may prove challenging.

For example, under revenue accounts in a gym’s chart of accounts, you may find subcategories like “membership fees,” “personal training,” “group classes,” “merchandise sales,” etc. This level of specificity allows gyms to track each source of revenue separately and evaluate their performance individually. Gym accounting doesn’t have to be difficult, but it can be confusing if you are not accustomed to the systems. Seeking out education and advice from professionals can allow any gym owner to confidently manage their gym’s finances. If you are looking for a low cost automated solution to perform the role of gym accounting software, you may consider Xero as an option. An entry-level subscription of Xero will limit you to sending five bills and invoices, and bank reconciliation will be restricted to a maximum of 20 transactions.

On the other hand, if you have in-depth tax and finance knowledge beyond the bookkeeping basics, you may be able to get the job done. Trying to juggle too many things at once only works to put your organization in danger. If you’re looking to convert from manual bookkeeping to digital, consider a staggered approach. Overhauling all at once can be overwhelming and discouraging, so it’s best to take it slow and make meaningful and intentional shifts. By staying up to date with your bookkeeping throughout the year, you can help alleviate some of the stress that comes with filing your taxes.

From an accounting perspective, deductions for these benefits need careful consideration and accurate reporting. Gym management software or time clock systems can be leveraged to streamline this process, facilitating reliable data collection. On the other hand, salary-based payments are commonly employed for employees with fixed working hours or positions that require a consistent level of responsibility, such as managers or administrative staff. To ensure financial stability and profitability, gyms must implement effective budgeting techniques. Start by creating a comprehensive budget that includes all anticipated expenses and revenue projections for the upcoming period.

Overall, the role of a gym bookkeeper encompasses maintaining meticulous records of financial transactions while providing crucial financial insights to gym owners. Their expertise helps identify trends in revenue generation and expense management that allow for informed decision-making pertaining to business growth strategies or potential cost-saving opportunities. Exercise.com’s software can assist with some of these tasks by providing streamlined billing, financial reporting, and payroll functionality. Many accountants prefer QuickBooks due to its user-friendly interface and robust feature set for general accounting tasks. The cost of accounting software for gyms can vary widely based on features, support, and the brand.

- It should allow gym owners to make informed decisions based on accurate and up-to-date financial data.

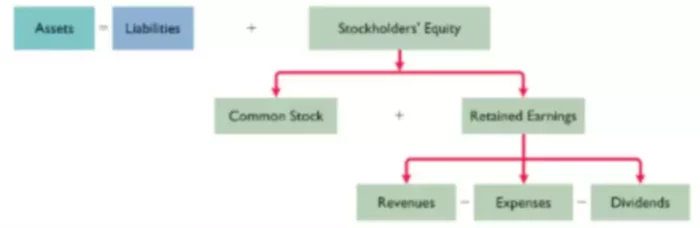

- You’ll also need to track assets like gym equipment and liabilities like loans or accounts payable.

- Accounting software for gyms can also help gym owners stay compliant with tax laws and regulations.

- We provide third-party links as a convenience and for informational purposes only.

- All business expenses and purchases should go through your business credit card or checking accounts.

However, you should still keep a record of the money they are paid as a business expense. Secondly, bookkeeping services handle all documentation and paperwork which makes your tax filing process effortless. They ensure you are taking advantage of all eligible tax deductions and abide by the tax laws, thus preventing any potential penalties. For recurring revenue, a bookkeeper sets up a system that automatically records the transaction each time it occurs in the time interval specified, for example monthly or annually. Any overdue payments from members are carefully monitored and follow-up actions are taken to ensure the revenues are collected.