Adp 401k Review 2020

Content

For employees, the customer service experience goes beyond just phone support. ADP offers an outstanding website that’s easy to navigate as well a mobile app that allows all employees to research funds and make and/or change investments. ADP is one of the longest-running payroll and 401 companies in the country.

- This new plan is integrated with ADP’s payroll services, so there is no need for small business owners to contact the fund manager to submit payroll data via telephone or fax.

- Through the program, both employees and employers may invest up to $6,000 a year in a tax deferred account and business owners may deduct matching contributions and receive additional tax savings.

- Well, we stayed with them because we really didn’t have any other options at the time .

- When we decided to offer a simple IRA benefit, ADP had an option to manage that.

- ADP’s Simple IRA removes the burden of setting up and administering retirement plans from small business owners so they can concentrate on more business-critical activities.

The company says it’s one of the fastest-growing retirement plan providers in the nation, serving more than 66,000 retirement plan clients and 1.6 million plan participants with $66 billion in retirement plan assets. Get quotes from a few different sources and compare prices and fees. The more you know before you pick a plan, the better off you and your employees’ retirement savings accounts will be. Price is also a drawback for many employers considering the ADP 401k plan. It is not the cheapest solution available — especially for physicians with small practices that have only a few employees. ADP fees tend to be a bit higher than those of their competitors.

K) Plan Fix

In deciding whether to do a transfer from a retirement plan, be sure to consider whether the asset transfer changes any features or benefits that may be important to you. Although automatic enrollment in retirement plans has been adopted by many employers, there may be complications. States have yet to publish details as to when and how this may occur, but retirement plan deductions may already have been made and remitted by the employer.

Your employees receive access to online participant dashboards and a mobile app, allowing them to view their retirement savings account balances and change their contribution rates or investment funds and allocations. They can also access ADP’s financial wellness website to learn about managing their money, saving for a home and planning for retirement. Investment options are available through the applicable entity for each retirement product. Nothing in these materials is intended to be, nor should be construed as, advice or a recommendation for a particular situation or plan.

What bank does ADP use?

The Wisely® Direct card is issued from Fifth Third Bank, N.A. Member FDIC, pursuant to a license by Mastercard International.

Lori has spent hundreds of hours researching, analyzing and choosing the best options for critical financial-related small business services, including credit card processing services, point-of-sale systems and employee retirement plans. Lori’s publishing experience is extensive, having worked as a magazine editor and then as a freelance writer and editor for a variety of companies. ADP is a popular business solutions company that offers services such as payroll, time and attendance, and HR and employee benefits – including employee retirement plans. It works with more than 700,000 businesses worldwide, including some with one employee and some with more than 1,000.

After about two years, we wanted to be more competitive and decided to offer a 401 with a 4% matching contribution. We thought that managing a 401 was something complicated that large corporations did, so we stayed put and used their 401 plan management. That’s when I saw an episode of Last Week Tonight with John Oliver that talks about his company setting up retirement plans for their employees. As the administrator and record-keeper, ADP provides documents related to the plan and prepares IRS Form 5500 for tax filings. They offer extra options for additional fees, such as fund performance monitoring and investment advice. These advisory services help employees enrolled in the plan to decide where and how to invest their money.

Registered representatives of ADP Broker-Dealer, Inc. do not offer investment, tax or legal advice to individuals. Review the fees and expenses you pay, including any charges associated with transferring your account, to see if rolling over into an IRA or consolidating your accounts could help reduce your costs. Employer-sponsored retirement plans may have features that you may find beneficial such as access to institutional funds, fiduciary-selected investments, and other ERISA protections not afforded other investors.

Help Your Employees Become Retirement Ready And Prepare For Life’s Financial Challenges

There’s no pricing information on ADP’s website, so you’ll need to contact the company for a pricing quote specific to your business, as the company customizes its plans. When we reached out to the company, we posed as a small business that had five employees, with no previous retirement plan, and was not yet an ADP client. ADP Retirement Services offers multiple plan types, such as Roth 401, safe harbor 401, SIMPLE IRA and SEP IRA plans. In addition to integrating seamlessly with ADP’s payroll services, it offers an unbiased selection of investments for plan participants and provides co-fiduciary services to help you comply with Department of Labor regulations.

ADP also makes it easy to set up retirement plans and accounts with new employees. They promote automatic enrollment, so rather than opting in, employees have to opt-out. This helps to encourage employees to participate in the plan available to them.

May I Participate In A Simple Ira If I Participate In Another Retirement Plan Sponsored By Another Employer?

In the education and healthcare sectors, these plans are the most common retirement vehicle. A payroll deduction IRA allows employees to save for retirement without an employer-sponsored retirement plan. The employee establishes the IRA with a financial institution and then authorizes the employer to make payroll deductions from the employee’s salary and contribute them to the IRA. This may not be as beneficial to employees as the employer cannot negotiate with the financial institution to obtain cost effective, or other special terms, for employees or help select investments for the IRA.

While ADP specializes in HR and administrative services, the company also provides payroll integration with retirement services for businesses of all sizes. The company caters retirement plans to the business’ specific needs and size, which makes ADP have a personal touch, even though it’s a very large company.

Further, studies have shown that automatic enrollment in such plans increases participation dramatically. Retirement services & planningHelp get your employees retirement ready with easy-to-manage retirement plans that can help you meet your fiduciary obligations, attract the best talent to your company and more. So aside from lack of fees, another reason I’m a huge fan of Guideline is their modern, beautiful user experience. ADP let me and my employees manage things online, but their UI is by no means modern.

Each year, employers must make either a matching contribution or a nonelective contribution. A 403 is a type of qualified retirement plan which is similar to a 401 and is available in certain industries. These plans allow your employees to contribute and save on a pre-tax and after tax basis, with the opportunity for employer matching contributions as well.

SIMPLE IRA and SEP are offered through ADP Broker-Dealer, Inc. , Member FINRA, an affiliate of ADP, Inc, One ADP Blvd, Roseland, NJ 07068. Only registered representatives of ADPBD may offer and sell such retirement products and services or speak to retirement plan features and/or investment options available in any ADP retirement product. A SIMPLE IRA is a retirement plan that allows you and your employees to contribute to the plan.

Adp Offers 401k Education And Support

ADP is well-known for the quality customer service it provides both employers and employees. Each employer gets a personal assistant at ADP who helps set up and administer the plan on an ongoing basis. So, in theory, the company says you shouldn’t need to contact them very often.

How much should I put in my 401k?

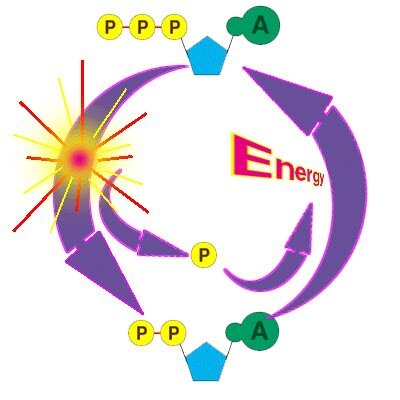

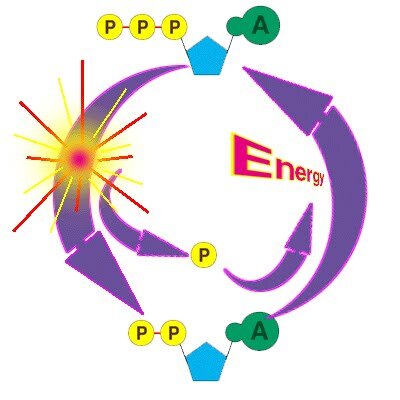

Most financial planning studies suggest that the ideal contribution percentage to save for retirement is between 15% and 20% of gross income. These contributions could be made into a 401(k) plan, 401(k) match received from an employer, IRA, Roth IRA, and/or taxable accounts.

ADP’s Simple IRA removes the burden of setting up and administering retirement plans from small business owners so they can concentrate on more business-critical activities. This new plan is integrated with ADP’s payroll services, so there is no need for small business owners to contact the fund manager to submit payroll data via telephone or fax. Through the program, both employees and employers may invest up to $6,000 a year in a tax deferred account and business owners may deduct matching contributions and receive additional tax savings. When we decided to offer a simple IRA benefit, ADP had an option to manage that. Well, we stayed with them because we really didn’t have any other options at the time .

To sum things up, many employers like the ADP 401k plan, especially those that use ADP services for payroll. The smooth integration of payroll and retirement accounts is great.

This could introduce complications for employees who travel or telecommute, because they could be subject to conflicting coverage under more than one state law. In the Connecticut Act, employers are subject to the mandate if they employed at least five employees on October 1st of the preceding year, and paid each employee at least $5,000 in the prior year. The Act excludes government entities and employers in business for less than two years, as well as employers that maintain a qualified retirement plan. Department of Labor published guidance designed to facilitate state plans and permit states to mandate employer participation in a payroll deduction IRA for employees that are not eligible for a qualified retirement plan. The goal of the DOL rule and related state legislation is to expand access to retirement savings plans through the workplace. Studies have established that as much as half of the workforce does not have access to a payroll deduction retirement savings plan.

The right retirement benefit can help employers attract and retain talented employees and demonstrate their commitment to employees’ long-term financial goals. While small employers may have concerns about the cost and complexity of administering a retirement plan, there are a number of options that are easy to establish and may be more affordable than you think. A nonelective contribution is made by an employer to employees’ qualified retirement plans regardless if employees make contributions. Lori Fairbanks is a writer and editor for business.com and Business News Daily who has written about financial services for small businesses for more than seven years.

But if you’re not already using ADP for payroll, the 401k plan might not be the best option for you. The information contained herein is intended as general information only, and nothing in these materials is intended to be, nor should be construed as, advice or a recommendation for a particular situation, individual or plan.

ADP provides payroll, tax filings, insurance, and a variety of other administrative services. When it comes to their 401k offerings, employers have several plans to choose from. Nothing in the following materials or agreements should be construed to create or provide for any other relationship between ADP and American Century, including but not limited to joint venture or partnership. Other states’ laws vary somewhat as to coverage and other matters. Employees under 18 are excluded in some states, while Connecticut excludes those under age 19. Some laws have adopted unemployment insurance definitions of covered employers and employees, while others adopted state income tax laws for such definitions.