These 8 Payroll Errors Cost You Money; How To Fix Them?

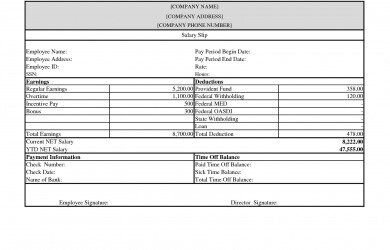

It is understandable for businesses to get wrapped up in things and get distracted, but payroll mistakes will only cost them more time and money if they do not do what they are supposed. At the end of the day, your goal is to operate your business, and compensate your employees accurately and in a timely manner. You can accomplish this by doing your best to avoid common payroll mistakes.

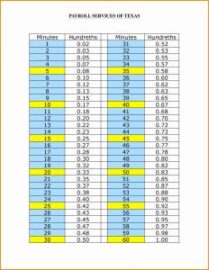

For most businesses and payroll staff, processing employee payroll deductions is probably one of the most […]