Adp Ceo Says He Sees Signs The Jobs Market Has Begun To ‘stabilize’

Content

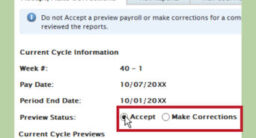

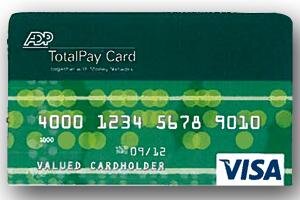

Now I have to prove to CT that my SS is the one I claim it is.I paid a few thousand dollars to this company to run the side of my business I didn’t want to (and didn’t know how to) run. Employees with an ADP payroll card can now use their smartphone and the ADP app to snap a photo of a check. Ingo’s instant money service via Ingo Check pushes those funds to those cards for the employees to use anywhere the cards are accepted. From an employer perspective, payroll cards can be a great way to securely compensate your employees while saving money on direct deposit fees and paper check overhead. Alerts can be set up to notify you of low balances, or when funds become available after a deposit. Also, payroll cards tend to be affiliated with (“branded”) one of the major credit card issuers, such as Visa, MasterCard or American Express.

Another reason pay cards are on the rise is the cost savings. This greatly depends on your situation and preferences.

They hold the same buying power as a bank card and can be used in stores, gas pumps, even ATMs. Cash can be taken out of the account at ATMs or using a cash-back option at grocery or retail stores that offer such at checkout. Payroll cards can also be used to make payments online that would accept the same brand of debit card. Depending on which payroll card service you sign up for, it may be more cost-effective to provide a payroll card option to your workers.

My Services

From a worker’s perspective, it’s important to understand the different fees associated with payroll cards, as theyaren’t exactly liketraditional debit cards. The exact fees will depend on which company you’re working with.

It’s a solid option for a company looking to grow, but it isn’t the cheapest for companies looking to save. Small businesses looking for a more affordable payroll solution might want to check out Gusto instead. Tweet Share Share Share EmailIt’s Wednesday, and Jane needs to get her car fixed. Payday for Jane comes Friday via a payroll card that pushes money into an account she can use. But Jane is like many workers – stringing together multiple gigs to make ends meet and working for employers who pay her by check.

ADP stabs and bleeds you before you even know it. As a small business owner, paying ADP for advice and payroll services was the worst decision of my entrepreneurship. From a Small business owner I would like to warn other new entrepreneurs to avoid this company. Their advice for me as a self employed and Sole proprietor of my business in Connecticut, was to place myself on payroll and pay CT’s labor taxes. This went on for 2 and a half years until I moved out of the state on 12/31/2019 and had to close my business. Furthermore, ADP was supposed to do my quarterly filings for the year 2019 which they only did the first quarter. I got charged late fees from CT for not filing and in one occasion had my account garnished.As if that wasn’t bad enough, ADP had submitted my SS number incorrectly since the beginning.

Payroll cards are an ideal option for small businesses looking to save money onprocessing payroll. They are also a vital tool for employees who don’t have bank accounts. Most of the large payroll processing companies offer small businesses a payroll card option. There is a host of third-party companies that can provide independent service, should your organization process payroll manually or work with a partner that doesn’t offer payroll card services. Payroll cards are ideal for workers with no bank account, whiledirect depositis a better option for workers who need immediate access to funds through a bank account. If your employer offers you a payroll card, it must offer you either a direct deposit or paper check option as well. There are several labor laws that require employers to provide multiple options.

Payroll Processor Adp Ceo Says Hiring Data Indicate The Jobs Market Has Begun To ‘stabilize’

Due to the savings of electronic fund transfers over paper checks (about $3.00 per payment, per employee), direct deposit is usually the second option. That is not to suggest that employers must only offer two forms of payment. Each state retains the right to regulate the specific methods of payment offered to employees. There are several payroll card providers for small businesses. Some majorpayroll providersoffer payroll cards as a way to compensate employees. If you’re working with a major payroll provider, talk with your representative to determine what payment via payroll cards would look like for your business. We were quoted $179.86 monthly for 11 employees for payroll and HR Plus; that is a $10 per-employee fee in addition to payroll fees.

Printing and handing out checks can be expensive, and certain payroll companies may charge extra for things like direct deposit. ADP is a big player in the payroll software and workplace management field. It has always been on the cutting-edge of technology, even back when they first needed to upgrade to punch-card machines, then computers, and now cloud-based mobile apps. Because of that, ADP might be a payroll expert, but it might not be the most cost-effective option for small businesses with less than 50 employees. The ADP TotalPay card gives card owners the option of loading money onto a debit card, rather than using a debit card linked to a bank account.

By the middle of 2019 when I figured out my SS # was incorrect, they tried to charge me to fix it. After proving that my paperwork was correct and the error had come on their end they said “we will take care of it”. Well, they did change my SS # on my paperwork, but they never went back to the previous year and a half to fix their error.

If the majority of your employees do not have a bank account, it may be easier and cheaper to get a payroll card. Payroll cards are a simple, easy way employees can access their paychecks without having a bank account. We use ADP Workforce Now and their PEO services. I have used ADP Run for years and it’s very easy to use and have had no issues until COVID and then it involved being on hold for long periods of time to get a question answered from customer service.

If you have a payroll card and you need to transfer funds to your bank account, it’s best to talk to your provider or employer. Keep in mind that you may pay a fee to transfer money to a bank account. In fact, according to the Disbursement Satisfaction Index, only 96 percent of consumers say they don’t want to get them.

There are several pros and cons to using payroll cards, but, as usual, the best option for your business depends on your workers, your business’s needs, and overall cost. As an employee, you should be aware of the fees and conditions associated with payroll cards. You should use a payroll card that provides some kind of online portal or mobile app. Some cards have very few fees associated with them, while other cards may charge a fee for things ranging from monthly use to withdrawing funds from an ATM. Additionally, not every card offers the option to deposit non-payroll money onto it, so your company might be limited as to what funds you can load onto the card. Payroll cards are generally accepted anywhere that you would typically use a standard bank account debit card.

Cut Payroll Time In Half

Workforce Now is cumbersome and very difficult to use. Previously using ADP Run it would take me about 15 minutes to process payroll. Using Workforce Now it usually take me an entire day. It has taken a week to receive a response to emails, difficult to reach our sales person unless you call or text them directly. Many times I have been on hold for 30 minutes and my employees too, to get a question answered. They even canceled one of my employees health benefits for turning in FMLA paperwork late – the guy was in a coma due to COVID, he couldn’t fill out the paperwork.

Everything is done via email and some of our employees are not overly computer savvy. It’s difficult to locate a firm price for the program online. Benefits administration abilities are add-ons, which means that compared to other starter-payroll programs, this one has way too many non-transparent fees that can quickly add up. However, ADP prides itself on customer support and will bend over backward to make itself available for clients with concerns.

Adp Benefits

For employers, said Lott, the value comes from the efficiency of processing transactions electronically. Expedited pay and payments in advance are coming up more and more, both with ADP clients and among regulators. Validated ADP cardholders can use Ingo Check to have funds added to their accounts as soon as paper checks clear – within days, for free, or within minutes for a small fee. The funds are irreversible, meaning that once they hit that account, the money can never be clawed back – and cardholders can access them immediately to cover planned or emergency expenses. My college student daughter works an occasional shift for an employer who recently converted to the ADP Aline card method of payment. The ADP Aline customer service agent said she can just take the card to her bank and have them deposit the funds into her account.

Ingo Money and ADP announced today a collaboration that will help workers like Jane get faster access to the money they’ve earned. Despite the growing popularity of payroll cards, federal banking laws require that employees be offered at least one additional payment option.

- Most of the large payroll processing companies offer small businesses a payroll card option.

- Payroll cards are an ideal option for small businesses looking to save money onprocessing payroll.

- There is a host of third-party companies that can provide independent service, should your organization process payroll manually or work with a partner that doesn’t offer payroll card services.

- They are also a vital tool for employees who don’t have bank accounts.

The ADP TotalPay card operates on a pay-as-you-go basis. To begin using the card, you must first load money onto the card. When your balance gets low, you can add more money. You can even transfer money from your bank account onto the card. You can access your ADP TotalPay account information online.

(The company charges a fee each time you run payroll with ADP software.) There is also a $25 setup fee that is usually waived with a contract. All quotes are customized per your business location, number of employees, frequency of running payroll, etc.

Gusto Vs Adp: Which Payroll Software Is Better?

Transferring money from your payroll card to a bank account can be simple or complicated, depending on which payroll card provider you choose. Surprisingly, there isn’t a lot of information out there on how to transfer funds from a payroll card to a bank account. Some services build it into their offerings, while with others, you may have to speak with your bank or payroll card provider.