Adp Developer Resources 2020

Content

Lenders have 60 days to make a decision on loan forgiveness. Often, the surest way to improve your payroll process is to work with a provider who can handle all aspects of payroll on your behalf. You may have peace of mind knowing that your employees are paid on time and your taxes are prepared correctly. Be transparent about the different ways employees are compensated at your business, whether it’s hourly pay, salary, bonuses, commission or stock options. In addition, pay careful attention to state laws covering the payment of final wages to those who leave your organization. Payroll schedules are a matter of preference, but minimum standards may apply.

+ To obtain full forgiveness, loan proceeds must be spent during the Covered Period or Alternative Payroll Covered Period. To obtain full forgiveness, loan proceeds must be spent within 8 to 24 weeks immediately following disbursement of the loan, whichever is earlier. Spend the loan proceeds, or incur qualifying costs, within applicable Covered Period or Alternative Payroll Covered Period. To obtain full forgiveness, loan proceeds must be spent within to the 8- to 24 week period immediately following disbursement of the loan . I used payroll cost and headcount reports for the PPP loan application. Can I use the same reports for purposes of loan forgiveness reporting?

Starting with the pay period in which an individual’s earnings exceed $200,000, you must begin deducting 0.9% from his or her wages until the end of the year. Additional Medical Tax also applies to certain levels of railroad retirement compensation and self-employment income. Tax and National Insurance contributions will be paid for you when they’re due, and reports provided to your business. Your payroll outsourcing provider may also be able to take care of new hire onboarding paperwork and required employee tax documents. My company previously laid off an employee, but later offered to rehire the employee. If the employee declined the rehire offer, will my PPP loan forgiveness amount still be reduced?

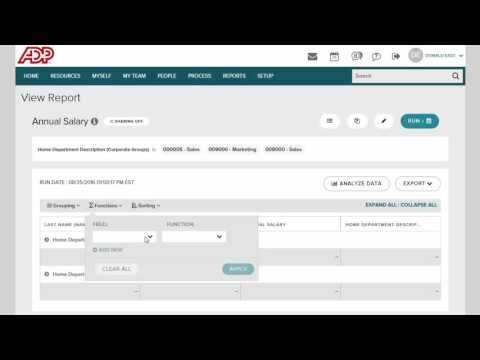

Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to. If less than 60 percent of loan is used on payroll costs, the amount of loan forgiveness may be reduced proportionately and may need to be repaid.

Finalizing Your Payroll

ADP then calculates and transfers pay to each employee, accurately and on time, on your behalf via a direct deposit or payroll cheque. If your employees clock in and out, we will process this data. Each pay period is taken care of by the payroll outsourcing software. National Payroll Week starts on Labor Day each year and is intended to celebrate America’s workforce and the payroll professionals that pay them. During this week, payroll professionals and government agencies come together to help educate employees about their paychecks.

Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

What Are Examples Of Incorrect Payroll Deductions?

To file them correctly, you need to know the work status of your employees. Payroll outsourcing is when a specialist company like ADP manages your payroll to ensure your employees are paid accurately each month, securely, and on time. They will care of the administrative tasks involved with payroll. This ensures your HR, finance and admin teams are freed up from time-consuming work. Now you can keep compliant with regulations, including GDPR. Your payroll will operate seamlessly, however many people you employ worldwide.

Hours.” Enter the number of regular hours each employee worked. The system will automatically calculate the gross salary, deductions and net salary for the pay period. Click on the “save” button frequently to save data you have entered. When you are done, click on the “done” button.Enter the number of overtime hours in the “O/T Earnings” column. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period.

With this in mind, we answer common questions related to garnishments, deductions, and timing and frequency of pay. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck. You can manually input these changes in the paydata grid.If an employee is set up for Automatic Pay but you need to change their salary or hours for this pay period, include the employee in the batch. Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period.

Associate Employees To Payroll

Some states require at least semimonthly payments for all employees, while others have specific frequencies for different types of workers. If you are not bound by state payday requirements, you can choose whichever pay period works best for you and your workers. Employees, especially those in low-wage jobs, usually prefer to be paid more often, but as your pay frequency goes up, so does your payroll processing costs. You’ll need to carefully weigh the expectations of your workforce and your budget and comply with all state laws.

When calculating the amount of loan forgiveness, how will the determination of whether my business has maintained pay levels be made? Payroll processing is important because paying employees late or filing taxes incorrectly may result in penalties and interest on back taxes. Payroll that’s unreliable can also hurt employee morale and tarnish your business reputation. When you consider these ramifications, it’s often best to dedicate the necessary resources, whether it’s time or money, to make sure you get payroll right. Most states require you to provide a pay statement in either print or electronic format at the time wages are paid. Some laws allow employees to opt in or out of electronic statements and you may have to ensure they are able to easily view or print their pay information. The FSLA also requires you to keep certain records for each nonexempt worker.

FICA requires that a portion of every employee’s gross earnings help pay for Medicare and Social Security benefits. Each pay period, you must deduct 6.2% for Social Security tax and 1.45% for Medicare tax. You’re also required to match these deductions, which brings the total FICA tax per employee to 15.3%. Post-tax deductions are taken from an employee’s paycheck after all required taxes have been withheld.

Wage garnishments are court-ordered deductions taken from an employee’s pay to satisfy a debt or legal obligation. Child support, unpaid taxes or credit card debt, defaulted student loans, medical bills and outstanding court fees are common causes for wage garnishments. Garnishments are typically a percentage of an employee’s compensation rather than a set dollar amount.

The 3508S form eliminates the need for borrowers to demonstrate that they maintained wage and employment levels during the applicable covered period. Instead, borrowers will need only to demonstrate that they spent the loan proceeds on covered payroll (at least 60% of the forgiveness amount) and non-payroll costs.

Many businesses choose automation because it reduces errors and ensures that payments are filed with the proper authorities on time. Your employees’ information is transferred to ADP as your payroll outsourcing provider, including information such as hire dates, job titles and pay rates. ADP then calculates and transfers pay to each employee, accurately and on time, on your behalf. To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

How To Issue Paychecks

Include all forms of compensation paid to employees, including wages and tips, as well as the taxes that were withheld. Withhold income tax, Social Security tax and Medicare tax only on wages paid to employees, not independent contractors. These types of workers pay self-employment tax on their income.

- To obtain full forgiveness, loan proceeds must be spent within the 8- to 24-week period immediately following disbursement of the loan.

- Borrowers can download the PPP Loan Forgiveness Payroll Costs report from their ADP system to submit to their lender with the 3508S form.

- Instead, borrowers will need only to demonstrate that they spent the loan proceeds on covered payroll (at least 60% of the forgiveness amount) and non-payroll costs.

- The 3508S form eliminates the need for borrowers to demonstrate that they maintained wage and employment levels during the applicable covered period.

- What is the period within which I must spend my loan proceeds to obtain full loan forgiveness?

Borrowers can download the PPP Loan Forgiveness Payroll Costs report from their ADP system to submit to their lender with the 3508S form. What is the period within which I must spend my loan proceeds to obtain full loan forgiveness? To obtain full forgiveness, loan proceeds must be spent within the 8- to 24-week period immediately following disbursement of the loan. The new round of PPP funding includes other important changes to the PPP loan forgiveness process, some of which may apply to loans issued previously in 2020. ADP is actively evaluating these changes and will update the guidance below and in the PPP Loan Forgiveness Reports as additional guidance is issued by the Treasury Department and Small Business Administration. For example, the CAA 2021 provides that the SBA will issue a streamlined forgiveness application form for loans of $150,000 or less. Borrowers would be required to retain – but not submit – documents substantiated their forgiveness application for 4 years for employment records and 3 years for other records.

Yes, the amount of the loan can be fully forgiven as long as certain conditions are met. The specific amount will generally depend in part on what portion of the loan is used on eligible payroll costs and whether the employer has maintained staffing and pay levels during the covered period. You will need to complete the PPP loan application, which your lender will provide, and submit the application with your payroll documentation. If you are applying for a second PPP loan, remember to run new PPP loan application reports from your ADP system. The ADP reports are updated frequently to reflect the latest government guidance. You should always run the applicable PPP report as close in time to submitting your PPP loan application as possible. For your reference, click here for application form provided by the SBA.

The long-term disability deduction covers a percentage of wages for employees who are injured or too sick to work for an extended period of time. When LTD is deducted pre-tax, employees pay slightly less for premiums, but are charged federal income tax on any benefits received. Post-tax LTD deductions, on the other hand, result in employees receiving slightly less take home pay each pay period, but their benefits aren’t subject to any further tax if they use them. Short-term disability is often taxed in the same manner. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your employees or a court order. The calculations can be done manually or you can automate the process using a payroll service provider.

Even if you’re not paying someone else to do payroll for you, it’s still considered a business expense. This is because your employees’ wages and your share of payroll taxes cut into your profit margin. And if business slows down, you may be faced with the difficult decision of delaying payments or diverting money from other resources. Many Americans who have health insurance purchase it through their employers via payroll deductions. This offers considerable cost savings because the premiums can be withheld from their wages on a pre-tax basis under a Section 125 plan. In actuality, however, employees are not paying for their health coverage directly, but are reimbursing their employer, who submits payment to the health insurance provider. Some employees may also be subject to Additional Medicare tax.

No, the ADP payroll cost and headcount reports that were developed to support PPP loan applications cannot be used for PPP loan forgiveness purposes. ADP has reports available to support clients that are navigating the forgiveness process. See below for more information about PPP loan forgiveness reports that are available. Additionally, borrowers who previously received loans of $50,000 or less may be exempt from reductions in loan forgiveness amounts based on reductions of full-time equivalent employees or in salaries or wages. If eligible, borrowers would use the SBA Form 3508S, or their lender’s equivalent form, to submit their loan forgiveness application. ADP has put together a Loan Forgiveness Checkup which outlines important steps to take before year-end to maximize loan forgiveness. If you’re a small business with only a few employees and choose to process payroll manually, you will need to keep precise records of hours worked, wages paid and worker classifications, among other details.

You must also ensure your calculations are correct and remember to file all the necessary taxes and paperwork with government authorities on time. As you add more employees, the more challenging payroll becomes and any mistakes you make can result in costly tax penalties. Your place of business and where your employees perform services also play a factor in payroll deductions because not every state collects income tax. If the pay reduction was made outside the February 15 to April 26 timeframe, the forgivable amount may still be reduced even if the pay reduction is later reversed. How will the determination of whether my business has maintained staffing levels be made? Borrowers may either use the period from February 15 through June 30, 2019 or January 1 through February 29, 2020. If the number of FTEEs during the Covered Period or Alternative Payroll Covered Period is lower than the time period chosen, the amount of loan forgiveness may be reduced proportionately.

What happens if I use less than 60 percent of the PPP loan on payroll costs? The Paycheck Protection Program Flexibility Act provides that at least 60% of the covered loan amount must be used for payroll costs. If less than 60% of the loan amount is used on payroll costs, the amount of the loan that is forgiven may be reduced. The Treasury Department has indicated that at least 60% of the loan forgiveness amount must have been used for payroll costs. In addition, the COVID-19 relief law passed by Congress in December 2020 provides that the forgiven portion of a PPP loan can be excluded from gross income. Borrowers have 10 months from the end of their covered period to apply for forgiveness before they would need to start paying back any portion of their loan.

Trademarks Of Intuit Inc Terms And Conditions, Features, Support,

These records must be kept for at least three years and the records on which payroll calculations are based, such as time cards, need to be kept for two years. If your employees are unionized, they’ll likely have to pay for their membership and any taxable benefits offered through the union. Other types of job expenses that can be deducted from payroll include uniforms, meals and travel. Some states, however, may prohibit these kinds of deductions. Statutory deductions are mandated by government agencies to pay for public programs and services. They consist of federal income tax, Federal Insurance Contributions Act tax and state income tax.