Adp Down? Current Problems And Outages

Content

Your money is also protected by Regulation E and either the Visa® or Mastercard® Zero Liability Policy. There are no overdraft fees because we will not allow you to overdraw your card.3 There are no minimum balance fees. There are, however, inactivity fees of $4.00 assessed on a monthly basis after 90 days of inactivity. Keep in mind there are also charges for using certain features on your Wisely™ Pay card.

People use Plastiq to pay important bills on their favorite cards. We charge fees to cover the costs of running this service – more on that below – though most customers report that the value they receive from using their cards actually offsets the fees charged. Plastiq’s mission is to provide you the option of making virtually any bill payment using your card. To fulfill this mission, we’ve set up with the card networks to process your cards, and we’ve plugged into the banking systems to send your payments out via bank transfer or physical check.

We are secure and strictly adhere to all wage and hour regulations throughout every state in the U.S. Our financial model eliminates risk for the employer and employee, and it is flexible enough to support adjustments as new legislation is enacted. DailyPay funds all employee transfers and assumes all responsibility associated with errors , fraud or risk. If the employer were to fund on-demand requests for payment, the IRS could view this as “payroll” and require the remittance of all applicable withholding tax amounts on the day a transfer is made. This is highly disruptive and burdensome to your tax-withholding schedule; it complicates your current payroll process and it’s a drain on your operating capital. Through mobile API technology and artificial intelligence, we seamlessly integrate with your payroll and time and attendance systems to receive your employees’ daily hours worked. DailyPay is offered at no cost to employers and it requires no disruption or changes to your current payroll processes, including the timing of payroll funds and withholding of taxes.

Visa and the Visa logo are registered trademarks of Visa International Service Association. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. ADP, the ADP logo, Wisely, myWisely, and the Wisely logo are registered trademarks of ADP, Inc. Wisely Pay by ADP offers a flexible pay card payment option that helps staffing companies meet employee demands and reduce costs while minimizing the payroll burden. @skaggsdawg @ADP I’m genuinely concerned about the type of people you hire for the Wisely online customer service chat. I’ve been experiencing debit card problems and I went to the online chat to be blamed for my card issues.

DailyPay also transforms the employer-workforce relationship and increases employee engagement by adding a benefit that empowers financial management. With the simple tap of a button, employees can request a transfer and receive their earnings immediately in their designated bank account or on any debit card or pay card, including Wisely Pay by ADP. Having 24/7/365 access to their earnings allows employees to pay bills on time, avoid overdraft and late fees, and fund any unexpected expenses. But when a place clearly double changes your account and cancels 1 wisely thinks it’s good business to keep your money for a week. They CAN reverse a charge so certainly they can return a double charge. I know every bank even these e banks have to answer to someone.

Gratuity Solutions’ Clients With Tipped Or Daily Paid Employees Have The Option To Choose From 3 Different Payment Options:

Give employees the flexible payment they want with a feature-rich, reloadable paycard. With either the debit card or instant check option, you can authorize checks, transfer funds instantly to registered debit cards and view account balances so you have complete control over the process. myWisely is the companion mobile app for both Wisely Pay and Wisely Direct cardholders. It brings workers the ability to manage, spend or save their money, along with bank-like features and financial wellness tools.

As ADP’s own independent pay solutions offering, Wisely™ integrates directly with your payroll system. Through a single provider, you can run full payroll, paying by check, ACH direct deposit and Wisely Pay reloadable prepaid cards – all at once. Direct deposit helps virtually eliminate the need for paper checks by electronically depositing payroll funds directly into your employees’ accounts. A paycard is a convenient way for employees to be paid. Instead of a traditional bank account, pay is deposited into the paycard account.

This integration is also available in the ADP Marketplace, and at no additional cost to clients who have already purchased POS Sync for RUN Powered by ADP for their location. Clients will see a price during the checkout process but they will not be charged for the additional POS Sync for Wisely Pay by ADP application. Be sure to select your WISELY Card at checkout and your payment will not include any additional Plastiq service fees. Signature-based transactions that qualify are protected by either the Visa or Mastercard Zero Liability Policy. The Zero Liability Policy provides protection from unauthorized purchases. With Wisely Pay by ADP, cardholders have additional fraud protection.

The app can also be used to access the largest surcharge-free ATM network in the payments industry. Regardless of which pay methods you choose, ADP delivers both active and former employees secure anytime access to pay, tax and account information via myADP and the ADP® Mobile Solutions app. It gives them a place to directly deposit their pay from multiple sources, get fast access to that income, shop and pay bills, budget and save, plus more. Issuing paper checks comes with overhead and takes time. With a paycard, you can pay employees anytime and anywhere.

Fully Integrated With Wisely Pay By Adp

Add the convenient administrative portal and fund approval workflow, and paying your people gets faster and easier. Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries.

The DailyPay user experience is very much like an ATM for your employees’ earnings. As employees work throughout the week, their earnings balance available for transfer increases. With a tap of a button, employees can transfer all or only a portion of their earnings into a bank account or onto a pay card or debit card, when needed, for a one-time transaction fee. myWisely delivers many traditional bank-like features without the fees banks often charge. We don’t charge any overdraft fees because we will not allow you to overdraw your card2.

At this point the customer is a non factor to them. After 2 hours and 10x giving my card # and every freckle on my rear end they can’t do anything or allow me to speak to a manager. When your employees use the Wisely ™ pay card for their payroll, they’re already fully set up to access and receive on-demand pay transfers — all you have to do is turn on DailyPay. The Wisely pay card and DailyPay offer a complete payroll experience, making it seamless and easy for your employees to access their earnings — whenever and wherever they want.

I’ve had Global Cash Card for at least the last 4-5 years and recently switched to wisely when I needed a replacement card. The only downfall with GCC was their cards were completely garbage and bent and broke easily. My new Wisely card seems thicker and doesn’t seem as cheesy as my GCC’s I’ve had. Gratuity Solutions offers the POS Sync for Wisely Pay by ADP® pay card integration.

@ArenaultE @ADP absolutely horrendous service for the past several weeks. Horrible hold times & failing chat apps with no response from anyone in customer service! Salespersons calling us right and left but they are no help referring us or getting us in contact with anyone knowledgeable. With Wisely™ Pay and the companion myWisely app, your employees get traditional bank-like features, total spending flexibility and help making responsible financial choices. With technology and money intertwined, today’s employees want more flexible payment options. With Wisely™ Pay you can attract, engage and retain top talent through the convenience and flexibility of 100% electronic pay.

Adp Wisely Pay Card

Eliminate the manual process of collecting & reconciling time punch detail between your POS or external time clock and your payroll platform. Many merchants choose to NOT accept credit or debit cards, usually because it doesn’t make sense for them to pay the transaction fees associated with doing so. These payments also tend to be some of the largest payments that any of us will make on a monthly or yearly basis. SVB’s acts only as a service provider to Plastiq, and its role in the completion of a payment is restricted to funds acceptance and treasury disbursement as instructed by Plastiq. Plastiq provides card processing services to you and dispatches payment instructions to SVB for the purpose of accomplishing these payments. 5) Once activation is complete, employee can link card to MyADP/MyWisely app by accessing the mywisely.com website and choosing Get Started. @ADP @leica_joaquin @mmpsailor Hello, I just check with the RUN Team and they aren’t aware of issues at this time.

Please log into your Wisely account and refer to the Wisely™ Pay list of all fees for applicable usage fees. The Wisely Pay Visa® is pursuant to a license from Visa U.S.A. Inc. ADP is a registered ISO of Fifth Third Bank N.A, or MetaBank, N.A. The Wisely Direct card is issued by Fifth Third Bank, N.A. Member FDIC, pursuant to a license by Mastercard International. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. The Wisely Pay and Wisely Direct Mastercard can be used everywhere Debit Mastercard is accepted.

Plastiq gets charged transaction fees for every payment, which we negotiate to industry-low rates and then pass onto you as a cost of using our service. Your employer should fund your card with your pay on payday. You can use the card to purchase goods and services everywhere Visa® or Mastercard® debit cards are accepted, and withdraw cash at all participating ATMs. (Please refer to the Cardholder Fee Schedule for applicable fees.) Once your card is activated, you can view your balance on the FREE myWisely Mobile app, or online at myWisely.com. Wisely Pay, brings your employees quick access to pay and many ways to use, share, or transfer their funds. DailyPay was architected by payments and financial experts to ensure we offer a service that meets optimal regulatory standards.

We provide payroll, global HCM and outsourcing services in more than 140 countries. Whether you operate in multiple countries or just one, we can provide local expertise to support your global workforce strategy. and when my weekly pay was deposited onto the card they only took what went over with that over drafted purchase.

Reduce cost and ease administration using innovative technologies and workflows. And do it all with the confidence that comes from partnering with a leader in payroll innovation. myWisely includes a section for establishing savings goals and setting aside money for future needs. The app can even prompt employees to save, helping them develop smart financial habits. Nationwide Compliance helps your payroll department easily monitor direct deposits, pay card activation, check authentication, and completion. Identify cardholders who have not activated their cards to help ensure that employees are receiving their pay, so your program continues to maintain compliance.

We believe that a secure approach to employee pay access is an essential part of the workforce of the future. It heralds the arrival of employee-centric payroll and moves Payroll into a strategic leadership role in your company.

- With the simple tap of a button, employees can request a transfer and receive their earnings immediately in their designated bank account or on any debit card or pay card, including Wisely Pay by ADP.

- DailyPay reduces your employees’ financial stress, which in turn increases productivity and improves retention.

- Having 24/7/365 access to their earnings allows employees to pay bills on time, avoid overdraft and late fees, and fund any unexpected expenses.

- DailyPay also transforms the employer-workforce relationship and increases employee engagement by adding a benefit that empowers financial management.

- But when a place clearly double changes your account and cancels 1 wisely thinks it’s good business to keep your money for a week.

- By controlling the amount and timing of when they get paid, DailyPay allows employees to take much-needed steps toward creating financial stability in their lives.

Employees can then store or spend their money using their paycard. Paycard accounts have many of the features of a traditional bank account but also may have fewer fees. DailyPay was purposefully designed to be simple and transparent.

By controlling the amount and timing of when they get paid, DailyPay allows employees to take much-needed steps toward creating financial stability in their lives. DailyPay reduces your employees’ financial stress, which in turn increases productivity and improves retention.

Employees can instantly transfer earned wages at any time via our mobile optimized website or Android app. DailyPay lets you provide employees with instant access to earned wages and causes no disruption to your current payroll process or timing of payroll funds.

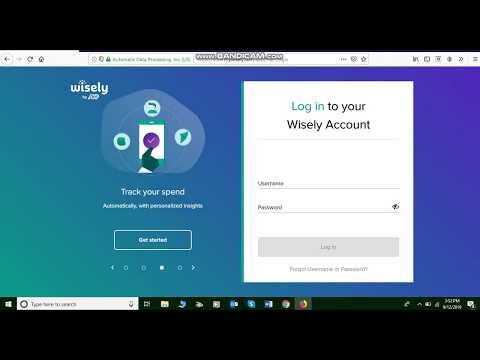

Are you a client of ADP trying to access your payroll? Can you try an alternate browser and see if it helps.