Adp Forms

Content

These forms need to get out to your employees, your contractors and submitted to the Social Security Administration by Jan. 31. Managing payroll often means dealing with a nonstop series of deadlines. To run payroll, start by reviewing all of your employee hours. If you utilize the Time and Attendance component, employees can log in from their smartphones, and the data will automatically be added to the company’s payroll files. The basic idea behind the ADP experience is simplicity and automation.

It is important that you obtain this information from the appropriate third party provider as soon as possible. These entries must be processed on or before your last payroll of the year to ensure that your Form 941 and W-2 reports are accurate. New employees need to submit a Form W-4 to your payroll department. Employees also will need to fill out a similar form for their state income tax withholding. ADP Payroll services also enable employees to access all of the company data via the mobile app, providing a green solution for companies, as well as a cost savings, by reducing paperwork. Department managers can also easily view basic information for employees in their work group, and can then message them via the app.

Strategies For Firing Employees: Lower Business Risk And Preserve The Person’s Dignity

When you hire your first employee, you’ll need to get a federal employer identification number from the IRS if you do not already have one for your business. Employers are required to make federal payroll tax payments to the government, as well as filing the proper reporting and informational returns. Employers must also provide employees and contractors with W-2 and 1099 reports explaining the compensation paid and withholding amounts.

The ADP payroll service also includes quarterly and annual tax reporting, as well as filing taxes on your behalf. If you have questions, the company’s professional payroll staff is available 24/7 to provide answers. The JD Edwards ADP interface process does not necessarily support all tax filing functionality available in the ADP Tax Filing Service. Furthermore, JD Edwards does not provide any support for taxes that are not calculated and stored in JD Edwards tax history tables.

Your Pay

As ADP® files your taxes, you should process these payrolls at least 48 hours before the check date, to allow ADP enough time to debit and deposit the tax amounts timely. In addition to your obligation to file payroll tax returns with your taxing authorities, you have a reporting obligation to your employees and your independent contractors. In essence, you must tell the employees how much you paid them in taxable compensation and how much you withheld from their wages for federal and state income taxes and FICA taxes.

Once the initial data is entered into the system, payroll can be processed easily with a few clicks. Rather than manually inputting an employee’s worked hours, pay rates, tax rates and deductions into a spreadsheet, the ADP software performs each step quickly and automatically. HR managers can review the payroll before processing it and can then approve the payroll for payment. Perhaps your biggest opportunity for realizing any kind of real savings is to make sure you tend to each of your obligations and avoid getting hit with penalties.

What is ADP payroll report?

About the Report

The ADP® National Employment Report™ provides a monthly snapshot of U.S. nonfarm private sector Employment based on actual transactional payroll data.

Some companies outsource all payroll processing, while others outsource only certain functions, such as tax preparation and filing. The largest provider of payroll outsourcing in North America is Automatic Data Processing . The Payroll department processes salary and other compensation payments to the faculty, staff, and students. They are responsible for withholding taxes and deductions from those payments. In addition to payroll processing, this office is responsible for reporting wage, tax, and deduction information to federal, state, and internal University offices.

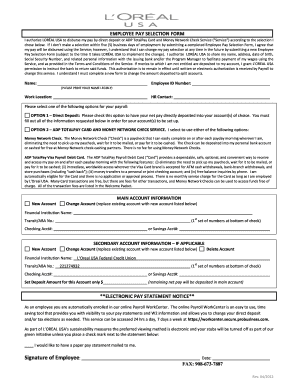

The rules can be complex and penalties for noncompliance severe, which is why the administration of payroll tax responsibilities is often outsourced by small businesses. ADP is a payroll service used by many businesses to handle the payment of their employees and remains a popular method of such electronic fund transfers. The form must be signed in order for it to be considered a legal document containing the necessary authorization for such transfers. If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date.

After Your Last Payroll, But Before The First Payroll Of The New Calendar Year

You do this by designating the return for the last quarter that you pay taxable wages as a “final” return, by checking a box at the top of the return. Along with actually depositing your federal payroll taxes, you also have an obligation to file periodic returns that show how you computed your tax liabilities.

Once you’ve paid over your payroll taxes and filed any necessary returns and reports, your last significant obligation is to maintain records that substantiate the payroll taxes you paid. Independent contractors receive a Form 1099-MISC.You don’t provide W-2s to your independent contractors, because you generally don’t withhold or pay any payroll taxes with respect to them.

How do I print a schedule in ADP?

Choose your desired department by clicking the Name of the department. Once you are viewing the week you would like to export, click Download Schedule in the bottom right corner. A notification will appear, allowing you to choose which program to export your schedule to. Select ADP Schedule (Beta).

As is true for deposits, the returns you must file for your income and FICA taxes are different from the returns you file for your FUTA taxes. Most employers will be required to make semi-weekly or monthly deposits. Only the smallest employers will be able to make annual payments.Annual tax return and deposit.

Mit’s State Sales Tax Exemptions

However, you are required to file a federal information return (Form 1099-MISC) for any independent contractor to whom you’ve paid at least $600 as compensation for services. Copies of the return must be provided to the contractors by January 31, and to the IRS by February 28. If you close your business or otherwise permanently stop paying wages that subject you to payroll taxes, you can end your obligation to file quarterly returns.

- Employers must also provide employees and contractors with W-2 and 1099 reports explaining the compensation paid and withholding amounts.

- ADP is a payroll service used by many businesses to handle the payment of their employees and remains a popular method of such electronic fund transfers.

- The rules can be complex and penalties for noncompliance severe, which is why the administration of payroll tax responsibilities is often outsourced by small businesses.

- When you hire your first employee, you’ll need to get a federal employer identification number from the IRS if you do not already have one for your business.

- Employers are required to make federal payroll tax payments to the government, as well as filing the proper reporting and informational returns.

Every year, your organization needs to complete a Form W-2 for each employee. This form reports how much an employee earned and how much tax was withheld. You also need to complete Form 1099-MISC for every contractor who earned more than $600.

Many of the potential payroll tax penalties are the same ones you’ll find when you’re dealing with other types of taxes. For example, there are both criminal and civil penalties for failing to timely file payroll tax returns or to timely deposit taxes you owe. There really aren’t too many opportunities for reducing your exposure to payroll taxes.

Changes that affect payroll operations such as implementing JD Edwards in additional facilities or operating in new jurisdictions require similar testing and validation between ADP and the customer. Many companies hire outside consultants and service agencies to perform administrative activities. This strategy enables managers to concentrate on critical business functions and core competencies. The processing of payroll and related items is an administrative activity that companies often outsource.

The JD Edwards EnterpriseOne ADP interface file is based on specifications from ADP Systems Interface Guide Tax GSI Format. When ADP publishes a new version of their interface guide, JD Edwards reviews any changes and determines whether to incorporate any changes into the existing interface. The JD Edwards EnterpriseOne interface file to ADP is intended as a starting interface for customers to use to build their own integration for ADP tax filing services. JD Edwards customers should work closely with ADP during implementation of the ADP Tax Filing Service to understand ADP specifications and compatibility prior to going live on the ADP Tax Filing Service.

Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party. If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s.

Small businesses may be able to file an annual payroll tax return (Form 944 Employer’s ANNUAL Federal Tax Return) and remit the taxes with that return. is designed specifically for accounting professionals looking for a better way to process payroll for their clients. RUN Powered by ADP Payroll for Accountants® gives your company a clear competitive edge by offering the industry’s only end-to-end service, from do-it-yourself through full tax filing capabilities. Some jurisdictions require that you provide an EITC notification to each of your employees with their annual tax forms. If your business is located in one of these jurisdictions, click the link to access and print the applicable notification.