Adp Freedom Help Documentation

Content

However, if an employee was terminated and given a final paycheck on the last day of employment, then you should uncheck this box so that the employee is not paid again when regular payroll is processed. If you’re a paperless W-2 client, you’re responsible for printing and providing W-2s to employees who did not consent to receiving paperless tax statements. To see which employees consented, log into the RUN platform and go to the Company tab, Employee Access, then Manage Employee Access.

Your payroll processing program uses this number to identify the employee. To add or change the employee’s payroll company code,click the button next to the Payroll Company Code field then select the appropriate payroll company code. In most cases, this box should be checked so that the employee’s pay data totals are transferred to payroll.

Although you can process a bonus payroll at any time during the year, many are processed at the end of the year. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectEnter Third Party Sick Payto begin the Guided Walk Through. If any of your employees received temporary disability payments in 2020 from a third party, such as an insurance company or state agency, the total amount of these payments must be submitted to ADP® by December 31, 2020. View your employees’ year-to-date earnings and deductions in the RUN Powered by ADP® or Payroll Plus® platform.

When you are done, click on the “done” button.Enter the number of overtime hours in the “O/T Earnings” column. Add or delete the current number in the field and enter a new file number.

If any of your employees received temporary disability payments in 2020 from a third party, such as an insurance company or state agency, the total amount of these payments must be submitted to ADP® by January 1, 2021. View your employees’ 2020 earnings and deductions in the RUN Powered by ADP® or Payroll Plus® platform. Go to the Reports tab, select Misc Reports and click Employee Summary. You can either report Group Term Life Insurance costs for your employees per payroll OR in lump sum via an Off-Cycle Payroll. Up to three years of their W-2 tax forms will be stored in EA.

The majority of businesses that opt for full-service payroll do so because of taxes. Established in 1949, ADP is perhaps the most recognizable payroll processing company in the world. In addition to payroll software, ADP also offers benefits management and integrated HR solutions.RUN Powered by ADP is their small-business payroll application, designed for businesses with one to 49 employees.

RUN Powered by ADP offers four plans, all designed for between one and 49 employees. A menu bar at the top of the screen offers access to employee data, reports, taxes, and your general ledger (G/L), if you’re integrating RUN with your accounting software. RUN Powered by ADP currently integrates with QuickBooks Online, Wave, and Xero, along with other applications. The employee access feature also allows employees to access paystubs and year-end forms such as W-2s and 1099s. However, RUN Powered by ADP makes it easy to enter prior payroll totals using the Prior Payroll Amounts Wizard, which helps to ensure that all year-end payroll forms and reports will be accurate.

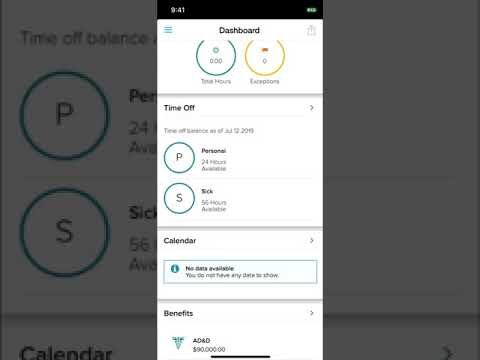

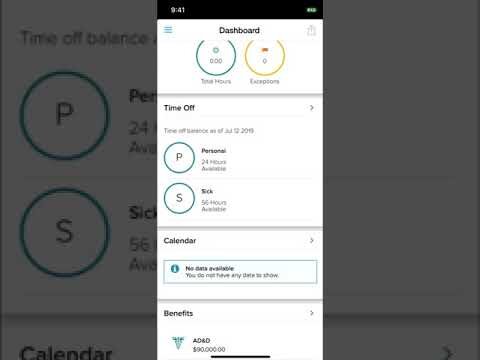

Welcome To Adp® Mobile Solutions!

In the pop-up menu, under “Payroll,” select “Payroll Cycle.” You will be directed to the Payroll Cycle page. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period. Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to. Some jurisdictions require that you provide an EITC notification to each of your employees with their annual tax forms. If your business is located in one of these jurisdictions, click the link to access and print the applicable notification.

This interactive tracking system will guide you through important To-Do items that need to be completed prior to running your last payroll of the year. Completing these tasks will help ensure W-2s and 1099s are accurate for you and your employees BEFORE they are printed. Log into the RUN Powered by ADP®/Payroll Plus®platform, click your name in the top, right-hand corner and select Settings to begin setup today. Christmas Day is Friday, December 25 and New Year’s Day is Friday, January 1. If your check dates fall on either of these dates, please adjust them to avoid delaying your employees’ direct deposits and delivery of your payroll package. A step-by-step Guided Walk Through is available in the RUN platform to assist you through the process of reporting third party sick pay. Click the Year-End Tasks and Tips button on the RUN homepage banner, then select Enter Third Party Sick Payto begin the Guided Walk Through.

- Established in 1949, ADP is perhaps the most recognizable payroll processing company in the world.

- In addition to payroll software, ADP also offers benefits management and integrated HR solutions.RUN Powered by ADP is their small-business payroll application, designed for businesses with one to 49 employees.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

- The majority of businesses that opt for full-service payroll do so because of taxes.

This process saves a lot of time and limits mistakes due to data entry errors. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck. You can manually input these changes in the paydata grid.If an employee is set up for Automatic Pay but you need to change their salary or hours for this pay period, include the employee in the batch. Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period.

Be sure to report any changes with your first payroll of 2021. If you have to run another payroll before the end of the year, you will have to review your company, employee, and contractor totals again. If you haven’t processed payrolls regularly due to COVID-19 impacts, but your account is still active with ADP®, you can resume processing payrolls at any time BEFORE December 31, 2020.

ADP offers phone support for both payroll administrators and employees, so both can contact the company with questions or concerns. ADP offers support for both employees and payroll administrators, with separate support options available, depending on your role. For administrators, a FAQ page is available, and you can access support using the password provided to you once your subscription is finalized. All RUN Powered by ADP plans include W-2 and 1099 processing as well as complete tax filing and remittance. RUN Powered by ADP will also deliver payroll to your business, and new hire reporting is included as well. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system.

Q: How Do I Add An Employees Fingerprint To An Ats 700?

You can now receive payroll text and calendar reminders 2 days before you’re scheduled to process payroll. We’ll even remind you of upcoming holidays in case you need to run payroll early! Log into the RUN Powered by ADP®/Payroll Plus® platform, click your name in the top, right-hand corner and select Settings to begin setup today.

Designed specifically for businesses with fewer than 49 employees, RUN’s intuitive navigation and use of wizards make it a good option for business owners with little or no payroll or accounting experience. If you’re a small business owner, RUN Powered by ADP gives you the tools you need in an easy-to-use format that will have you processing payroll in minutes, not days. This step allows you to verify the accuracy of the payroll once it’s been calculated. In the Payroll Cycle window, click on the “Preview Results” icon. You can review total payroll information for the entire company.

Also, you can drill down to verify payroll information by department or for individual employees.If you find incorrect information, click “Make Corrections” and edit the payroll batch. Then you will have to go back to the previous step and recalculate the payroll, and then run “Preview Results” function to verify the payroll once more. Add additional checks for bonuses, commissions, retroactive pay or advance pay. Select the employee for whom you want to create the additional check. Information for that employee’s regular pay for this pay period is already entered.

Terminated employees, who are registered on EA, can access, view and download their pay and tax statements. They also have the option to select and receive paperless W-2 tax statements. If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date. As ADP® files your taxes, you should process these payrolls at least 48 hours before the check date, to allow ADP enough time to debit and deposit the tax amounts timely.

There are many different payroll software companies you can use to process payroll but ADP does an exceptional job at helping your company process payroll. ADP can help payroll professionals grow along with company changes. They can also help payroll professionals stand out as people that employees, managers and department heads trust to get their pay checks right.

If your business has more than one company that processes payroll, confirm the correct company code. To change the company code, click on the magnifying glass icon and select the correct company code.If you don’t have more than one company, do nothing.

Payroll Software

Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. Employees can log in to the system and enter their timecard information, hours and any other relevant payroll information. This data is automatically uploaded to your paydata grid. You can get into the system and manually correct or adjust any data as needed.

Now, enter a second row for that employee to create a new check. Click on “insert” and select “new row.” A second row will appear with the same employee name. Now you can enter paydata for the additional check.Enter the tax frequency information, which calculates taxes based on the type of pay. For example, bonuses are taxed at different rates than regular pay. Hours.” Enter the number of regular hours each employee worked. The system will automatically calculate the gross salary, deductions and net salary for the pay period. Click on the “save” button frequently to save data you have entered.

Before you report costs in the payroll platform, you must first calculate the taxable portion of coverage that exceeds $50,000. To determine this amount, please review Publication 15-B, The Employer’s Tax Guide to Fringe Benefits , as prepared by the IRS, or speak with your company’s accountant. To help ensure W-2s are accurate for your employees, you should report Group Term Life Insurance in the RUN Powered by ADP® /Payroll Plus® platform PRIOR to running your final payroll of the year. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checksto begin the Guided Walk Through.

Help And Support For Adp® Mobile Solutions

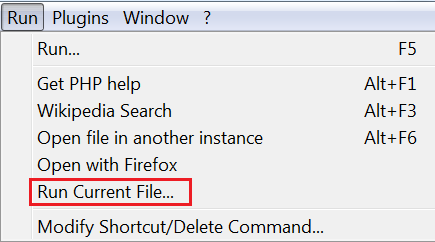

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

Watch a quick tutorial in Help & Support to learn how to add a new employee to your payroll. Also, the I-9 form is available in the Help & Support section of the RUN platform under Forms & Tools, then Tax & Payroll Forms. They will not have full visibilityof their SSN/TIN once their tax forms are printed and distributed. If you want to surprise your employees with the bonus, consider processing an Off-Cycle Payroll after you run your regular payroll. That way, the bonus amount won’t be included in the year-to-date total. Federal legislation requires the reporting of both taxable and non-taxable sick payments made to employees from a third party. Taxes withheld on those payments must also be reported.

Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party. If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s. It is important that you obtain this information from the appropriate third party provider as soon as possible. These entries must be processed on or before your last payroll of the year to ensure that your Form 941 and W-2 reports are accurate. This is the process for entering data for your salaried and hourly employees who are not set up for Automatic Pay. You enter paydata in batches, which are groups of employees. You can use previously-created batches, or you can create and customize new batches.Click on “Process” in the task bar at the top of the page.