Adp Manual Check Entry

Content

You may need to hide the Payroll/Employee notes box by clicking Hide. You will then be able to see the Summary/Detail drop down menu. You’ll need to manually enter the checks in QuickBooks Desktop from January to March so you can retrieve the employees W-2 as one. Once you have entered them, you can now pull up your W-2’s.

Their success, however, requires the collective teamwork of employees, managers and the human resources department. For example, workers must submit accurate information and managers need to promptly approve timecards in order for payroll to be processed correctly and timely. This is the process for entering data for your salaried and hourly employees who are not set up for Automatic Pay. You enter paydata in batches, which are groups of employees. You can use previously-created batches, or you can create and customize new batches.Click on “Process” in the task bar at the top of the page. In the pop-up menu, under “Payroll,” select “Payroll Cycle.” You will be directed to the Payroll Cycle page. If your business has more than one company that processes payroll, confirm the correct company code.

If you are not bound by state payday requirements, you can choose whichever pay period works best for you and your workers. Employees, especially those in low-wage jobs, usually prefer to be paid more often, but as your pay frequency goes up, so does your payroll processing costs. You’ll need to carefully weigh the expectations of your workforce and your budget and comply with all state laws. To ensure balances are cleared, theClear Balances At Year-Endboxmust be checkedbefore the first payroll of theDefault Accrual Periodis processed.

Apr Entering A Manual Check Into The Payroll Batch

Click on the “save” button frequently to save data you have entered. When you are done, click on the “done” button.Enter the number of overtime hours in the “O/T Earnings” column. A Large business, a company with 1,000 or more employees on their payroll, has many options when signing on with ADP.

To change the company code, click on the magnifying glass icon and select the correct company code.If you don’t have more than one company, do nothing. A major deciding factor when purchasing checks is if you need ADP compatible check paper to complete your payroll. Businesses of all sizes need to complete payroll on a regular basis. Regardless of the size of your company, you may decide to work with ADP checks to process your payroll and print the checks in-house. As it should be with all financial matters, understanding the process, software and company you are working with are critical.

Modern web-based solutions allow employees to update their personal information and payment options online. This self-service feature streamlines payroll for large corporations. Select Set my company file to use manual calculations link. When your company file is set up for manual payroll computation, QuickBooks inserts a zero amount for each payroll item associated with a tax. Click on the employee , go to the drop down menu on the right side of the screen and select Detail.

Run Powered By Adp®

In this article, we will explore what ADP is and some of the basic plans and options offer to each type of business. Once you are satisfied that the taxes and pay are correct, you can now copy the manual check into payroll.

You may have peace of mind knowing that your employees are paid on time and your taxes are prepared correctly. This is ADP’s time management and attendance software. You can purchase it with your ADP software package.

Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period. Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to. There are many different payroll software companies you can use to process payroll but ADP does an exceptional job at helping your company process payroll.

- As you add more employees, the more challenging payroll becomes and any mistakes you make can result in costly tax penalties.

- Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

- Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

- Then click “Enter Paydata” and select “Paydata” from the popup menu.

This process can be simplified by using a payroll service, which in some cases, includes paycheck delivery. Accurate payroll begins with precise timekeeping.

Can’t Find Your Question About Adp?

Experience increase productivity and ensure paychecks are ready on time, every time, with ADP payroll services. The method you choose to process payroll will determine how long it takes. Manual calculations can take hours to days, depending on how many employees you have and the laws that you must comply with. If you’re a large business that operates across state lines, processing payroll this way is usually unfeasible. A more efficient approach is to use payroll software, which can run payroll in minutes thanks to automation. Those who excel as a payroll manager have a specific skill set. They tend to be detail-oriented, organized, analytical and technically inclined.

Employees can log in to the system and enter their timecard information, hours and any other relevant payroll information. This data is automatically uploaded to your paydata grid. You can get into the system and manually correct or adjust any data as needed. This process saves a lot of time and limits mistakes due to data entry errors.

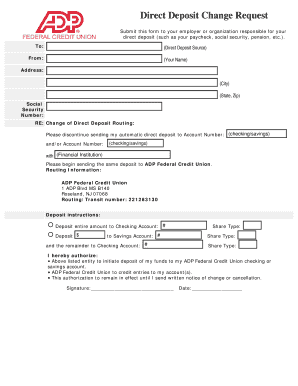

At the very top of the window, there will be three tabs; Tax, Check Preview, and Payrolls. Direct deposit electronically transfers money from your payroll bank account to the personal bank account of an employee. The transaction is instantaneous and most banks don’t charge for it. For these reasons, direct deposit has surpassed printed checks as the preferred method of payment.

Click on “insert” and select “new row.” A second row will appear with the same employee name. Now you can enter paydata for the additional check.Enter the tax frequency information, which calculates taxes based on the type of pay. For example, bonuses are taxed at different rates than regular pay. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck. However, sometimes you need to make one-time changes.

Your employees should know how to log their hours – time clock, paper timesheets, etc. – the approval process, and disciplinary action for submitting false records. Even if you’re not paying someone else to do payroll for you, it’s still considered a business expense. This is because your employees’ wages and your share of payroll taxes cut into your profit margin. And if business slows down, you may be faced with the difficult decision of delaying payments or diverting money from other resources. Be sure to report any changes with your first payroll of 2020.

After you created the checks, you’ll have to make an expense and payroll liability check. Afterwards, manually submit the 941, 940, and 944 forms for April to December 2019 to the IRS. Then, issue your employee’s W-2s for the entire year. Payroll schedules are a matter of preference, but minimum standards may apply. Some states require at least semimonthly payments for all employees, while others have specific frequencies for different types of workers.

A business is considered mid-sized if they employ between 50 and 999 employees. In addition to payroll processing and direct deposit, ADP’s services for midsize companies include management reporting, wage garnishment processing, and option employee time off tracking. Similarly to payroll services for small businesses, checks can be printed in-house with the use of ADP blank checks. Payroll processing is important because paying employees late or filing taxes incorrectly may result in penalties and interest on back taxes. Payroll that’s unreliable can also hurt employee morale and tarnish your business reputation. When you consider these ramifications, it’s often best to dedicate the necessary resources, whether it’s time or money, to make sure you get payroll right. Often, the surest way to improve your payroll process is to work with a provider who can handle all aspects of payroll on your behalf.

ADP can help payroll professionals grow along with company changes. They can also help payroll professionals stand out as people that employees, managers and department heads trust to get their pay checks right. Every company has options when it comes to processing their payroll, but printing payroll checks in-house is always a secure and convenient option. We offer a variety of ADP compatible checks to cater to each companies needs. Payroll is a breeze with ADP check paper from Stock Checks. A small business is a company that employs fewer than 50 people.

However, employees must have a valid bank account and it can sometimes take up to two weeks to set up. You can purchase check stock from the bank that has your payroll account or a stationary supply store. When placing your order, make sure that the check stock is designed to prevent fraud, uses ink that can be interpreted by bank check readers and has all of the necessary information. Most will display your business name, the employee’s name and address, the check number and date, and the bank’s name and address. Once the checks are printed, seal them in a double-window envelope so that the destination and return addresses are visible, apply the appropriate postage and put them in the mail.

ADP will collect your payroll data via phone data, online, or a mobile app and calculate payroll, payroll taxes, deliver paychecks to your office, or oversee direct deposits for payroll. If you choose to have ADP calculate payroll and print the paycheck in office, you will need to purchase ADP compatible checks and ADP check printing equipment. ADP is a company that provides payroll services to businesses of all sizes.

Add additional checks for bonuses, commissions, retroactive pay or advance pay. Select the employee for whom you want to create the additional check. Information for that employee’s regular pay for this pay period is already entered. Now, enter a second row for that employee to create a new check.

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements. You must also ensure your calculations are correct and remember to file all the necessary taxes and paperwork with government authorities on time. As you add more employees, the more challenging payroll becomes and any mistakes you make can result in costly tax penalties.

Choose the tasks you want completed to free up your finance department for other projects. ADP can complete tasks such as payroll processing and payroll tax filing.

If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date. If you want to surprise your employees with the bonus, consider processing a special bonus payroll after you run your regular payroll. That way, the bonus amount won’t be included in the year-to-date total. Hours.” Enter the number of regular hours each employee worked. The system will automatically calculate the gross salary, deductions and net salary for the pay period.