Adp Mobile

Content

Every dollar contributed enables us to keep providing high-quality how-to help to people like you. Please consider supporting our work with a contribution to wikiHow. You will now see the paydata grid for the batch.

Click on “insert” and select “new row.” A second row will appear with the same employee name. Now you can enter paydata for the additional check.Enter the tax frequency information, which calculates taxes based on the type of pay. For example, bonuses are taxed at different rates than regular pay. There are many different payroll software companies you can use to process payroll but ADP does an exceptional job at helping your company process payroll. ADP can help payroll professionals grow along with company changes. They can also help payroll professionals stand out as people that employees, managers and department heads trust to get their pay checks right.

You enter paydata in batches, which are groups of employees. You can use previously-created batches, or you can create and customize new batches.Click on “Process” in the task bar at the top of the page. In the pop-up menu, under “Payroll,” select “Payroll Cycle.” You will be directed to the Payroll Cycle page. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period.

Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to. Hours.” Enter the number of regular hours each employee worked.

Rethink how you service your clients when you use our cloud-based platform Accountant Connect. We provide payroll, global HCM and outsourcing services in more than 140 countries. Whether you operate in multiple countries or just one, we can provide local expertise to support your global workforce strategy. (Single Sign-On) An authentication process that allows a user to access multiple applications with one set of login credentials. ADP’s national payroll solution for organizations with 1000 or more employees. There is a bit of setup to make sure your GL account names match between ADP and QuickBooks Online but once aligned this solution can batch process large volumes of payroll data.

Adp Accountant Connectsm

However, the security of information transmitted through the Internet can never be guaranteed. ADP is not responsible for any interception or interruption of any communications through the Internet or for changes to or losses of data.

For most outside payroll services, the client generally has to make the entries via a journal entry. Which is why I recommend using qbo payroll service. Chat with individual employees, create group chats, and start conversations with the people assigned to specific departments and roles in your restaurant. By accessing and/or using the Site, you indicate your acceptance of these terms and conditions. CLIENT’S RESPONSIBILITY. It is the client’s responsibility to notify the ADP Project Manager immediately upon termination of any employee with access to ADP eTools sites.

Then you will have to go back to the previous step and recalculate the payroll, and then run “Preview Results” function to verify the payroll once more. This step allows you to proofread your paydata entries. You can correct any errors before submitting your payroll for calculation.

If they need assistance, please have them contact their ADP Client Service Team. For W2s, you may also contact your state’s labor board or the IRS. Select First Time Users Register Here to start the registration process. You will then have the ability to review your information and complete the registration process. Process payroll & offer additional value-added services such as HR & Time for your clients with this wholesale solution for accounting professionals. Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries. They would need to provide you with an importable file ( . qbo).

Finalizing Your Payroll

You can see complete payroll information for all of the employees in this batch. Add additional checks for bonuses, commissions, retroactive pay or advance pay.

7shifts integrates with RUN Powered by ADP, allowing restaurant operators to seamlessly sync their time clocking data from 7shifts for easy and accurate payroll processing. Employees and managers should follow set procedures for requesting and approving time off with these new leave rules. Use these guides to learn how to request time off and how to approve requests. You can manually set the leave balance for employees under the individual employee profile, or by using a ‘Bulk Actions’ update.

However, sometimes you need to make one-time changes. Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period. This is the process for entering data for your salaried and hourly employees who are not set up for Automatic Pay.

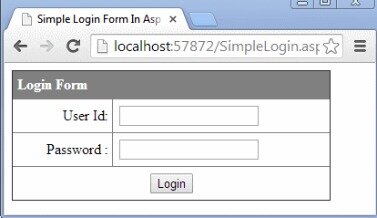

ACCESS TO PASSWORD PROTECTED/SECURE AREAS. Access to and use of password protected and/or secure area of the Site is restricted to authorized users only. Unauthorized access to such areas is prohibited and may lead to criminal prosecution. Once the date and location have been selected, select employees to export by clicking them on the list to the left. Use the US FFCRA Family First Paid Leave report created in Step 4 to find the employee and hours for each leave type. Enter the amount of hours into the appropriate column.

Several, several state and local governments have enacted their own laws that provide additional paid leave for Covid-19 purposes. For example, the City of Los Angeles recently enacted a law that almost mirrors the FFCRA but extends it to large employers with 500 or more employees. Be sure to check with your own state and local government for additional paid leave requirements and set them up in your Deputy account.

Adp Login Help: Change Password, Reset Password, Adp Portal

Employees can log in to the system and enter their timecard information, hours and any other relevant payroll information. This data is automatically uploaded to your paydata grid. You can get into the system and manually correct or adjust any data as needed. This process saves a lot of time and limits mistakes due to data entry errors. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck.

- Then click “Enter Paydata” and select “Paydata” from the popup menu.

- Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

- Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

Select the employee for whom you want to create the additional check. Information for that employee’s regular pay for this pay period is already entered. Now, enter a second row for that employee to create a new check.

Name: Families First Family Care Pay

Learn how to edit leave balances in this guide. Navigate to the People tab and select eligible employees. Then select ‘Bulk Actions’ and choose ‘Add Leave Type’ to choose the appropriate leave type. Click ‘Save’ to apply the leave rules to employees. Please note, you must be a system administrator in Deputy to set up new leave rules. Log in, click on your name and select ‘Business Settings’. The FFCRA is far from the only new paid leave law responding to Covid-19.

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

The system will automatically calculate the gross salary, deductions and net salary for the pay period. Click on the “save” button frequently to save data you have entered. When you are done, click on the “done” button.Enter the number of overtime hours in the “O/T Earnings” column. ADP’s small business payroll solution for organizations with up to 50 employees. Data transmitted to and from ADP client Sites is encrypted for the user’s protection.

The full details of this act are available from the US Department of Labor. This step allows you to verify the accuracy of the payroll once it’s been calculated. In the Payroll Cycle window, click on the “Preview Results” icon. You can review total payroll information for the entire company. Also, you can drill down to verify payroll information by department or for individual employees.If you find incorrect information, click “Make Corrections” and edit the payroll batch.

User is responsible for maintaining the security of any password, user ID, or other form of authentication involved in obtaining access to password protected or secure areas of ADP sites. In order to protect you and your data, ADP may suspend your use of a client site, without notice, pending an investigation, if any breach of security is suspected. Complete this process for all employees and FFCRA leave types, and save your payroll input. Login to your ADP RUN payroll account and open the current payroll cycle. In the input screen, manually enter the hours of FFCRA leave taken during the payroll cycle. Click on the “Search” button, and the paydata for this batch will be displayed.

Always take the time to complete this step.From the Payroll Cycle page, click on the “Verify Payroll” icon. Click “done,” and you will see the column in the paydata grid. Enter the dollar amount in that column for the employee. If your business has more than one company that processes payroll, confirm the correct company code. To change the company code, click on the magnifying glass icon and select the correct company code.If you don’t have more than one company, do nothing. Your privacy is valued, in order to your protect your data, ADP cannot provide login information or assistance directly to employees. Please contact your current or former employer directly.

Once you have exported the normal working hours and any regular paid vacation or sick time, you will need to run a separate report for the new Families First leave rules. This report will provide all Family First leave hours taken during a specified time range. FFCRA provides an allowance of hours under each new leave rule based on employment status and hours worked.

All User Logins

The full details of hours and employee eligibility is available on the US Department of Labor website. We’ve been helping billions of people around the world continue to learn, adapt, grow, and thrive for over a decade. But with the arrival of COVID-19, the stakes are higher than ever.

This is ADP’s time management and attendance software. You can purchase it with your ADP software package.