Adp Pay Stub 2020

Content

They will not have full visibilityof their SSN/TIN once their tax forms are printed and distributed. Step-by-step Guided Walk Throughs are available in the RUN platform to assist you with recording manual checks using our Calculate Checks tool; reporting third party sick pay; and maxing out retirement.

Federal legislation requires the reporting of both taxable and non-taxable sick payments made to employees from a third party. Taxes withheld on those payments must also be reported. Add additional checks for bonuses, commissions, retroactive pay or advance pay.

ADP iPay offers employees the option of viewing online payroll information such as W-2 forms and paycheck stubs. Paycheck stubs include payroll deductions, withholding and earnings. Although the iPay system is web-based and requires no special downloads, registration is required before viewing payroll information. ADP offers support for both employees and payroll administrators, with separate support options available, depending on your role. For administrators, a FAQ page is available, and you can access support using the password provided to you once your subscription is finalized. However, RUN Powered by ADP makes it easy to enter prior payroll totals using the Prior Payroll Amounts Wizard, which helps to ensure that all year-end payroll forms and reports will be accurate.

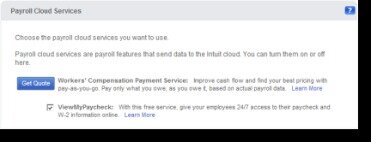

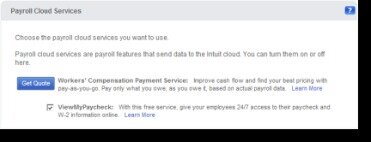

All RUN Powered by ADP plans include W-2 and 1099 processing as well as complete tax filing and remittance. RUN Powered by ADP will also deliver payroll to your business, and new hire reporting is included as well. To run an ACA report, you will need to log into eTime, employee time and attendance welcome manager and approvers. Here you will click my quickness, a quick nap next to show, you will choose all home or either all home and transferred in. Businesses using Paychex Time and Labor Online may log in here to create pay rules, view time sheets, manage group schedules, approve time off, and set up custom reports and alerts. Some jurisdictions require that you provide an EITC notification to each of your employees with their annual tax forms.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

- Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

- Then click “Enter Paydata” and select “Paydata” from the popup menu.

- The majority of businesses that opt for full-service payroll do so because of taxes.

Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to.

Established in 1949, ADP is perhaps the most recognizable payroll processing company in the world. In addition to payroll software, ADP also offers benefits management and integrated HR solutions.RUN Powered by ADP is their small-business payroll application, designed for businesses with one to 49 employees. You can run this report several ways, from previous pay period, current pay period, specific date, or range of dates. If you scroll to the bottom you’ll see as of today, this is the current pay period, the number of hours this employee has worked as of today. Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party. If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s.

There are many different payroll software companies you can use to process payroll but ADP does an exceptional job at helping your company process payroll. ADP can help payroll professionals grow along with company changes. They can also help payroll professionals stand out as people that employees, managers and department heads trust to get their pay checks right. RUN Powered by ADP offers four plans, all designed for between one and 49 employees. A menu bar at the top of the screen offers access to employee data, reports, taxes, and your general ledger (G/L), if you’re integrating RUN with your accounting software. RUN Powered by ADP currently integrates with QuickBooks Online, Wave, and Xero, along with other applications.

Payroll Software

CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. To terminate an employee from your company, you must schedule the employee for termination in the Time & Attendance module. The employee is “marked” for termination but is not actually terminated until payroll is run for the pay period containing the employee’s termination date and the pay period is closed.

The majority of businesses that opt for full-service payroll do so because of taxes. To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements. ADP offers phone support for both payroll administrators and employees, so both can contact the company with questions or concerns.

Log In To Our Most Popular Platform

Watch a quick tutorial in Help & Support to learn how to add a new employee to your payroll. Also, the I-9 form is available in the Help & Support section of the RUN platform under Forms & Tools, then Tax & Payroll Forms. You can either report Group Term Life Insurance costs for your employees per payroll OR in lump sum via an Off-Cycle Payroll.

Now, enter a second row for that employee to create a new check. Click on “insert” and select “new row.” A second row will appear with the same employee name. Now you can enter paydata for the additional check.Enter the tax frequency information, which calculates taxes based on the type of pay. For example, bonuses are taxed at different rates than regular pay. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period.

How To Register For Adp Paycheck Stub View

At that time, the employee’s status becomes “terminated” and the employee no longer appears in any area of the Time & Attendance module . Until the pay period containing the scheduled termination date is closed, the employee continues to appear in the system. For clients not using Paychex Flex or MyPaychex, log in here to manage their payroll, reports, HR information, retirement plans, health insurance, and more. HR, payroll, time and attendance, and benefits login for owners and administrators who use Paychex Preview® and other Paychex solutions for midsize companies.

It is important that you obtain this information from the appropriate third party provider as soon as possible. These entries must be processed on or before your last payroll of the year to ensure that your Form 941 and W-2 reports are accurate. Terminated employees, who are registered on EA, can access, view and download their pay and tax statements. They also have the option to select and receive paperless W-2 tax statements. ADP offers payroll payment services to small, medium and large companies.

If your business is located in one of these jurisdictions, click the link to access and print the applicable notification. Before you report costs in the payroll platform, you must first calculate the taxable portion of coverage that exceeds $50,000.

Select the employee for whom you want to create the additional check. Information for that employee’s regular pay for this pay period is already entered.

Q: How Do I Delete A Row In Adp Time & Attendance?

To determine this amount, please review Publication 15-B, The Employer’s Tax Guide to Fringe Benefits , as prepared by the IRS, or speak with your company’s accountant. To help ensure W-2s are accurate for your employees, you should report Group Term Life Insurance in the RUN Powered by ADP® /Payroll Plus® platform PRIOR to running your final payroll of the year. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checksto begin the Guided Walk Through. This will help ensure accurate and timely tax filings. If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date. As ADP® files your taxes, you should process these payrolls at least 48 hours before the check date, to allow ADP enough time to debit and deposit the tax amounts timely.

The employee access feature also allows employees to access paystubs and year-end forms such as W-2s and 1099s. Designed specifically for businesses with fewer than 49 employees, RUN’s intuitive navigation and use of wizards make it a good option for business owners with little or no payroll or accounting experience. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time.

You and employees (with Employee Access®) will be able to view your W-2s and 1099s on or around January 4, 2021. Please review online or via Employee Self Service prior to receiving the package with the physical forms. Ensuring information is accurate before January 15 will help you avoid amendment and reprint fees if forms need to be re-printed. Be sure to report any changes with your first payroll of 2021. You can view your tax forms by logging into the RUN Powered by ADP® platform and clicking Review Tax Documents under the Taxes tab. Christmas Day is Friday, December 25 and New Year’s Day is Friday, January 1. If your check dates fall on either of these dates, please adjust them to avoid delaying your employees’ direct deposits and delivery of your payroll package.

If you’re a paperless W-2 client, you’re responsible for printing and providing W-2s to employees who did not consent to receiving paperless tax statements. To see which employees consented, log into the RUN platform and go to the Company tab, Employee Access, then Manage Employee Access.