Adp Personal Discounts

Content

ADP and its affiliates have got your back with standout benefits like retirement plans and group health insurance, as well as benefits administration and business insurance. What group health insurance plan is right for my business? Finding the plan that works best for both you and your employees is a matter of balancing your coverage and budget needs. How does group health insurance benefit a small business owner? Health insurance helps protect the personal health of the business owner and its employees, as well as the financial health of the business. Group health coverage can relieve some of the financial fears of getting sick and help employees to stay health. Today, health insurance can also be a top benefit factor in attracting and retaining talented workers.

All insurance products will be offered and sold only through ADPIA, its licensed agents or its licensed insurance partners; One ADP Blvd. Certain services may not be available in all states with all carriers.

At ADPIA, we provide access to a wide range of group health insurance plans. We connect you with one of our carrier partners, while offering guidance and support. A benefit provider is an organization that charges premiums in exchange for health care coverage or other services. From the employee’s perspective, the group benefits provider is often the employer. As your company grows — and as industry regulations change — you may need to reassess your health insurance needs.

A minimum of at least 75% of “net eligible” or 50% of “total eligible” employees participate in the health plan. ADP has traditionally been known as a great company to work for. However, that changed starting around 2015 as the company embarked on a strategy to remake itself into a “tech” SAAS company as new cloud-based companies entered HCM. When compared to tech companies ADP’s operating margins were too low and costs too high, especially as a result of headcount and salaries. The focus to upgrade its platforms and move to the cloud was necessary to remain competitive.

Features And Benefits

Group health insurance helps create a healthy environment through prevention and wellness. Employees want to work for companies with the best compensation and benefits. Offering a comprehensive employee benefits package makes it more likely you’ll attract and retain top talent. We strive to do the right thing for the local and global communities where we live and work.

Automatic Data Processing, Inc. offers defined benefit pension plans and defined contribution pension plans. Employees at businesses with defined benefit pension plans collect a fixed sum when they retire. With a defined contribution pension plan, companies help workers save and invest for retirement. To thrive, your business needs to attract and keep the best and brightest employees.

What is the typical waiting period before employees become eligible for a new employer’s group health insurance plan? According to ACA, waiting time cannot exceed 90 days and some states have adopted a 60-day maximum waiting period. What percentage of the group health insurance premium does an employer usually pay? According to a Kaiser Family Foundation survey, small employers (3-199 employees) typically pay 86% of premiums for single-employee coverage and 66% of premiums for family coverage. Midsized firms ( employees) pay 88% of single-employee premiums and 82% of family premiums.

Contacting Adp Payroll And Benefits

For example, if you’re not particularly busy during the summer, you can institute a policy in which your employees can leave a few hours earlier on Fridays over this period. But the world started changing, and a bigger issue emerged around company culture. Therefore, we built a second business to help companies upgrade their culture. LifeMart is a proprietary, members-only discount shopping website that provides discounts on nationally recognized brand-name products and services and local retailers. We provide employees with real savings to help them manage everyday needs. Attract, retain and reward your employees with retirement solutions such as 401, SIMPLE IRA or SEP IRA plans — to help them become retirement ready.

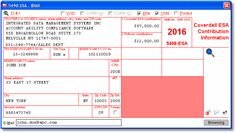

ADP’s Pay-by-Pay is a payroll enhancement feature of ADP’s payroll processing services. Clients must be using ADP’s tax filing service to take advantage of the Pay-by-Pay Premium Payment Program. What are the typical features of a group health insurance plan and how do they affect its price? Plan deductible – The expenses a member must cover before the insurer covers expenses. The lower the plan deductible, the higher the premium. Other insurance plans offer a higher deductible, which results in a lower premium, but have higher out-of-pocket costs until the deductible and any coinsurance requirements are met. This type of plan provides coverage for significant medical expenses and can work for people who don’t anticipate frequent trips to the doctor.

One way we do this is by paying you to pay it forward with volunteer time off and matching your contributions to the causes you support. We know that it’s our people who make the difference, for our company and for companies around the globe. Sharing ideas and perspectives helps us and our clients to be better, and we like to think that makes the world a better place.

Common Questions About Group Health Insurance

Register TODAY and your employees or members can access exclusive pricing & perks at all major car rental brands. COVID Wage Growth Report How the pandemic has affected wages across the U.S.Pay Transparency Report Does pay transparency close the gender wage gap? College Salary Report Which alumni earn the most after graduation? Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries.

One ADP® health care client prepared for a 15,000-employee increase with a limited staff of only two full-time employees, with the help of ADP’s HR outsourcing services. Get help with decision support toolsso your employees can make well-informed decisions and become more engaged with their benefits. We provide payroll, global HCM and outsourcing services in more than 140 countries. Whether you operate in multiple countries or just one, we can provide local expertise to support your global workforce strategy. Automatic Data Processing Insurance Agency, Inc. is an affiliate of ADP, Inc.

However, they missed the mark in terms of taking care of the PEOPLE that helped them get there. I think the benefits are good as we get to pick which carrier we prefer and dental plans have good coverage. Notorious for underpaying employees because they’re giving you their name. They don’t fire anyone unless they do something egregious, so you’ll be working around people who get paid the same for doing half the work.

Worth it if you can suck it up for a year or two to get it on your resume. If your company tends to have a period of slower business during the year, you may want to adjust your employees’ schedules accordingly.

We’ll get to know your business and help you determine what coverage is right for your situation. By investing in unique office perks, you can create a more positive and engaging workplace environment. In the current market, companies are coming up with all kinds of popular employee perks as they try to attract talent and create a better company culture. In an effort to stay competitive, you should strive to understand the types of affordable benefits that your team would truly value. Some material covers the offering of the ADP Pay-by-Pay Premium Payment Program.

Job Seekers Also Viewedpreviousnext

In addition, employer-paid premiums are generally tax-deductible. Your employees’ contributions to their premiums can be paid with pre-tax dollars, which lowers your employees’ taxable income as well as your payroll taxes. Business health insurance is typically more affordable than an individual policy. Businesses generally enjoy lower premiums because the more people in an employer health insurance plan, the lower the health insurance costs for everyone. Group health is the #1 benefit that employees desire when evaluating a new role.1Business health insurance helps to keep your employees healthy and productive. When it comes to group health insurance, your business should benefit too.

Glassdoor is your resource for information about ADP benefits and perks. Learn about ADP, including insurance benefits, retirement benefits, and vacation policy. Benefits information above is provided anonymously by current and former ADP employees, and may include a summary provided by the employer. When covid hit, many people couldn’t make quota for months and ended up getting laid off. It was weird to see because they were still hiring new people at that time instead of putting more focus on their current employees who had been at the company for a while. Are you looking to enroll your company or organization in a top employee discount program?

- What’s the difference between group health insurance and individual coverage?

- If you have a business that employs two or more people, you’re eligible to purchase group health insurance for your business.

- Automatic Data Processing, Inc. offers several options for retirement benefits and other amenities to promote employee well-being.

- By pooling employees together, premiums for group health insurance plans can be less expensive than buying individual plans for your employees.

- These contributions are tax deductible for employers and tax-free for workers.

This is a call center so all that matters to management is how many calls can you take per hour, that’s the bottom line. The calls have 3 seconds in between the next caller. This position as a Associate Client Service Rep is the most stressful position. You have to refer products and solve the problems the clients have and do it quick to meet the calls per hour goal. It’s near impossible while you are trying to get a good survey from the client. If you have no family or friends and like feeling like your never doing good enough this is the job for you.

Some carriers may charge an additional fee for services. This information is not intended as tax or legal advice. If you have any questions, contact a tax or legal professional. Copayment for services – The fixed dollar amount that’s due when the covered service is provided. In most cases, this is the only cost that the member is responsible for paying – the plan covers the majority of the cost of services. A healthy workforce can be a more productive one.

What’s the difference between group health insurance and individual coverage? If you have a business that employs two or more people, you’re eligible to purchase group health insurance for your business. By pooling employees together, premiums for group health insurance plans can be less expensive than buying individual plans for your employees. Automatic Data Processing, Inc. offers several options for retirement benefits and other amenities to promote employee well-being. These contributions are tax deductible for employers and tax-free for workers. Automatic Data Processing, Inc. provides health, dental, and vision benefits. Employer-financed retirement plans help to secure a steady money flow later in life.

We create experiences, products and services that people love using everyday. Explore skills and training, pay raises and promotions and management and culture. I have never worked at a company that actually loves their employees. They are about growth where you are and preparing for the next step in your career. The amount of training and resources they provide their salesforce is astounding. They never quit investing in their processes and people.

I would be taking calls while others were talking for 30 Minutes or more. S.), there are many career pathing options and overall they do a great job of caring for their employees for such a larger employer. Nice people, very flexible on remote work however expect to be on call all the time. Huge ability to move in the company, even sometimes if you don’t want to.

Large firms (1,000-4,999 workers) pay 89% of single employee premiums and 77% of family premiums. Typically available to a company of two or more employees and their families, there are several reasons why it makes good business sense to offer group health insurance. Benefits tend to fall into two categories – traditional and unique. Examples of traditional benefits include health and dental care, life insurance and retirement savings plans. Unique benefits, on the other hand, consist of education assistance, paid parental leave, telecommuting and more. Employers who succeed in keeping their employees engaged often find the right mix of both types of benefits. Group health insurance is an employee benefit provided by an employer that offers medical coverage to employees and sometimes their spouses, partners and/or legal dependents.