Adp Smartcompliance® Employment Verification For Adp Workforce Now® By Adp

Employers may also choose to re-communicate their policy to departing employees. Some jurisdictions require that you provide an EITC notification to each of your employees with their annual tax forms.

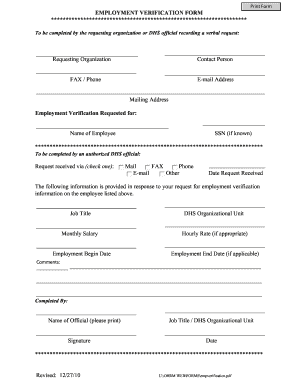

During the hiring process, many employers use reference checks to verify information provided in employment applications, resumes, and interviews. For instance, they may use the reference check to confirm dates of employment, positions held, and final salary or hourly wage.

Other Apps By Adp

Employers should be particularly sensitive to the risks associated with providing a negative reference. Before disclosing any negative job-related information, make sure you have thoroughly documented the issue at the time it occurred. For employment verifications, the information provided is generally limited to dates of employment, positions held, and pay history. To help make informed hiring decisions, employers often ask for references from prospective employees. Employers also provide references for former employees seeking other employment.

- ADP has absolutely no empathy or system in place to serve small business.

- Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party.

- Our next payroll, however, almost caused our employees to walk off the job.

- All of this investigating should have been done in the 3-4 weeks leading up to our first payroll, not upon the submission of our second payroll.

- We signed up with ADP and processed our first payroll flawlessly.

- We are an oilfield services company employing over 50 people.

If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s. It is important that you obtain this information from the appropriate third party provider as soon as possible. These entries must be processed on or before your last payroll of the year to ensure that your Form 941 and W-2 reports are accurate. For clients newly subscribing to ADP Employment Verification, the verification reports provided on your behalf will include current year and one year of additional history. Every time you process payroll, ADP sends payroll information to The Work Number, and your historical employee data is stored and builds by itself. Eventually The Work Number will have built up enough data to accommodate the vast majority of requests from Verifiers.

This will help ensure accurate and timely tax filings. Terminated employees, who are registered on EA, can access, view and download their pay and tax statements. They also have the option to select and receive paperless W-2 tax statements.

About Adp

Truework allows you to complete employee, employment and income verifications faster. The process is simple and automated, and most employees are verified within 24 hours. Verifiers love Truework because it’s never been easier and more streamlined to verify an employee, learn more here. There is no cost to your company or your employees. They pay for the speed and convenience that The Work Number offers over traditional methods of manually reaching out to employers.

If your business is located in one of these jurisdictions, click the link to access and print the applicable notification. Before you report costs in the payroll platform, you must first calculate the taxable portion of coverage that exceeds $50,000. To determine this amount, please review Publication 15-B, The Employer’s Tax Guide to Fringe Benefits , as prepared by the IRS, or speak with your company’s accountant. Federal legislation requires the reporting of both taxable and non-taxable sick payments made to employees from a third party.

The FCRA also has very specific guidelines employers must follow when taking adverse action against an individual (e.g. failing to hire) based on the results of the investigation. Several states have their own laws similar to the FCRA so it is important to review applicable state laws to ensure compliance.

ADP Employment Verification Services Connector integrates with ADP WorkForce NowTM to provide easy sync of data from ADP. Once you sign up for ADP Employment Verification Services and completed your set-up and activation of the services, it will pull your participating employees worker details , and the payroll details. When contacted for a job reference, it is considered a best practice to provide only limited information about former employees, such as dates of employment, positions held, and in some cases, final salary or hourly wage.

Whether you are conducting a reference check or are asked to provide a reference or employment verification, it’s important to have policies and procedures in place to handle these requests. Corporate check fraud is a growing concern among U.S. employees. ADP is one of the largest providers of payroll services and issues millions of checks each year.

Adp Employment Verification Services For Adp Workforce Now®

Some states have enacted laws that prohibit employers from “blacklisting” former employees. In other words, these states prohibit employers from intentionally trying to prevent a former employee from obtaining other employment. Don’t forget to comply with FCRA if using a third party. If you hire another company to perform certain background or reference checks, you must make sure you comply with the Fair Credit Reporting Act . Among other things, the FCRA requires that employers provide written notification to, and obtain authorization from, any individual subject to a background investigation.

We are an oilfield services company employing over 50 people. We signed up with ADP and processed our first payroll flawlessly. Our next payroll, however, almost caused our employees to walk off the job. All of this investigating should have been done in the 3-4 weeks leading up to our first payroll, not upon the submission of our second payroll. ADP has absolutely no empathy or system in place to serve small business. Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party.

Employers who provide Group Term Life Insurance to their employees must calculate and report the cost of coverage over $50,000, as required by the Internal Revenue Service . This cost is fully taxable and must be reported as additional income for any employee who receives this benefit. The amount will be displayed on your applicable employees’ W-2s in Box 12 .

It requires the requestor confirm they have a permissible purpose as defined by FCRA. ADP Employment Verification, powered by The Work Number® from Equifax, is your no-cost, automated service available with your services. It responds on your behalf to third party requests for your employees’ employment and income information, most often when your employees apply for loans, credit and public aid. • With verification data provided directly from employee payroll records, results are less prone to human error. To help ensure W-2s are accurate for your employees, you should report Group Term Life Insurance in the RUN Powered by ADP® /Payroll Plus® platform PRIOR to running your final payroll of the year.

For such a large company they are very antiquated when it comes to their reports. They give you a workers’ comp report that is useless as they cannot process more than one code per employee. Call and ask for support and they say they are a good company and nobody else has issues. I wish I would have seen this review site earlier. Now that I just moved over I have to look for a new company and have a quarter change over. Inform employees what information you will provide.

Taxes withheld on those payments must also be reported. ADP Employment Verifications, validates the true identity of the requestor .

Neither employers or employees are charged by ADP or The Work Number at any time to participate in the service – Verifiers pay fees for each verification request. The verification of income provides basic employment information about an employee’s job plus salary information such as total pay for year-to-date wages and previous year income if available. Verifiers can also include collection agencies, however the service does not allow third-party collection agents to access employee income information. Verifiers obtain consent from employees for their employment and income information during the application process for access to a loan, lease, credit, or government benefit. Neither you nor your employees pay for these services—Verifiers pay fees for each verification request. • Verifiers requesting an employment or income verification report must additionally certify they have a form of the consumer’s consent. • Verifiers cannot obtain an employment or income verification report without providing an applicable CRL permissible purpose and identifying the person making the request, to minimize data risk.

Horrible Reports And Customer Service

This is generally a preferred approach, since the information is limited to factual and objective data. If you choose to provide more information, make sure you are providing it in good faith; the information is accurate and job-related; and you provide the same types of information about all former employees.

Because of their ubiquitous nature in the American workplace, ADP is an obvious target for check forgers. If you are concerned that you have received a fraudulent ADP check, there are many indicators that can help you verify the authenticity of your check.

Christmas Day is Friday, December 25 and New Year’s Day is Friday, January 1. If your check dates fall on either of these dates, please adjust them to avoid delaying your employees’ direct deposits and delivery of your payroll package. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checksto begin the Guided Walk Through.

If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date. As ADP® files your taxes, you should process these payrolls at least 48 hours before the check date, to allow ADP enough time to debit and deposit the tax amounts timely. A fringe benefit is a form of compensation for the performance of services. For example, you provide an employee with a fringe benefit when you allow the employee to use a business vehicle to commute to and from work. If your check date falls on this date, please adjust it to avoid delaying your employees’ direct deposits and delivery of your payroll package. SSNs and TINs will now be truncated on copies of Forms W-2, 1099-MISC and 1099-NEC. This includes copies that are provided to employees to report third party sick pay and group-term life insurance.

Asus Has You Covered For:

To set proper expectations, let employees know what type of information the company will provide if asked to provide a reference or employment verification. This can be included in a written policy and within authorization forms.