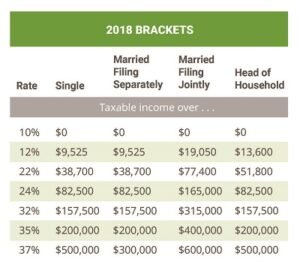

2021 Tax Brackets

The amount you set aside is treated as an employer contribution to a qualified plan. An elective deferral, other than a designated Roth contribution , isn’t included in wages subject to income tax at the time contributed. However, it’s included in wages subject to social security and Medicare taxes. For those who are responsible to run payroll, here’s a guide to help you comprehend the concept of federal taxable wages.

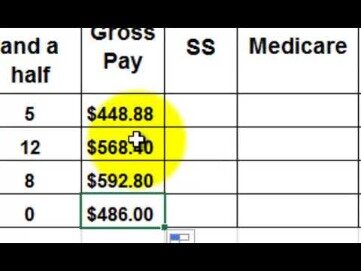

Generally, the employee’s gross wages will be equal […]