Logins 2021

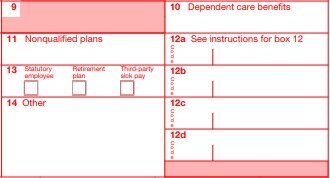

Cafeteria plans also can build employees’ loyalty within the company by saving them money and offering benefits they could not otherwise afford. Form 1095-C, under the Affordable Care Act, gives information about health care coverage provided or offered to benefits-eligible employees and their dependents during the previous year.

Typically, this is over 40 hours worked in a week or over eight hours worked in a day.

State and federal income taxes are withheld from your gross pay and are […]