Am I Required To File A Form 1099 Or Other Information Return?

Content

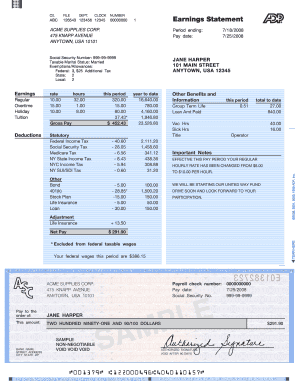

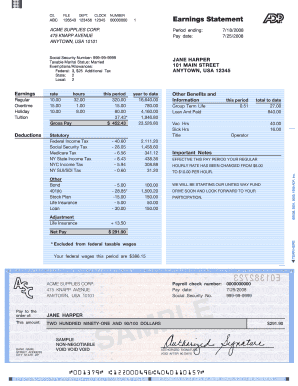

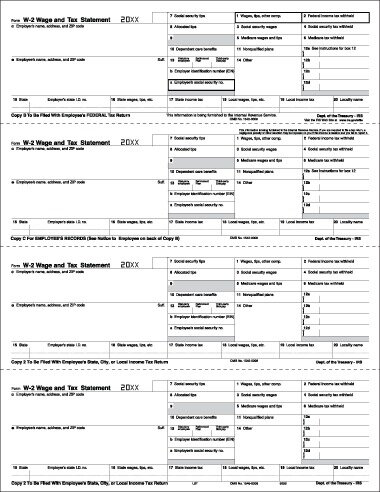

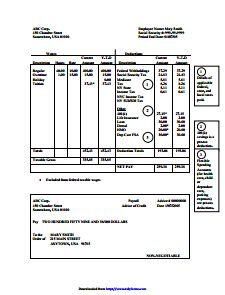

You’ll use a W-2 tax form to report annual compensation and payroll taxes withheld from their compensation. If you filed a Form 1099-R with the IRS and later discover that there is an error on it, you must correct it as soon as possible. See part H in the 2021 General Instructions for Certain Information Returns, or Pub. Excess contributions can occur in a section 401 plan or a SARSEP. All distributions of the excess contributions plus earnings , including recharacterized excess contributions, are taxable to the participant in the year of distribution. Report the gross distribution in box 1 of Form 1099-R. In box 2a, enter the excess contribution and earnings distributed less any designated Roth contributions.

- You do not have to complete this box for a direct rollover.

- Enter all the NUA in employer securities if this is a lump-sum distribution.

- See Regulations section 1.402-1 for the determination of the NUA.

- If this is not a lump-sum distribution, enter only the NUA in employer securities attributable to employee contributions.

- Use this box if a distribution from a qualified plan includes securities of the employer corporation and you can compute the NUA in the employer’s securities.

An excess contribution not withdrawn by April 15 of the year after the year of notification is considered a regular IRA contribution subject to the IRA contribution limits. For example, when using Code P for a traditional IRA distribution under section 408, you must also enter Code 1, if it applies. For a normal distribution from a qualified plan that qualifies for the 10-year tax option, enter Codes 7 and A. For a direct rollover to an IRA or a qualified plan for the surviving spouse of a deceased participant, or on behalf of a nonspouse designated beneficiary, enter Codes 4 and G . If two or more distribution codes are not valid combinations, you must file more than one Form 1099-R.

In addition to reporting distributions to beneficiaries of deceased employees, report here any death benefit payments made by employers that are not made as part of a pension, profit-sharing, or retirement plan. Also, enter these amounts in box 2a; enter Code 4 in box 7. 1099s and W-2s are the tax forms employers use to report wages and taxes withheld for different workers.

For a total distribution, report the total employee contributions or designated Roth contributions in box 5 rather than in box 9b. If a total distribution is made, the total employee contributions or insurance premiums available to be recovered tax free must be shown only in box 5. If any previous distributions were made, any amount recovered tax free in prior years must not appear in box 5. If a recipient does not submit a Form W-4P, withhold by treating the recipient as married with three withholding allowances. See Regulations section 35.3405-1T, Q/A A-9, for a definition of periodic payments.

Big Data Helps Hr Unlock Robust Employee Retention Strategies

Use this box if a distribution from a qualified plan includes securities of the employer corporation and you can compute the NUA in the employer’s securities. Enter all the NUA in employer securities if this is a lump-sum distribution. If this is not a lump-sum distribution, enter only the NUA in employer securities attributable to employee contributions. See Regulations section 1.402-1 for the determination of the NUA. Include the NUA in box 1 but not in box 2a except in the case of a direct rollover to a Roth IRA or a designated Roth account in the same plan (see Notice , Q/A-1, and Notice , Q/A-7). You do not have to complete this box for a direct rollover.

If contributions were made for more than 1 prior year, each prior year’s postponed contribution must be reported on a separate form. Report the amount of a late rollover contribution made during 2021, including rollovers that are certified by participants, qualified plan loan offsets, and related to taxpayers for federally declared disasters. , I.R.B. 995, available at IRS.gov/irb/ _IRB#REV-PROC . If the participant also has a postponed contribution, use a separate Form 5498 to report a late rollover. Use Code C for a distribution to report payments of reportable death benefits.DD—Annuity payments from nonqualified annuities and distributions from life insurance contracts that may be subject to tax under section 1411. If you choose to report the total employee contributions or designated Roth contributions, do not include any amounts recovered tax free in prior years.

This includes the earnings portion of any nonqualified designated Roth account distribution that is not directly rolled over. The recipient cannot claim exemption from the 20% withholding but may ask to have additional amounts withheld on Form W-4P, Withholding Certificate for Pension or Annuity Payments. If the recipient is not asking that additional amounts be withheld, Form W-4P is not required for an eligible rollover distribution because 20% withholding is mandatory. If a distribution is a loss, do not enter a negative amount in this box. If you made annuity payments from a qualified plan under section 401, 403, or 403 and the annuity starting date is in 1998 or later, you must use the simplified method under section 72 to figure the taxable amount. Under this method, the expected number of payments you use to figure the taxable amount depends on whether the payments are based on the life of one or more than one person.

Workmarket Features And Benefits

If only employer securities are distributed, show the FMV of the securities in boxes 1 and 2a and make no entry in box 5 or 6. If both employer securities and cash or other property are distributed, show the actual cash and/or FMV of the property distributed in box 1, the gross less any NUA on employer securities in box 2a , no entry in box 5, and any NUA in box 6. If any portion of a distribution from a designated Roth account that is not includible in gross income is to be rolled over into a designated Roth account under another plan, the rollover must be accomplished by a direct rollover. Any portion not includible in gross income that is distributed to the employee, however, cannot be rolled over to another designated Roth account, though it can be rolled over into a Roth IRA within the 60-day period described in section 402.

15-A for additional information regarding withholding on periodic payments and Pub. 15-T for applicable tables used to determine withholding on periodic payments. The 20% withholding does not apply to distributions from any IRA, but withholding does apply to IRAs under the rules for periodic payments and nonperiodic distributions. For withholding, assume that the entire amount of a distribution from an IRA other than a Roth IRA is taxable (except for the distribution of contributions under section 408, in which only the earnings are taxable, and section 408, as applicable). Generally, Roth IRA distributions are not subject to withholding except on the earnings portion of excess contributions distributed under section 408. If an eligible rollover distribution is paid directly to an eligible retirement plan in a direct rollover, do not withhold federal income tax. If any part of an eligible rollover distribution is not a direct rollover, you must withhold 20% of the part that is paid to the recipient and includible in gross income.

In the case of a direct rollover, the distributing plan is required to report to the recipient plan the amount of the investment in the contract and the first year of the 5-tax-year period, or that the distribution is a qualified distribution. A distribution from a designated Roth account that is a qualified distribution is tax free. A qualified distribution is a payment that is made both after age 59½ and after the 5-tax-year period that begins with the first day of the first tax year in which the employee makes a contribution to the designated Roth account. Certain amounts, including corrective distributions, cannot be qualified distributions. Report the amount of any postponed contribution made in 2021 for a prior year.

The Tax Differences Between W

Excess contributions that are recharacterized under a section 401 plan are treated as distributed. Corrective distributions must include earnings through the end of the year in which the excess arose. These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402). Enter Code 8 or P in box 7 to designate the distribution and the year it is taxable. If the distribution is paid to the surviving spouse, the distribution is treated in the same manner as if the spouse were the employee. Also, see Notice , Part II, I.R.B. 638, available at IRS.gov/irb/ _IRB#NOT , which has been amplified and clarified by Notice , I.R.B. 436, available at IRS.gov/irb/ _IRB#NOT , for questions and answers covering rollover contributions to Roth IRAs. Federal legislation requires the reporting of both taxable and non-taxable sick payments made to employees from a third party.

For purposes of section 72, designated Roth contributions are treated as employer contributions, as described in section 72 (that is, as includible in the participant’s gross income). For a return of employee contributions plus earnings, enter the gross distribution in box 1, the earnings attributable to the employee contributions being returned in box 2a, and the employee contributions being returned in box 5.

Taxes withheld on those payments must also be reported. Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party. If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s. RMD AmountRetirement payments, Specific Instructions for Form 1099-R, Boxes 14–19. RMD DateRollovers, Direct Rollovers, Explanation to Recipients Before Eligible Rollover Distributions (Section 402 Notice), Transfers, Corrected Form 1099-R, Box 1. IRA Contributions (Other Than Amounts in Boxes 2–4, 8–10, 13a, and 14a), Box 2. Enter any contributions made to a Roth IRA in 2021 and through April 18, 2022, designated for 2021.

1099 workers are also known as self-employed workers or independent contractors. These workers receive a 1099 form to report their income on their tax returns. Your company employs these workers directly, and they receive regular pay and employee benefits.

For a SARSEP, the employer must notify the participant by March 15 of the year after the year the excess contribution was made that the participant must withdraw the excess and earnings. All distributions from a SARSEP are taxable in the year of distribution.

Compliantly Organize, Manage And Pay All Your Freelancers And Contractors

However, report Roth IRA conversion amounts in box 3. Report a qualified rollover contribution made under section 408A from an eligible retirement plan to a Roth IRA in box 2. For lump-sum distributions from qualified plans only, enter the amount in box 2a eligible for the capital gain election under section 1122 of the Tax Reform Act of 1986 and section 641 of the Economic Growth and Tax Relief Reconciliation Act of 2001. Enter the full amount eligible for the capital gain election. You should not complete this box for a direct rollover. For a plan with no after-tax contributions or designated Roth contributions, even though the value of the account may have decreased, there is no loss for reporting purposes. Therefore, if there are no employer securities distributed, show the actual cash and/or FMV of property distributed in boxes 1 and 2a, and make no entry in box 5.