Beginners’ Guide to Financial Statement

Content

Assets are generally listed based on how quickly they will be converted into cash. Current assets are things a company expects to convert to cash within one year. Most companies expect to sell their inventory for cash within one year. Noncurrent assets are things a company does not expect to convert to cash within one year or that would take longer than one year to sell. Fixed assets are those assets used to operate the business but that are not available for sale, such as trucks, office furniture and other property.

- Unlike the balance sheet, the income statement covers a range of time, which is a year for annual financial statements and a quarter for quarterly financial statements.

- Reading the financial statement will give an overall view of the condition of the business and if there are any warnings signs of possible future problems.

- Investors can also see how well a company’s management is controlling expenses to determine whether a company’s efforts in reducing the cost of sales might boost profits over time.

- This financial statement shows a company’s total change in income, even gains and losses that have yet to be recorded in accordance to accounting rules.

- More detailed definitions can be found in accounting textbooks or from an accounting professional.

Some companies also choose to put this as a separate line item from operating expenses. Gross profit is the difference between a company’s revenue (net sales) and the cost of goods sold. It reflects the efficiency of a company in its production and selling process. Revenue is typically listed as net sales as it would exclude any applicable sales returns, allowances, and discounts before cost of goods sold is deducted to arrive at gross profit.

Another concern is that financial statements are entirely historical in nature, and so can be misleading when used to project the future results of a business. The cash flow statement reconciles the income statement with the balance sheet in three major business activities. Cash from financing activities includes the sources of cash from investors or banks, as well as the uses of cash paid to shareholders. Financing activities include debt issuance, equity issuance, stock repurchases, loans, dividends paid, and repayments of debt. The balance sheet provides an overview of a company’s assets, liabilities, and shareholders’ equity as a snapshot in time.

Income Statement

Liabilities also include obligations to provide goods or services to customers in the future. Combined, these statements provide a good view of the financial health of your business. Securities and Exchange Commission have mandated XBRL for the submission of financial information. Financial statements have been created on paper for hundreds of years. The growth of the Web has seen more and more financial statements created in an electronic form which is exchangeable over the Web. These types of electronic financial statements have their drawbacks in that it still takes a human to read the information in order to reuse the information contained in a financial statement.

Cash from operations includes any changes made in cash accounts receivable, depreciation, inventory, and accounts payable. These transactions also include wages, income tax payments, interest payments, rent, and cash receipts from the sale of a product or service. Financial statements are important because they provide a snapshot of a company’s financial position at a specific point in time. They can be used to assess a company’s financial health, performance, and cash flow. A cash flow statement is another type of financial statement that provides a snapshot of a business’s cash inflow and outflow during a specific period. This statement shows how much cash is being generated or used by a company, and can be used to assess its financial health.

Components of an Income Statement

The CFS allows investors to understand how a company’s operations are running, where its money is coming from, and how money is being spent. The CFS also provides insight as to whether a company is on a solid financial footing. Below is a portion of ExxonMobil Corporation’s income statement for fiscal year 2021, reported as of Dec. 31, 2021. Investors can also see how well a company’s management is controlling expenses to determine whether a company’s efforts in reducing the cost of sales might boost profits over time.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Selling, general, and administrative (SG&A) expenses, in other words, all non-production costs, are usually lumped together with operating expenses.

“Show me the money!”

These reports provide a snapshot of a business’s financial situation, results of operations, and cash flows. A balance sheet shows a snapshot of a company’s assets, liabilities and shareholders’ equity at the end of the reporting period. It does not show the flows into and out of the accounts during the period. Reported assets, liabilities, equity, income and expenses are directly related to an organization’s financial position. The operating activities on the CFS include any sources and uses of cash from running the business and selling its products or services.

- If financial statements are issued strictly for internal use, there are no guidelines, other than common usage, for how the statements are to be presented.

- We all remember Cuba Gooding Jr.’s immortal line from the movie Jerry Maguire, “Show me the money!

- Current assets are things a company expects to convert to cash within one year.

- Third, management can manipulate financial statements to give a false impression of the company’s financial health.

Financial statements that are being issued to outside parties may be audited to verify their accuracy and fairness of presentation. Generally Accepted Accounting Principles (GAAP) are the set of rules by which United States companies must prepare their financial statements. It is the guidelines that explain how to record transactions, when to recognize revenue, and when expenses must be recognized. International companies may use a similar but different set of rules called International Financial Reporting Standards (IFRS). It provides insight into how much and how a business generates revenues, what the cost of doing business is, how efficiently it manages its cash, and what its assets and liabilities are.

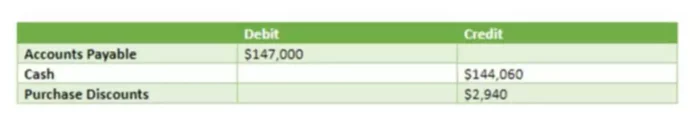

Financing Activities

This purchase will entail an increase in assets (equipment) and a liability (credit purchase) for the amount of $2,000. The company’s assets would then equal its liabilities plus shareholders’ equity. Financial statements aid in making decisions about investing in a company, lending money to a company, or providing other forms of financing. If a company has an inventory turnover ratio of 2 to 1, it means that the company’s inventory turned over twice in the reporting period. When you subtract the returns and allowances from the gross revenues, you arrive at the company’s net revenues. It’s called “net” because, if you can imagine a net, these revenues are left in the net after the deductions for returns and allowances have come out.

Financial statements provide all the detail on how well or poorly a company manages itself. Instead, it contains three sections that report cash flow for the various activities for which a company uses its cash. Operating revenue is the revenue earned by selling a company’s products or services.

Example of an Income Statement

It is used by lenders and investors to check a business’s financial health and earnings potential. Notably, a balance sheet represents a single point in time, whereas the income statement, the statement of changes in equity, and the cash flow statement each represent activities over a stated period. The rules used by U.S. companies is called Generally Accepted Accounting Principles, while the rules often used by international companies is International Financial Reporting Standards (IFRS).

Financial Statement Ratios and Calculations

It’s the money that would be left if a company sold all of its assets and paid off all of its liabilities. This leftover money belongs to the shareholders, or the owners, of the company. This brochure is designed to help you gain a basic understanding of how to read financial statements. Just as a CPR class teaches you how to perform the basics of cardiac pulmonary resuscitation, this brochure will explain how to read the basic parts of a financial statement.

The operating revenue for an auto manufacturer would be realized through the production and sale of autos. Operating revenue is generated from the core business activities of a company. The accuracy of financial statements is only as good as the information utilized to prepare them. The financial statements will also be inaccurate if a company’s accounting records are inaccurate. Finally, financial statements can be difficult to interpret without a basic understanding of accounting principles. This makes them inaccessible to many people who could benefit from using them.

From the balance sheet above, we can see that as of September 2021, Apple, Inc.’s total assets amount to $351,002,000. Its total liabilities are $287,912,000, and total shareholders’ equity is $63,090,000, which, when lumped together, will equal the total assets of $351,002,000. Financial statements and their supplementary notes are prepared in compliance with accounting frameworks such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). United States’ companies apply GAAP for the preparation of financial statements. Shareholders’ equity is the amount owners invested in the company’s stock plus or minus the company’s earnings or losses since inception.