Best Hr Payroll Software Systems & Companies 2021

Content

If you add or remove services, your service fees will be adjusted accordingly. To be eligible for this offer you must be a new Payroll customer and sign up for the monthly plan using the “Buy Now” option. This offer can’t be combined with any other QuickBooks offers.

With more than 30 years of experience, we know how to get it right. And if something does go wrong, we have a great customer service team available by phone so you can keep your on your small business, not your technology. Still, the basic reporting you get from Paychex could be worth the monthly fee alone, giving it the edge in this category.

Best Staffing Software For Recruiting & Staffing In 2021

The vendor also offers professional services to help companies with taxes, benefits and insurance. OnPay is a payroll software option for businesses with up to 10 employees. Features include automatic payroll deductions and payroll tax payments, and guaranteed accurate and timely tax filings and payments. OnPay is a cloud-based platform, meaning you can manage your payroll from your laptop, desktop, smartphone or any location with an internet connection.

- If you’re comparing pricing to features, Gusto offers the best small-business payroll software.

- Gusto’s online payroll service is popular enough to sync with most accounting software options.

- Starting at $19 a month, Gusto calculates and files your payroll taxes, helps with workers comp administration, and lets you build paid time off policies for your employees.

- Service optimized for up to 50 employees or contractors, and capped at 150.

- Your account will automatically be charged on a monthly basis until you cancel.

Designed to meet the needs of small and medium-sized businesses, APS Payroll is a cloud-based solution for managing human resources. Built with scalability in mind, it’s able to grow with businesses. Additionally, each organization has access to a dedicated support team and account lead that can assist with tech support and field general assistance inquiries.

Gusto is similar to other payroll software solutions in that it offers direct deposit or checks to pay your employees. It also tracks and files federal, state, and local taxes automatically. What sets Gusto apart from the other options is that it offers a better plan for each tier that you go up.

Webinar: 5 Employee Appreciation Ideas Your Workforce Will Love

A winner of multiple industry awards, it saves time by making payments more efficiently, auto calculating taxes and staying up to date with current rates and compliance. The best payroll management systems can help streamline communication across the organization. With alerts and reminders for everything from approving payroll, remitting taxes, pulling reports, or enrolling workers, it’s easier to keep the important tasks on track.

Can I do payroll without software?

A payroll calculator (also known as a paycheck calculator) is another way to make payroll easier without investing in software. All you need is your employee’s salary information and tax withholding status.

If you’re comparing pricing to features, Gusto offers the best small-business payroll software. Starting at $19 a month, Gusto calculates and files your payroll taxes, helps with workers comp administration, and lets you build paid time off policies for your employees. Gusto’s online payroll service is popular enough to sync with most accounting software options. Your account will automatically be charged on a monthly basis until you cancel. Service optimized for up to 50 employees or contractors, and capped at 150. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. The discounts do not apply to additional employees and state tax filing fees.

Your Guide To Top Payroll Software, March 2020

Buyers can choose from various pricing plans and payment options such as direct deposit, real-time transfers and same-day ACH. Users can customize it to meet their specific needs, adding only what they use. This allows administrators to ensure it fits their requirements, whether they be simple or complex. RUN powered by ADP is a cloud-based payroll solution designed to meet the needs of small businesses . Basic capabilities, such as benefits administration and hiring, are available besides the payroll module.

It offers an array of core features including payroll, benefits, recruiting, onboarding and learning. This helps optimize performance, streamline tasks, improve understanding of the workforce and drive retention. Paychex Flex is a cloud-based compensation and HR solution that can serve thousands of employees.

To cancel your subscription at any time go to Account & Settings in QuickBooks and select Cancel. Your cancellation will become effective at the end of the monthly billing period. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice. OnPay’s easy payroll software is the perfect solution for small businesses . We help you set up pay runs in just a few minutes, avoid costly mistakes, and add benefits and HR tools that will make your employees happy. Our software even takes care of your payroll taxes for you.

What Is The Best Free Payroll Software?

While there is a base version that mainly handles financials, it handles a wide range of functionality. This serves groups of varying sizes including one to nine, 10 to 49 and 50 to thousands. It also has distinct roles for workers, managers or administrators.

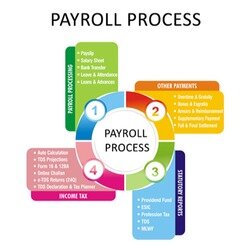

Plus, you’ll be able to add any other data field you’d like, thanks to custom fields, which is rare for small business online payroll services. Payroll software is a system that handles payroll services including payroll taxes, compensation, year-end bonuses, pay stubs, paid time off, benefits management, and organizing employee records. Many organizations outsource the payroll process, but you may decide that in-house is best for your company, and there are many payroll software solutions available to streamline the task.

Payroll That Caters To Small Businesses

Various customization features can help businesses with unusual workflows. Users may add custom fields for industries that want to track different metrics. Then, when deploying the system to employees, the software is branded or white labeled for an organization with multiple branches.

Xero is an online accounting software designed to meet the needs of small businesses. The easy-to-use interface helps companies visualize their financial position and monitor performance based on real-time data. The solution is designed to connect businesses with third-party advisors and services in order to increase collaboration. This vendor offers a variety of integrations, making the platform capable of handling a variety of tasks associated with accounting. TriNet is a payroll and full-service HR solution used by small and medium-sized businesses. The company has been in service for over 30 years, has more than 18,000 clients and employs 300,000 onsite workers.

It’s also ESAC accredited and is classified as an official Certified Professional Employer Organization by the IRS. Gusto offers a web-based payroll system that meets the needs of small and medium-sized businesses. This vendor provides assistance with a variety of processing tasks such as payroll filing and direct deposit. Gusto also offers accounting and time-tracking integration options.This product features workers compensation, 401K and other HR tools to streamline all parts of the process. It enables users to check more than 50 states to assist with properly filing both state and federal taxes. UKG Pro provides a unified, cloud-deployed suite that allows companies to manage human capital at a global scale.

Justworks is a professional employer organization that helps businesses automate and streamline multiple administrative functions. By automating tasks such as payroll, benefits administration and reporting, it saves companies both time and money. Designed with small and medium-sized businesses in mind, it offers multiple pricing plans and can scale with the growth of any business.

It offers many convenient features like self-onboarding for employees, benefits management, automatic payroll runs, and top-rated customer service. OnPay is designed to address core payroll needs for small businesses and handles basic HR functions as well. It also offers assistance with data migration for new users, making the transition even easier. Paychex provides payment processing, time-keeping and other general human resource software. They offer this to self-employed users, small businesses, medium business and large enterprise ventures.

Sage Payroll is an HR system used by businesses of all sizes across all industries to process pay in-house. It streamlines tasks such as tallying hours worked, calculating tax and managing data. Its single platform approach lets users streamline their pay processes and ensure employees receive accurate paychecks at the end of each pay period. If you integrate with a full suite, users can automate a variety of tasks in relation to processing pay, including tasks like time and attendance tracking, benefits management and recruitment.

Square Payroll is a cloud-based solution that is suited for businesses of all sizes. The solution offers two pricing packages, one of which is designed specifically for organizations that only hire contractors. The solution offers features that assist with processing pay, filing taxes, employee self-service and more. The system assists with switching from an old system or provides assistance and resources to users who are processing pay for the first time.