Bookkeeping for Truck Drivers

Content

If you find it difficult to find time to update your books daily, at least aim to update them weekly. One of your most powerful trucking bookkeeping resources comes in the form of a tiny slip of paper—receipts! Without them, you run the risk of losing hundreds, even thousands, in taxes. That’s why we’ve put together a few truckers’ bookkeeping tips to simplify your bookkeeping process. As an owner-operator, however, bookkeeping is an important part of running your trucking business. Understanding bookkeeping helps to give you a clear picture of your business’ performance and be prepared for when tax time rolls around.

- The RumbleStrip Essentials package is designed for experienced owner-operators who are looking for a more simplified, pared-down solution.

- If you ever need any of these files back, a good bookkeeper will be able to easily find and send back electronic copies of the receipts or files that you need at any time.

- At PorteBrown Accountants and Advisors, they understand that transportation companies are the lifeblood of commerce and the economy.

- If the average owner-operator is spending 30% of their revenue on fuel, and you only show 10% of revenue spent on fuel, your bookkeeper should be able to alert you to the discrepancy.

- You want to avoid that happening to you, but you want assurances that you’ve done everything right if it does.

- Q7 is a fleet management software that also acts as full double-entry accounting software.

Purchase an expanding file folder, a stapler, and a desktop calculator with register tape from an office supply store. If not, you will be happy you took the time to keep your records in order. One out of every 25 owner-operators gets audited by the IRS for taxes each year. You want to avoid that happening to you, but you want assurances that you’ve done everything right if it does. With an accrual system, you recognize revenue when it’s earned (before it’s paid) and bills when received (before they are paid). TBS will process your MC#/USDOT Number and BOC-3 for free (both are required to activate your authority), with no annual membership fee or application processing fee.

Use an accounting system.

The Trucker CFO is a Certified Public Accountant (CPA) who specializes in helping owner-operators, independent contractors, fleet owners and trucking entrepreneurs. With our bookkeeping service, we utilize strategies and solutions to help you manage your money effectively and help increase your profits. Bookkeeping is an important part of running your business as an owner-operator truckers bookkeeping service truck driver. It allows you to keep your financial statements organized and gives you an idea of how your business is performing. As a truck driver, you may have a hard time keeping good records while on the road. That’s why it may be best to look into using a bookkeeping service for your business that works specifically with owner-operator truck drivers.

- Scanned images of receipts are acceptable, but keep original paper copies for warranty purposes for any big-ticket items you purchase.

- ATBS knows truckers are busy, and expenses are high – that’s why they’re here to help you save time and money with bookkeeping, tax, and consulting services.

- This is the important final step in making sure all of your transactions from the previous month are accounted for or reconciled.

- At the end of the day, your most important concern is whether your trucking business is making money.

- Building credit for your business is important, but it is equally as important to make sure that your liquid cash flow is available when you need it.

Trucking bookkeeping services have several benefits, such as receipt scanning, tax calculation, money management, document storage, and invoicing. When compiling this list, we focused on what 5 different services would be most important to truckers when managing their books. From P&L statements to emergency bookkeeping services, one of these truck bookkeeping services will perfectly fit your needs. Last but certainly not least, it’s always a good idea to hire a CPA for help with tax preparation and trucking accounting services.

Scan and Archive Receipts/Files

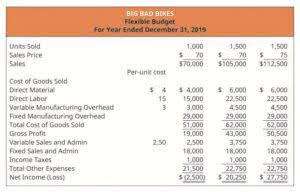

If you’re also using truck management software, you can usually link the two and automate your IFTA responsibilities completely. In broad terms, bookkeeping involves maintaining financial records of your trucking business’s day-to-day transactions in a general ledger. It’s a routine, administrative process that requires relatively little critical thinking.

While it’s not the simplest solution, it is the most robust option for other trucker bookkeeping needs. Now that you know what you need to do, it’s time to start implementing good habits and putting your truck driver accounting processes to the test. For starters, you should make sure you have all of the tools you need. Start with a notebook, an app, a pen and some envelopes to begin keeping your books clean and tidy. Though plenty of accounting software fits the bill, we would recommend starting with TruckingOffice.

Purchase an expanding file folder.

In the unfortunate case that you end up being audited by the IRS, you’ll also have a paper trail to fall back on, too. Remember, it can be surprisingly hard to catch up on trucking records once you’ve fallen behind. It becomes even worse if you also neglect to separate your business and personal transactions. The accrual basis of accounting requires that you recognize revenues when you earn them and expenses when you incur them, regardless of when funds enter or leave your accounts. It takes more work, but it also documents your profitability more accurately.

If the average owner-operator is spending 30% of their revenue on fuel, and you only show 10% of revenue spent on fuel, your bookkeeper should be able to alert you to the discrepancy. From there they can figure out if you have not sent all fuel expense documentation that needs to be submitted, or if you simply spent less on fuel. There are many benefits that come with using a bookkeeping service for your trucking business. In this article, we will discuss important things to consider when you search for one.

Make sure your books are audit-proof.

You can email us or you can upload your business receipts to a secure portal. We’ll enter them into your specific account so you see the current financial status of your business in real time. Avoid missed payments and stay on top of the money going out of your bank account by switching to electronic billing. That way, all of your bills can be accessed through any computer or mobile device, no matter where you are in the world. For any bills that don’t have an option to go digital, you can use Shoeboxed to scan your paper copies and save them to the cloud.

- You can email us or you can upload your business receipts to a secure portal.

- With the trucking software program from TruckingOffice.com you can keep up with invoices that are coming due and receive alerts if any payments are past due.

- By updating your books daily, you will have a better idea of how your business is doing and be able to manage your cash flow more easily.

- One of the primary problems with managing your small business accounting is the sheer amount of time and energy it takes.

- From there, you can export the information directly for use in your ledgers.

- Without them, you run the risk of losing hundreds, even thousands, in taxes.