Breakeven Point: Definition, Examples, and How to Calculate

Content

It can also be used to determine the impact on profit if automation (a fixed cost) replaces labor (a variable cost). Yet another possibility is to determine the change in profits if product prices are altered. Finally, the breakeven point can be used to determine the amount of losses that could be sustained if the business suffers a sales downturn. In other words, the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs. Note that in this formula, fixed costs are stated as a total of all overhead for the firm, whereas Price and Variable Costs are stated as per unit costs—the price for each product unit sold. The break-even points (A,B,C) are the points of intersection between the total cost curve (TC) and a total revenue curve (R1, R2, or R3).

Thus, if a project costs $1 million to undertake, it would need to generate $1 million in net profits before it breaks even. Identifying a break-even point helps provide a dynamic view of the relationships between sales, costs, and profits. As we can see from the sensitivity table, the company operates at a loss until it begins to sell products in quantities in excess of 5k. After entering the end result being solved for (i.e., the net profit of zero), the tool determines the value of the variable (i.e., the number of units that must be sold) that makes the equation true. Variable Costs per Unit- Variable costs are costs directly tied to the production of a product, like labor hired to make that product, or materials used.

- The main purpose of break-even analysis is to determine the minimum output that must be exceeded for a business to profit.

- In short, all costs that must be paid are paid, and there is neither profit nor loss.[1][2] The break-even analysis was developed by Karl Bücher and Johann Friedrich Schär.

- Break-even analysis is often a component of sensitivity analysis and scenario analysis performed in financial modeling.

- The contribution margin ratio is the contribution margin per unit divided by the sale price.

If a company has reached its break-even point, this means the company is operating at neither a net loss nor a net gain (i.e. “broken even”). All businesses share the similar goal of eventually becoming profitable in order to continue operating. This analysis will help you easily prepare an estimate and visual to include in your business plan. We’ll do the math and all you will need is an idea of the following information.

Let’s say that we have a company that sells products priced at $20.00 per unit, so revenue will be equal to the number of units sold multiplied by the $20.00 price tag. Remember the break-even point is used as an estimate for lender viability and your business plan. It is not intended to 100% accurately determine your accounting or financing since those calculations can only be done after all costs and production have occurred. It’s also a good idea to throw a little extra, say 10%, into your break-even analysis to cover miscellaneous expenses that you can’t predict.

Costs are fixed for a set level of production or consumption and become variable after this production level is exceeded. The break-even point is the point at which total cost and total revenue are equal, meaning there is no loss or gain for your small business. In other words, you’ve reached the level of production at which the costs of production equals the revenues for a product.

What Happens to the Breakeven Point If Sales Change

The break-even point is calculated by dividing the total fixed costs of production by the price per individual unit, less the variable costs of production. Fixed costs are costs that remain the same regardless of how many units are sold. Break-even analysis is a financial tool that is widely used by businesses as well as stock and option traders. For businesses, break-even analysis is essential in determining the minimum sales volume required to cover total costs and break even. It helps businesses make informed decisions about pricing strategies, cost management, and operations. It is also helpful to note that the sales price per unit minus variable cost per unit is the contribution margin per unit.

Once you know the fixed and variable costs for the product your business produces or a good approximation of them, you can use that information to calculate your company’s breakeven point. Small business owners can use the calculation to determine how many product units they need to sell at a given price point to break even. In stock and option trading, break-even analysis is important in determining the minimum price movements required to cover trading costs and make a profit.

The break-even quantity at each selling price can be read off the horizontal axis and the break-even price at each selling price can be read off the vertical axis. The total cost, total revenue, and fixed cost curves can each be constructed with simple formula. For example, the total revenue curve is simply the product of selling price times quantity for each output quantity. The data used in these formula come either from accounting records or from various estimation techniques such as regression analysis. In the first calculation, divide the total fixed costs by the unit contribution margin.

Contribution Margin

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. When dealing with budgets you would instead replace “Current output” with “Budgeted output.”

If P/V ratio is given then profit/PV ratio. Management should constantly monitor the breakeven point, particularly in regard to the last item noted, in order to reduce the breakeven point whenever possible. All incremental revenue beyond this point contributes toward the accumulation of more profits for the company.

Once the break-even number of units is determined, the company then knows what sales target it needs to set in order to generate profit and reach the company’s financial goals. If an activity involves a fixed cost, consider outsourcing it in order to turn it into a per-unit variable cost, which reduces the breakeven point. Profitability may be increased when a business opts for outsourcing, which can help reduce manufacturing costs when production volume increases. Break-even analysis can also help businesses see where they could re-structure or cut costs for optimum results. If sales drop, then you may risk not selling enough to meet your breakeven point.

From this analysis, you can see that if you can reduce the cost variables, you can lower your breakeven point without having to raise your price. Upon doing so, the number of units sold cell changes to 5,000, and our net profit is equal to zero, as shown below in the screenshot of the finished solution. In effect, the analysis enables setting more concrete sales goals as you have a specific number to target in mind. At that price, the homeowner would exactly break even, neither making nor losing any money.

How to Calculate the Break-Even Point

If the stock is trading at $190 per share, the call owner buys Apple at $170 and sells the securities at the $190 market price. Assume that an investor pays a $5 premium for an Apple stock (AAPL) call option with a $170 strike price. This means that the investor has the right to buy 100 shares of Apple at $170 per share at any time before the options expire. The breakeven point for the call option is the $170 strike price plus the $5 call premium, or $175. If the stock is trading below this, then the benefit of the option has not exceeded its cost. The breakeven point (breakeven price) for a trade or investment is determined by comparing the market price of an asset to the original cost; the breakeven point is reached when the two prices are equal.

Variable costs often fluctuate, and are typically a company’s largest expense. The break-even point allows a company to know when it, or one of its products, will start to be profitable. If a business’s revenue is below the break-even point, then the company is operating at a loss. Potential investors in a business not only want to know the return to expect on their investments, but also the point when they will realize this return. This is because some companies may take years before turning a profit, often losing money in the first few months or years before breaking even.

Fund your business

Therefore, the break-even point in sales dollars is $50,000 ($20,000 total fixed costs divided by 40%). Confirm this figured by multiplying the break-even in units (500) by the sale price ($100), which equals $50,000. The total fixed costs, variable costs, unit or service sales are calculated on a monthly basis in this calculator. Meaning that adding the total for all products and services monthly should account for all products and services. You may also want to do the calculation individually for each product or service if the products or service sales vary per month. Calculating the breakeven point is a key financial analysis tool used by business owners.

In cases where the production line falters, or a part of the assembly line breaks down, the break-even point increases since the target number of units is not produced within the desired time frame. Equipment failures also mean higher operational costs and, therefore, a higher break-even. The main purpose of break-even analysis is to determine the minimum output that must be exceeded for a business to profit.

How do you calculate a breakeven point in options trading?

It is only possible for a firm to pass the break-even point if the dollar value of sales is higher than the variable cost per unit. This means that the selling price of the goods must be higher than what the company paid for the good or its components for them to cover the initial price they paid (variable and fixed costs). Once they surpass the break-even price, the company can start making a profit. Calculating the break-even analysis is useful in determining the level of production or a targeted desired sales mix. The study is for a company’s management use only, as the metric and calculations are not used by external parties, such as investors, regulators, or financial institutions.

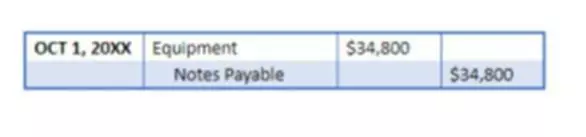

Calculations for Break-Even Analysis

This could be done through a number or negotiations, such as reductions in rent payments, or through better management of bills or other costs. Break-even points can be useful to all avenues of a business, as it allows employees to identify required outputs and work towards meeting these. He wants to know what kind of impact this new drink will have on the company’s finances. So, he decides to calculate the break-even point, so that he and his management team can determine whether this new product will be worth the investment. A breakeven point tells you what price level, yield, profit, or other metric must be achieved to not lose any money—or to make back an initial investment on a trade or project.

For example, if a book’s selling price is $100 and its variable costs are $5 to make the book, $95 is the contribution margin per unit and contributes to offsetting the fixed costs. The concept of break-even analysis is concerned with the contribution margin of a product. The contribution margin is the excess between the selling price of the product and the total variable costs. For example, if an item sells for $100, the total fixed costs are $25 per unit, and the total variable costs are $60 per unit, the contribution margin of the product is $40 ($100 – $60). This $40 reflects the amount of revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin.