Business Gross Income

Content

Additionally, just because a lender says that you qualify for a certain mortgage amount does not mean that is the right loan amount for you. Because your monthly gross income plays such a key role in financial decision-making it is important that you can accurately calculate how much money you make. While determining your income is pretty easy to do if you are paid on a monthly basis it can be more complicated if you are paid on a different schedule such as hourly, weekly, bi-weekly , semi-monthly or annually. Let The Hourly Wage Calculator do all the sums for you – after the tax calculations, see the annual pay, and the monthly, weekly or daily take-home. Net pay is a worker’s total take-home pay, or what’s left after payroll taxes and deductions are taken out. Some common deductions include FICA payroll taxes, income tax withholdings, health insurance, and retirement contributions.

Subtract your employee’s voluntary deductions and retirement contributions from his or her gross income to determine the taxable income. Then, subtract what the individual owes in taxes from the taxable income to determine the net income. Your debt-to-income ratio represents the maximum amount of your monthly gross income that you can spend on total monthly housing expense plus monthly debt payments such as auto, student and credit card loans. Lenders usually use a maximum borrower debt-to-income ratio of 43% to 45% to determine what size mortgage you can afford, although some lenders and mortgage programs apply higher or lower ratios. In short, lenders only permit you to spend a certain amount of your income on debt expenses including your mortgage. Borrowers with higher monthly gross income and lower debt payments can afford to spend more on their mortgage payment which enables them to qualify for a larger mortgage.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Subtract any deductions and payroll taxes from the gross pay to get net pay. The PaycheckCity salary calculator will do the calculating for you. This salary calculator estimates total gross income, which is income before any deductions such as taxes, workers compensation, or other government and employer deductions.

Each company must report their gross income on their business tax return, and this number is used to determine how much taxes are owed. Outside of that, it’s significant because it’s the basis for many other business financials that determine your business’s profitability and viability. The general distinction is simple – gross pay is the amount before taxes are applied. The mechanism may be different from country to country; in the US, medical, dental, life insurance and 401 payments are handled by the employer and are calculated at an earlier stage. In Poland, on the other hand, the difference between net and gross salary is much bigger – an employee needs to pay social security , which are often higher than the income tax itself.

How To Calculate Taxes Taken Out Of A Paycheck

Some deductions are mandatory, while others are at the request of the employee. Gross pay, also called gross wages, is the amount an employee would receive before payroll taxes and other deductions.

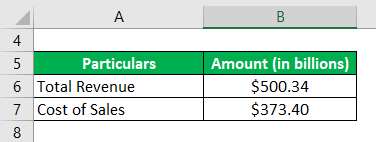

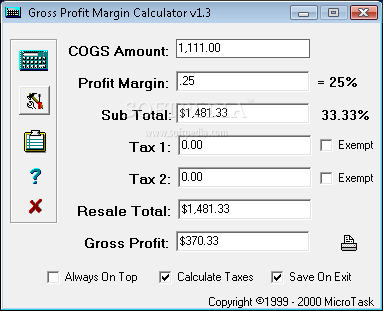

This calculator helps you determine the gross paycheck needed to provide a required net amount. We will then calculate the gross pay amount required to achieve your net paycheck. Divide the sum of all assessed taxes by the employee’s gross pay to determine the percentage of taxes deducted from a paycheck. Taxes can include FICA taxes , as well as federal and state withholding information found on a W-4. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. When it comes to tax withholding, employees face a trade-off between bigger paychecks and a smaller tax bill.

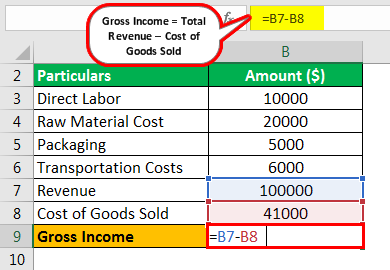

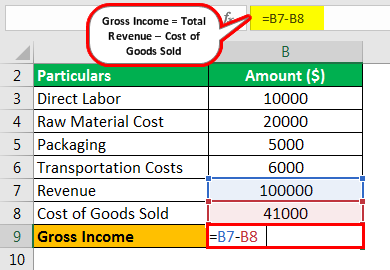

By contrast, net pay is the amount left over after deductions have been taken from an employee’s gross pay. Depending on the size of the payroll deductions, an employee’s net pay may be significantly lower than their gross pay. Gross business income is the total income a business receives before any taxes, expenses, adjustments, exemptions, or deductions are taken out. It is calculated on a business tax return as the total business sales lesscost of goods sold and appears on theincome statementas a starting figure.

How Your Paycheck Works: Pay Frequency

Generally speaking, wage-earners tend to earn less than salaried employees. Although lenders use your gross income to determine what size mortgage you qualify for, your net income is also important to think about when you apply for a mortgage. Your net income is often called take-home pay because it is the money you earn after all deductions — including 401, IRA and health insurance contributions — are subtracted from your gross income. Borrowers need to make sure that they are comfortable paying their monthly mortgage payment and total housing expense based on their net income.

It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions.

To determine your net income, you have to deduct these items from your gross annual salary. Note that deductions can vary widely by country, state, and employer.

Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much you’ll take home. You can use our Monthly Gross Income calculator to determine your gross income based on how frequently you are paid and the amount of income you make per pay period. Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income. If you are paid hourly, multiply your hourly wage by the number of hours you work per week. Input this income figure into the calculator and select weekly for how often you are paid to determine your monthly gross income.

You calculate gross wages differently for salaried and hourly employees. To calculate an hourly employee’s gross wages for a pay period, multiply their hourly pay rate by their number of hours worked. Then add any additional income they’ve earned that pay period, including overtime pay, commissions, bonuses, etc. Here’s how that gross pay formula would look, using a one-week pay period. When you start a new job or get a raise, you’ll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isn’t a simple matter of multiplying your hourly wage by the number of hours you’ll work each week, or dividing your annual salary by 52. That’s because your employer withholds taxes from each paycheck, lowering your overall pay.

U S. Salary Information

While salary and wages are important, not all financial benefits from employment come in the form of a paycheck. For hourly employees, the calculation is a little more complicated. First, to find your yearly pay, multiply your hourly wage by the number of hours you work each week, and then multiply the total by 52. Now that you know your annual gross income, divide it by 12 to find the monthly amount. To calculate a salaried employee’s gross pay for a single pay period, divide their annual salary by the number of pay periods in the year. Then add any additional income the employee has earned that pay period, just as you did with the hourly employees.

- To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

- The PaycheckCity salary calculator will do the calculating for you.

- This salary calculator estimates total gross income, which is income before any deductions such as taxes, workers compensation, or other government and employer deductions.

- To determine your net income, you have to deduct these items from your gross annual salary.

- Subtract any deductions and payroll taxes from the gross pay to get net pay.

- Note that deductions can vary widely by country, state, and employer.

When you convert hourly to salary, it’s important to consider deductions as well. Use this federal gross pay calculator to gross up wages based on net pay. For example, if an employee receives $500 in take-home pay, this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. It determines the amount of gross wages before taxes and deductions that are withheld, given a specific take-home pay amount.

Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information. While those hired before Jan. 1, 2020, aren’t required to complete the form, you may want to do so if you’re changing jobs or adjusting your withholdings.

How To Calculate Adjusted Gross Income (agi)?

Use SmartAsset’s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Also, wage-earners tend to be non-exempt, which means they are subject to overtime wage regulations set by the government to protect workers. Non-exempt employees often receive 1.5 times their pay for any hours they work after surpassing 40 hours a week, also known as overtime pay, and sometimes double their pay if they work on holidays. Salaried employees generally do not receive such benefits; if they work over 40 hours a week or on a holiday, they will not be directly financially compensated for doing so.

From there, it is reduced by returns, allowances, and other deductions to get net income ornet earnings. For example, if you are paid $12 per hour and work 40 hours per week, your weekly gross pay is $480. Finally, dividing by 12 reveals a gross income of $2,080 per month. If you are paid an annual salary, the calculation is fairly easy. Since gross income refers to the total amount you earn before tax, and so does your annual salary, simply take the total amount of money you’re paid for the year, and then divide this amount by 12. This salary calculator can be used to estimate your annual salary equivalent based on the wage or rate you are paid per hour. Follow the instructions below to convert hourly to annual income and determine your salary on a yearly basis.

The Mortgage Repayment Calculator

Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary. Your gross income or pay is usually not the same as your net pay especially if you must pay for taxes and other benefits such as health insurance. Calculate gross pay, before taxes, based on hours worked and rate of pay per hour including overtime. To enter your time card times for a payroll related calculation use this time card calculator. One of the more important reasons to know your business’s gross income is its use for tax purposes.