Carrying Value How to Calculate Carrying Value Definition, Formula

Content

These differences usually aren’t examined until assets are appraised or sold to help determine if they’re undervalued or overvalued. The carrying value and the fair value are two different accounting measures used to determine the value of a company’s assets. All three terms can be used interchangeably because they refer to the same thing – the true market value of an asset at any given point in time. The carrying value of an asset is its net worth—the amount at which the asset is currently valued on the balance sheet. Generally, it is estimated that the fair values of cash and cash equivalents, short-term investments (less than one year), and long-term investments (beyond one year) are equal to 100% of the book value.

The said tractor’s annual depreciation is $3,000 and is expected to still be of use for 20 years, at which time the salvage value is expected to be $20,000. The result can be a wide divergence between carrying value and market value for the same assets owned by different entities. However, after two negative gross domestic product (GDP) rates, the market experiences a significant downturn. Therefore, the fair value of the asset is $3.6 million, or $6 million – ($6 million x 0.40). Because the fair value of an asset can be more volatile than its carrying value or book value, it’s possible for big discrepancies to occur between the two measures. The market value can be higher or lower than the carrying value at any time.

Reviewed by Subject Matter Experts

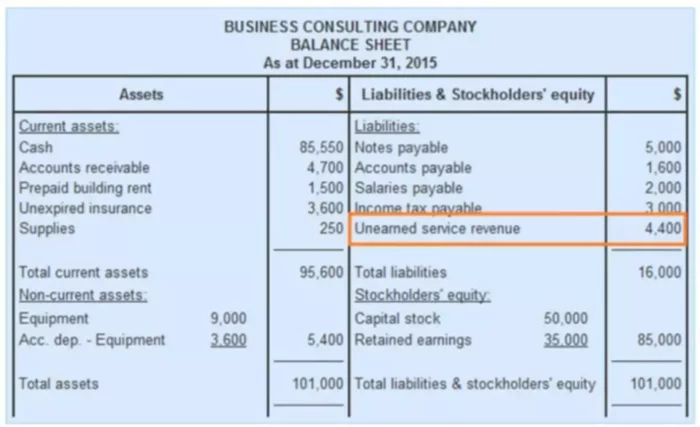

Due to the changing nature of open markets, however, the fair value of an asset can fluctuate greatly over time. The carrying values of an asset can be calculated by subtracting the total liabilities of that particular asset from its total assets. In case the value obtained is negative, it means that the asset has a net loss or it can be said that its losses exceed its profits, thus making it a liability. In other words, it is the total value of the enterprise’s assets that owners (shareholders) would theoretically receive if an enterprise was liquidated. Usually, it is not shown in the balance sheet but can easily be calculated.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Carrying value or book value is the value of an asset according to the figures shown (carried) in a company’s balance sheet. Let’s say a company owns a tractor worth $80,000 to be used for developing its newest land property.

Terms Similar to Carrying Value

Therefore, the book value of the 3D printing machine after 15 years is $5,000, or $50,000 – ($3,000 x 15). Let’s assume in 2015, company A bought a piece of machinery for its factory for $1.2 million. Based on its market condition, its useful life is assumed at 10 years, and the accountant has agreed to adopt a straight-line depreciation method. So below is the depreciation schedule and CV of the machinery each year. Many people use the terms carrying value and book value in different industries. But what they don’t know is that both terms are ultimately the same thing and are interchangeable.

The carrying value, or book value, is an asset value based on the company’s balance sheet, which takes the cost of the asset and subtracts its depreciation over time. The fair value of an asset is usually determined by the market and agreed upon by a willing buyer and seller, and it can fluctuate often. In other words, the carrying value generally reflects equity, while the fair value reflects the current market price. The CV is the asset’s book value, calculated by deducting accumulated depreciation from the asset’s initial cost. The carrying amount is the original cost of an asset as reflected in a company’s books or balance sheet, minus the accumulated depreciation of the asset.

The carrying value of an entire business may be divided by the number of shares outstanding to arrive at carrying value per share. This amount is sometimes considered to be the baseline value per share, below which the market price of a share should not drop. However, since there is not necessarily any connection between market value and carrying value, the baseline assertion can be difficult to justify. Carrying value is typically determined by taking the original cost of the asset, less depreciation. The carrying value of the truck changes each year because of the additional depreciation in value that is posted annually. At the end of year one, the truck’s carrying value is the $23,000 minus the $4,000 accumulated depreciation, or $19,000, and the carrying value at the end of year two is ($23,000 – $8,000), or $15,000.

AccountingTools

ABC decides to depreciate the asset on a straight-line basis with a $3,000 salvage value. The depreciable base is the $23,000 original cost minus the $3,000 salvage value, or $20,000. The annual depreciation is the $20,000 divided by five years, or $4,000 per year. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

When an asset is bought, its original cost is recorded on the balance sheet. This original cost can be linked back to the buying receipt of the asset. Then, based on the asset’s useful life and the appropriate depreciation formula, some depreciation or amortization is attached to the asset each year. CV or book value at any time will be the asset’s initial cost minus accumulated depreciation. Note that buildings, plants, etc .are depreciation assets, but the land are not a depreciation asset. This CV can be very different from the asset’s fair value because the fair value will be dependent on the current market condition and subjective.

- Carrying value is the original cost of an asset, less the accumulated amount of any depreciation or amortization, less the accumulated amount of any asset impairments.

- When an asset is bought, its original cost is recorded on the balance sheet.

- Carrying value can be defined as the difference between the face value of the bond and the unamortized portion of the premium or discount.

- At the initial acquisition of an asset, the carrying value of that asset is the original cost of its purchase.

Both book value and carrying value refer to the accounting value of assets held on a balance sheet, and they are often used interchangeably. “Carrying” here refers to carrying assets on the firm’s books (i.e., the balance sheet). Hence, if an enterprise undergoes liquidation, the fair value prediction of assets clearly indicates that the owners (shareholders) cannot receive the net carrying value of assets.

Carrying Value vs. Market Value

It is also called book value and is not necessarily the same as an asset’s fair value or market value. In the fixed asset section of the balance sheet, each tangible asset is paired with an accumulated depreciation account. At the end of year two, the balance sheet lists a truck at $23,000 and an accumulated depreciation-truck account with a balance of -$8,000. A financial statement reader can see the carrying amount of the truck is $15,000. The carrying value of an asset is based on the figures from a company’s balance sheet.

Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. It is important to predict the fair value of all assets when an enterprise stops its operations.

For example, a company may subject a fixed asset to an accelerated rate of depreciation, which rapidly reduces its carrying value. Different from the carrying value, the fair value of assets and liabilities is calculated on a mark-to-market accounting basis. In other words, the fair value of an asset is the amount paid in a transaction between participants if it’s sold in the open market.

Then based on the estimated life and depreciation method, depreciation is calculated on the asset after each period. The CV of assets is the net book value of assets after subtracting the accumulated depreciation from the initial cost. This value can be much different from the asset’s current market or fair value, which is estimated using current market conditions. CV is based on the asset’s book value, which depends on the asset’s initial cost and depreciation schedule. For example, let’s assume an asset bought at $1,000,000 in 2015 has a carrying value of $500,000 as per the books.

Both depreciation and amortization expenses are used to recognize the decline in value of an asset as the item is used over time to generate revenue. Note that, while buildings depreciate, the land is not a depreciable asset. This is due to the fact that land is often considered to have an unlimited useful life, meaning that the value of the land will not depreciate over time. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.