Common Size Financial Statement: Definition, Overview & Formula

Content

Let’s say that you’re looking into the line items on an income statement for a company. The items include selling and general administrative expenses, taxes, revenue, cost of goods sold, and net income. It’s worth noting that calculating a company’s margins and the common size calculation are the same. To find the net profit margin, you simply divide net income by sales revenue.

- The most frequent common size financial statements include the likes of the cash flow statement, the income statement, and the balance sheet.

- For instance, in the above set of figures, the common-size income statement format makes it clear that the company is spending 50% of its sales revenue on producing goods.

- All other line items are expressed as a percentage of the base figure.

- One of the best examples of a common size financial statement is to take a look at the sales revenue on an income statement.

- A common size balance sheet is set up with the same logic as the common size income statement.

- Common size income statements with easy-to-read percentages allow for more consistent and comparable financial statement analysis over time and between competitors.

On this income statement, the common size divides each line item by the total revenue. For example, if the cost of goods sold was $50,000 then you would divide it by $100,000 to equal 50%. One of the biggest benefits is that it provides investors with information to see changes in the financial statement of a company.

Pros and Cons of Common-Size Income Statements

Comparing these two income statements reveals two significant red flags. To calculate net income, you subtract the cost of goods sold, selling and general administrative expenses, and taxes from total revenue. After some calculations, you determine the revenue for the company to be $100,000. However, it’s important to recognize that some of these limitations come due to various interpretations of the data being observed.

- The income statement equation is sales minus expenses and adjustments equals net income.

- A common size income statement makes it easier to see what’s driving a company’s profits.

- For example, an increase in the cost of goods sold percentage might call for changes in price points or more attention to supplier costs.

- Creating this type of financial statement makes for easier analysis between companies.

- In general, you can prepare a common-size income statement by going line-by-line and dividing each expense as a percentage of sales.

- Second, the financial statements of competitors can be converted into the common size format, which makes them comparable to a company’s own financial statements.

Keep in mind that this example illustrates only part of a traditional income statement converted into a common-size income statement. First, the cost of goods sold (COGS) for the business firm has increased from Year 1 to Year 2. The COGS usually includes direct labor costs and the cost of direct materials used in production. One reason the cost of goods sold has gone up is that sales have gone up, but here is an important distinction. This would come at the expense of good profit margins but would increase revenues.

Taken in isolation, it’s impossible to say whether or not this is good, bad or indifferent. A common-size income statement is usually created alongside a regular income statement. The top line on the income statement provides the base figure for the calculations. All other line items are expressed as a percentage of the base figure.

What Is a Common-Size Income Statement?

The standard figure used in the analysis of a common size income statement is total sales revenue. The common size percentages are calculated to show each line item as a percentage of the standard figure or revenue. A common size income statement is an income statement in which each line item is expressed as a percentage of the value of revenue or sales. It is used for vertical analysis, in which each line item in a financial statement is represented as a percentage of a base figure within the statement. One of the best examples of a common size financial statement is to take a look at the sales revenue on an income statement. Here, the common size percentages get calculated for each line item, and they’re listed as a percentage of the standard revenue or figure.

The income from selling the products or services will show up in operating profit. If it is declining, which is in the case of XYZ, Inc., there is less money for the shareholders and for any other goals that the firm’s management wants to achieve. It is also watched closely by lenders (e.g., banks) when assessing a company’s credit risk. Before breaking down the different types of common size analysis, it’s worth understanding that it can be conducted in two ways.

Common size cash flow statements

On the other hand, the cost of goods sold has also increased, not just in absolute terms but also as a percentage of revenue. On the plus side, Sporty Shoes has reduced its selling, general and administrative expenses. The real value of a common-size income statement comes when you can compare it to other income statements.

This type of analysis will let you see how revenues and spending on different types of expenses change from one year to the next. A common-size income statement expresses all revenue and expenses as a percentage of total sales or revenue. Investors may use common-size income statements to help them identify trends or anomalies, either positive or negative. A common size financial statement is used to analyze any changes in individual items when it comes to profit and loss. They’re also used to analyze trends in items of expenses and revenues and determine a company’s efficiency.

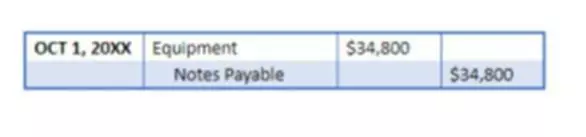

A common size balance sheet is set up with the same logic as the common size income statement. The balance sheet equation is assets equals liabilities plus stockholders’ equity. It’s important to note that the common size calculation is the same as calculating a company’s margins. The net profit margin is simply net income divided by sales revenue, which happens to be a common-size analysis.

A statement that shows the percentage relation of each income/expense to the Revenue from Operations (Net Sales), is known as a Common-size Income Statement. To express the amounts as the percentage of the total, Revenue from Operations (Net Sales) is taken as 100. One may prepare a Common-size Statement of Profit & Loss (Income Statement) for different periods of the same firm or for the same period of different firms. With the help of the comparison between the Common-size Income Statements of different periods, one can understand the efficiency in earning revenues and incurring expenses. It can also highlight the expense items that provide a company a competitive advantage over another.

Objectives of Common Size Income Statement

It will also include total financing cash flows and total investing cash flows for both of those activities. Also known as the profit and loss statement, the income statement is an overview. It includes business net income, sales, and expenses over a reporting period. To find net income using the income statement equation, you simply minus sales from expenses. Even though common size analysis doesn’t provide as much detail, it can still be effective in analyzing financial statements. For instance, in the above set of figures, the common-size income statement format makes it clear that the company is spending 50% of its sales revenue on producing goods.

Balance sheets, income statements, and cash flow statements are examples of common size financial statements. A common size financial statement shows each line item on a financial statement as a percentage of a base figure. Most commonly, this means that each revenue, expense, and profit line item on the income statement is presented as a percentage of net sales. In addition, each asset, liability, and shareholders’ equity line item on the balance sheet is expressed as a percentage of total assets. A common size financial statement displays items as a percentage of a common base figure, total sales revenue, for example. This type of financial statement allows for easy analysis between companies, or between periods, for the same company.

Conducting a common size analysis is relatively straightforward to do. All you need to have is the percentage of the base amount, the total amount of an individual item, and the amount of the base item. Essentially, it helps evaluate financial statements by expressing the line items as a percentage of the amount. It helps break down the impact that each item on the financial statement has, as well as its overall contribution. Here is a hypothetical example of how some line items might look on a common-size income statement for three successive years.

What is a Common Size Financial Statement?

Using common size percentages allows you to gain a different perspective of each line item. Or, they can also help show how each item affects the overall financial position of a company. If you’re interested in finding out more about how to create a common-size income statement, then get in touch with the financial experts at GoCardless. Find out how GoCardless can help you with ad hoc payments or recurring payments. There should also be huge concern about the difference in the selling, general and administrative expenses. Even so, creating a common-size income statement can still have a lot of value.

The common size income statement shows that the percentage of COGS has also gone up. This means that the cost of direct expenses and purchases have gone up. This suggests that the firm should try to find quality material at a lower cost and lower its direct expenses if possible.

Within each section, there will be additional information that outlines the business activity for each source and use. One of the most common versions of the common size cash flow statement will express any and all line items as a percentage of total cash flow. A financial statement or balance sheet that expresses itself as a percentage of the basic number of sales or assets is considered to be of a common size.

Each section provides additional information about the sources and uses of cash in each business activity. Generally speaking, a common-size financial statement is a type of analysis of an income statement that expresses each line of the statement as a percentage of sales. It’s a quick way to get an analysis of a company’s financial health. A common-size income statement can help company leaders and investors determine what is driving profits or dragging on them. Understand the ways in which it helps investors determine how a business is performing within its own industry. You would do this for each of the other line items to determine the common size income statement figures.