Comparative Balance Sheet: Objectives, Advantages and Format of Comparative Balance Sheet

Content

Investors can also compare companies who use the same accounting principles for reasons such as how organizations in the same business vertical respond to the changes in seasons. Another common technique is to include additional financial ratios related to the balance sheet in the comparative analysis. A bank, for example, may require a company to maintain a maximum debt to equity ratio.

In other cases, it may be more informative to compare more snapshots over time. A comparative balance sheet analysis is a method of analyzing a company’s balance sheet over time to identify changes and trends. A comparative balance sheet presents side-by-side information about an entity’s assets, liabilities, and shareholders’ equity as of multiple points in time.

To see the Comparative Balance Sheet report:

To take your analysis to the next level, you can add additional techniques to make the comparative balance sheet analysis even more powerful. For example, you can show each of the balance sheet accounts as a percentage of the company’s total assets. By comparing how these numbers change over time, you can see not just how the balance sheet is changing, but also how its composition is shifting on a common-sized basis. The first step to complete a comparative balance sheet analysis is to get organized. Locate the company’s balance sheet data and arrange it in a table such that each account is shown side by side over time. In its most basic form, this could be as simple as two quarterly snapshots, side by side.

A comparative balance sheet is a side-by-side comparison of the entire balance sheet report of a current accounting period and a previous accounting period. This report includes an Amount column that defaults to the current date range or period, and a Comparison Amount column that defaults to the last year or last fiscal year. You select a value in the As Of list in the report footer to change the date or period for Amount column data. The date of the Comparison Amount column changes automatically because it is defined by a alternate range that is relative to the Amount column date. For more information about comparison columns, see Adding Time-Based Comparison Columns to Reports. The Comparative Balance Sheet report compares the category and worth of each account across two or more specified time periods.

- Another variation is to present the balance sheet as of the end of each month for the past 12 months on a rolling basis.

- The key in each case is to consider the numbers over time to understand and identify changes and trends.

- During an analysis of comparative balance sheets, these tools add alternative angles to consider.

- You can use this report to compare your company’s performance with previous years.

It shows increases and decreases in the various assets, liabilities, and capital. A comparative balance sheet usually has two columns of amounts that appear to the right of the descriptions. The first column of amounts contains the amounts as of a recent moment or point of time i.e. current year and the column to the right contains corresponding amounts from a previous year.

A Comparative Balance Sheet is a financial statement that presents the financial position of a company at two or more different points in time, usually side by side. It is a useful tool for analyzing and comparing a company’s financial health over multiple periods. The main components of a balance sheet include assets, liabilities, and shareholders’ equity. In this example, we start our comparative balance sheet analysis by examining how each account changed from the first year to the second. In this case, the company’s cash has increased quite a bit, alongside a steep decline in inventory. The decline in inventory is greater than the increase in cash, driving a decrease in total assets.

Performing a comparative balance sheet analysis is a straightforward and highly effective method for analyzing a company’s balance sheet. As you follow the company over time, the trends and changes will become even easier to spot with more familiarity. Without the income statement, statement of cash flows, and the ability to ask management questions, we can’t know for sure what drove these changes to the company’s balance sheet.

Common-Size Ratio

The key advantage of a comparative balance sheet is that it gives you the ability to spot trends in the presented data. When the presentation is over a short period of time, these trends probably relate to seasonal changes in financial position. A well-conducted financial analysis can improve the financial position of a business by identifying operational and financial issues that can be corrected. Remember, though, that the company’s balance sheet is just a snapshot in time. It’s equally important to consider its income statement and statement of cash flow. And, at the end of the day, the company’s financial statements are just a report of how the company has performed over time.

- A comparative balance sheet is a statement where Information about shareholders’ equity, assets and liabilities is presented side by side as of…

- The main components of a balance sheet include assets, liabilities, and shareholders’ equity.

- A bank, for example, may require a company to maintain a maximum debt to equity ratio.

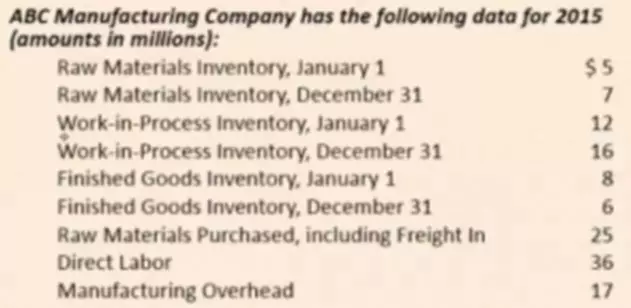

- Here’s a simple example of a Comparative Balance Sheet for a hypothetical company, “ABC Corporation,” showing the financial position at the end of two consecutive years.

Always take the time to take what you’ve learned from the numbers and apply it to what’s actually happening at the company. That last step is the key to taking a financial analysis and translating it into an actionable investment decision. A date-to-date comparison within the company helps a business owner or investor identify financial performance trends over time.

More advanced techniques to compliment a comparative balance sheet analysis

By including that ratio in the comparative analysis, an equity analyst can monitor the company’s balance sheet to ensure there is minimal risk of tripping that restriction. The comparative figures in comparative balance sheets can help you identify trends and areas of weaknesses or strengths. It can also help you understand fluctuations caused by seasons so that you can make better-informed business decisions. A comparative balance sheet is a type of comparative statement used by business owners, investors, and analysts to evaluate a company’s performance over time.

The common-sized numbers on this side of the balance sheet are even more informative, here. In year one, the company was considerably leveraged with liabilities at 86% of total assets. Reviewing the common-sized figures gives even more context to the changes. Cash increased from 19% of total assets to over 73%, while inventory ended year two at just 12%. Publicly-traded companies are required to provide comparative statements, often in the form of a balance sheet. Review the basics of balance sheets, comparative statements, ordering statements, horizontal analysis, and vertical analysis.

Here’s a simple example of a Comparative Balance Sheet for a hypothetical company, “ABC Corporation,” showing the financial position at the end of two consecutive years. Lastly, it is prepared to analyse and determine the reasons for any change in financial position. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. If the current year’s value of a company has decreased, then show the Absolute Change and Percentage Change in brackets to reflect the negative item. Business owners use the comparative report to make strategic business decisions. The status bar in the footer of the report indicates the progress as your report loads.

Comparative balance sheet definition

It can help you see the variance in how much a line item has changed from one period to another so that you focus on what is causing the increase or decrease in figures in a particular area of the balance sheet. This guide will help you understand what a comparative balance sheet is, its advantages, and how to use it to do a comparative analysis. In the footer of the report, you can select from lists to refilter report data. You also can select from the Column list to display report amounts by an additional dimension, including class, department, location, or if you are using NetSuite OneWorld, subsidiary. After you change values in the lists, click Refresh to see the changes. It is also prepared to analyse an increase or decrease in every item of Equity and Liabilities, and Assets in terms of percentage and rupees, and also to determine the trend and effect of each item.

By comparing balance sheets from different periods, stakeholders can identify trends, changes, and improvements or declines in the company’s financial position. This information helps in assessing the company’s liquidity, solvency, and overall financial performance. A technique of comparing financial statements through which the balance sheet of a company is analysed by comparing its Asset, and Equity and Liabilities for two or more two accounting periods is known as Comparative Balance Sheet. It is a horizontal analysis of Balance Sheet, and with this tool, every item of Assets, and Equity and Liabilities is analysed for two or more accounting periods.

Example of a Comparative Balance Sheet

This company could be winding down operations, it could be going out of business, or it may have tripped a loan covenant and been forced to deleverage quickly. Whatever the case, our comparative analysis revealed major changes across the entire balance sheet. The company’s accounts payable decrease sharply as well on the liabilities side, while its other short-term debt declined, but to a much lesser degree. Together, those accounts drove total liabilities lower, while shareholders’ equity increased from $75 to $130. Calculating the dollar and percentage variance between the prior and current period’s balance can help you or investors understand the severity of a change.

For the estimation of an organisation’s future progress, it is essential to look into its past performance, for which performing a comparative study of two or more years of company financial statements becomes necessary. A statement that helps in the comparative study of the components of a company’s balance sheet and income statement over a period of two or more years, both in absolute and percentage form, is known as a Comparative Statement. It is a horizontal type of analysis and not only provides the absolute figures of various years, but also, the columns to indicate any increase or decrease in these figures from one year to another in absolute and in percentage form. One can form an opinion on the progress of an enterprise based on the comparative statements.