Compass Group Pay Stubs & W2s

Content

It can take anywhere from a few days to a few weeks. If you’re not satisfied with the time your bank deposits, see our article that lists the banks and credit unions that offer early direct deposit . took information and after clicking next it shut down without setting a password or security questions. Cannot register as it says there is already an account for that employee. Cannot “reset” a non existent password and cannot use “forgot” password because no security questions were set.

The payroll team ensures accurate and timely disbursements are made to UAMS employees. All active employees can access ESS to update payroll data and contact information. Additional Medicare Tax is only imposed on the employee.

Once the funds hit your bank account, they are available to you. Most banks, including BBVA, give customers the ability to download direct deposit forms from their web site. You can then complete the form and take it to your employer’s payroll or human resources department. In the past, most payments such as income, Social Security, tax refunds, and more were paid by check. Today, those payments can be made via direct deposit, with the funds being electronically deposited directly into your checking account. There’s not a hold on direct deposits, regardless of how long your account has been open. You’ll have full access to the funds as soon as the deposit has been processed.

Citizens Bank

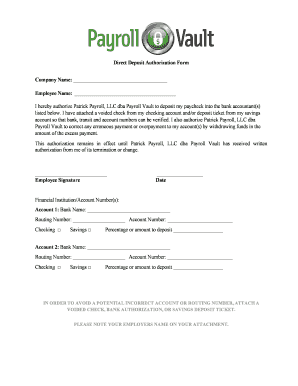

Deposit by Mail How do I deposit a check by mail? Deposit Requirements All the details on how a check or money order deposit should be written and endorsed. Enter your employer, and tap the checkmark to generate a form.

The company deposits funds during regular business hours as soon as it receives a payroll notification, and the funds will be available the same day. Direct deposits are available immediately on the day your employer sends the funds to the bank, as long as the deposit is made before 8 p.m. Provided your employer posts funds at least two business days in advance of your scheduled payday, USAA will put the funds in your account one day early. If not, the funds will be available the day USAA receives the deposit. Most direct deposits credit your account in “real time” on the day your employer makes the deposit. However, it can vary depending on the instructions provided by the originator.

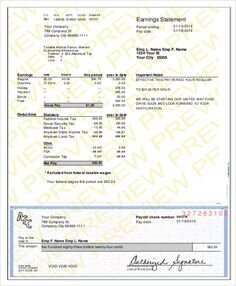

If you’re not sure when your payday is scheduled, check the date on your pay stub. Most employers, government agencies, and other payors encourage payment recipients to sign up for direct deposit. And in most cases, there are no fees associated with direct deposit.

Direct deposits will post to your account early in the morning on the day the bank receives the file from your employer, usually between 12 a.m. Most employers nowadays rely on direct deposits to pay employees. One benefit of this system is that you can typically get access to your paycheck immediately, and sometimes, you can even access your funds before your scheduled payday. Direct deposits are posted to accounts between 12 a.m. Direct deposits arrive in accounts no later than 9 a.m.

If you’re worried about when just one check will deposit, consider checking out our article about how long it takes a check to deposit and clear at the top 50 U.S. banks. Ordering Checks Online Ordering Checks Online Easily order checks online with a variety of personalized options and convenient delivery to your mailing address. You may also consult the Department of Veteran’s Affairs and Social Security Go Direct for additional help with setting up direct deposit.

I have not been able to access either paystubs or W2. The last paystub I received was for thru . Contacted Manager was told contact IT. IT does not answer, recording says contact manager. Please stop the run around and fix your system or e-mail me my paystubs and mail my W2 to PO Box 3374, Bandera, Tx ASAP thank you. Your direct deposit will arrive by around 8 a.m.

Woodforest National Bank

It’s more convenient than taking a check to a bank to deposit, and more secure than paper checks. What’s more, with direct deposit you have immediate access to the funds, whereas with checks there could be a several-day delay until the check clears. Enroll in direct deposit or make changes such as removing bank accounts, adjusting the amounts deposited between them and a payroll debit card, and more. When I try to log onto the Compass Associate Portal Dashboard I’m told I need to reset my password.

I do not have access to the old email address. If you are locked out, email at -usa.com for account recovery. Photo Check Deposit Making deposits with your phone. Checks We Can’t Process We can process most checks, but there are a few rarer types of deposits that we’re not able to accept. Wire Transfers All the information you need to receive a wire with Simple. Check Holds When will my check or money order funds be available?

When does a direct deposit hit your account? Axos Bank makes direct deposits as soon as your employer sends a payroll notification to its bank, which can be up to two days before your regular payday.

Additionally, you have control over where your paycheck goes , and you can access the money as soon as it hits your account. You can request a direct deposit form from your employer or human resources department. In some cases, you might be asked to supply a voided check when you fill out the direct deposit form. There are many benefits to direct deposit.

You will either be asked to provide a voided check or your bank’s routing number to complete the form. To set up direct deposit, you may need to provide your routing number. Easily locate your routing number in bottom left corner of your checks or via the link below. Enjoy the ease of having your paycheck, Social Security, or other income automatically deposited in your BBVA checking or savings account. I am locked out of my account due to the fact of to many log in attemps.

Compass Group Pay Stubs & W2s

And if your payday happens to fall on a Federal banking holiday, your pay will arrive the following business day. Direct deposits are available by 8 a.m. Direct deposit eliminates paper checks and the need to make a trip to the bank to deposit funds.

If you get paid before the switch is complete, your employer will usually either credit the account you previously had set up for direct deposit or give you a paper check. Just head over here to generate a customized form to give to your employer. You can choose to deposit all of your paycheck with Simple, or just part. If you have more than one Simple account, you can specify which account you’d like your direct deposit to go to. We spoke to representatives from the following banks to find out the exact time frame you can expect a direct deposit to post to your account. With direct deposit, you don’t need to worry about your paper check getting lost, stolen, or damaged.

Determine the amount of withholding for social security and Medicare taxes by multiplying each payment by the employee tax rate. There are no withholding allowances for social security and Medicare taxes. In most cases, direct deposit is free. In fact, most employers, government agencies, and other entities encourage signing up for direct deposit. Once complete, take the form to your employer’s payroll or human resources department. The form will ask for basic information such as your name, address, date of birth, and phone number.

- When does a direct deposit hit your account?

- Direct deposits are available immediately on the day your employer sends the funds to the bank, as long as the deposit is made before 8 p.m.

- The company deposits funds during regular business hours as soon as it receives a payroll notification, and the funds will be available the same day.

- Axos Bank makes direct deposits as soon as your employer sends a payroll notification to its bank, which can be up to two days before your regular payday.

- If not, the funds will be available the day USAA receives the deposit.

It can be different for every customer and is determined by the sender. Direct deposits will post to your account as soon as your employer sends the payment, with availability during the same business day. Direct deposit funds will be available to use no later than 6 a.m. If you’re anticipating a payroll deposit and your paydays are Fridays, for example, you can expect to receive the funds by 6 a.m. The expected time frame for direct deposits to post is between 12 a.m. on the date your employer sends the deposit . Direct deposits usually post to your account between 3 a.m.

Td Bank

on the day the bank receives the deposit from your employer. Direct deposits are posted on business days as soon as the deposit is sent to them by your employer. Typically, they are posted between 12 a.m. Generally, direct deposits are posted between 3 a.m. on the day the bank receives the deposit. Direct deposits will post to your account on the date the bank receives the deposit from your employer; typically between 12 a.m.

After I go through the security process I’m told to check my email for further instruction on how to do the reset. I’ve tried several times—I’ve waited an entire day—but it does not send the email. I believe I had this same problem when I initially set up my account and had to go through a manager or something to get it working. Evidently there is something wrong with your system and you need to get it fixed. The dashboard would be a useful feature—if it worked. The timing for setting up direct deposit with a new account depends on your employer.

Social security and Medicare taxes have different rates and only the social security tax has a wage base limit. The wage base limit is the maximum wage subject to the tax for the year.

There is no employer share of Additional Medicare Tax. All wages that are subject to Medicare tax are subject to Additional Medicare Tax withholding if paid in excess of the $200,000 withholding threshold. For 2021, the social security tax rate remains at 6.2% for both the employer and employee (12.4% total). The social security wage base increases to $142,800.00, a 3.7% increase over 2020. The tax rate for Medicare is 1.45% for both for the employee and employer (2.9% total). There is no wage base limit for Medicare tax; all covered wages are subject to Medicare tax.

You may also be asked to provide a voided check. Direct deposits are typically posted between 12 a.m. We process direct deposits Monday through Friday, so if your payday falls on the weekend, you’ll see the funds Monday.

On-time payment history can have a positive impact on your credit score. Improvement in your credit score is dependent on your specific situation and financial behavior. Failure to make on time payments by the payment due date may result in delinquent payment reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report.