Configuring A Pay Cycle For Projected Payroll

Content

For more information, see Viewing and Changing Payroll Projection Dates. You can use the Pay Cycle Start selection tools to view pay periods up to 3 months in the past or future. If you navigate away from the current week, you can return to it by clicking the button next to the Pay Cycle Start selection tools. If the Project Payroll check box is not available for a pay cycle and a boxed number “2” appears next to it, the pay cycle is out of date and must be moved forward before payroll projection can begin. Projected payroll can only be enabled when today’s date falls within the current pay cycle. The date range for each current pay cycle is displayed in the right-most column of the Projected Pay Cycles page.

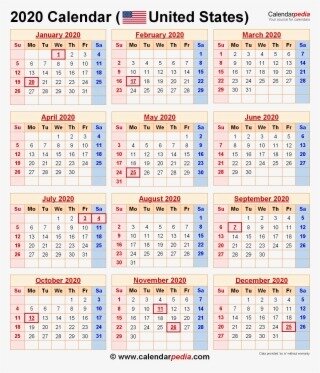

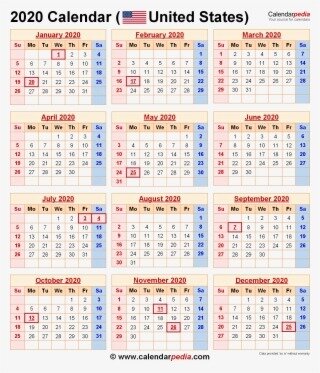

The Projected Pay Cycle Calendar page displays a calendar that begins with the current pay cycle and shows the projection start date and the pay period end date for each pay cycle in view. The calendar also displays all holidays assigned to the pay groups associated with the pay cycle. When pay day falls on a weekend or holiday, paychecks are issued on the first business day after the first of the month. All changes, including direct deposit and W-4 forms, need to be submitted by five working days from the end of the month. Some jurisdictions require that you provide an EITC notification to each of your employees with their annual tax forms. If your business is located in one of these jurisdictions, click the link to access and print the applicable notification. Before you report costs in the payroll platform, you must first calculate the taxable portion of coverage that exceeds $50,000.

Before you can configure individual pay cycles for projected payroll, an ADP Time & Attendance Representative must enable the Projected Payroll feature for your company. You can review the forms ADP® files on your behalf in the RUN Powered by ADP® or Payroll Plus® platform. Go to the Reports tab, select Tax Reports and click Quarterly Tax Verification. If you’re a paperless W-2 client, you’re responsible for printing and providing W-2s to employees who did not consent to receiving paperless tax statements. To see which employees consented, log into the RUN platform and go to the Company tab, Employee Access, then Manage Employee Access.

If necessary, you can change the date on which projection begins for a specific pay period. You can also change the interval between the end of the pay cycle and the beginning of payroll projecting for every pay period.

When a holiday is awarded in advance, the Holiday Processor does not evaluate all of the qualification rules defined in the holiday qualification rule assigned to the holiday. For example, any qualification rules based on employees’ schedules or worked time are not evaluated. Only the probation period, which is defined relative to employees’ service dates, is considered when holidays are awarded in advance. As a practitioner, you can add holidays to existing holiday programs. When you add a holiday, you define how the date of the holiday is determined and when the holiday is awarded. You also associate the holiday with a holiday qualification rule and a holiday pay distribution rule. These calendars apply to employees of agencies who receive payroll services from the Interior Business Center.

To determine this amount, please review Publication 15-B, The Employer’s Tax Guide to Fringe Benefits , as prepared by the IRS, or speak with your company’s accountant. To help ensure W-2s are accurate for your employees, you should report Group Term Life Insurance in the RUN Powered by ADP® /Payroll Plus® platform PRIOR to running your final payroll of the year.

Payroll And Hcm Solutions That Meet Your Needs

If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date. As ADP® files your taxes, you should process these payrolls at least 48 hours before the check date, to allow ADP enough time to debit and deposit the tax amounts timely. You can now receive payroll text and calendar reminders 2 days before you’re scheduled to process payroll. We’ll even remind you of upcoming holidays in case you need to run payroll early! Log into the RUN Powered by ADP®/Payroll Plus® platform, click your name in the top, right-hand corner and select Settings to begin setup today.

Be sure to report any changes with your first payroll of 2021. You can view your tax forms by logging into the RUN Powered by ADP® platform and clicking Review Tax Documents under the Taxes tab. Christmas Day is Friday, December 25 and New Year’s Day is Friday, January 1. If your check dates fall on either of these dates, please adjust them to avoid delaying your employees’ direct deposits and delivery of your payroll package. View your employees’ 2020 earnings and deductions in the RUN Powered by ADP® or Payroll Plus® platform. Go to the Reports tab, select Misc Reports and click Employee Summary.

Other Design Ideas Of Free 55 Adp Check Stub Template

A step-by-step Guided Walk Through is available in the RUN platform to assist you through the process of reporting third party sick pay. Click the Year-End Tasks and Tips button on the RUN homepage banner, then select Enter Third Party Sick Payto begin the Guided Walk Through.

This interactive tracking system will guide you through important To-Do items that need to be completed prior to running your last payroll of the year. Completing these tasks will help ensure W-2s and 1099s are accurate for you and your employees BEFORE they are printed. Employers who provide Group Term Life Insurance to their employees must calculate and report the cost of coverage over $50,000, as required by the Internal Revenue Service . This cost is fully taxable and must be reported as additional income for any employee who receives this benefit. The amount will be displayed on your applicable employees’ W-2s in Box 12 . A step-by-step Guided Walk Through is available in the RUN Powered by ADP® platform to assist you with reporting S Corp earnings. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectReporting S Corpto begin the Guided Walk Through.

Below we have list some of most popular payroll calendar that you can download for free. We will continue to add more payroll to meet our reader needs. Payroll Calendars can help you save a lot of time, money and effort by allowing you to customize the information, and functions that are displayed on them. Plus, they will save you the expense of having to purchase software packages for your payroll calendar each year when you want to change the details or make modifications to your system. Download calendars with pay dates, holidays, the number of working days, and the number of working hours per month. Create a projected payroll export template for the pay cycle.

Watch a quick tutorial in Help & Support to learn how to add a new employee to your payroll. Also, the I-9 form is available in the Help & Support section of the RUN platform under Forms & Tools, then Tax & Payroll Forms. You can either report Group Term Life Insurance costs for your employees per payroll OR in lump sum via an Off-Cycle Payroll.

Pay cycles that are already configured for payroll projection are indicated by a check mark in the Project Payroll column. Projected payroll must be enabled for each pay cycle for which you want to project payroll.

If you have to run another payroll before the end of the year, you will have to review your company, employee, and contractor totals again. The last day you can submit final 2020 payrolls with a check date in December is 12/31. Payrolls submitted after 12/31 may incur penalty and interest charges.

- Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party.

- It is important that you obtain this information from the appropriate third party provider as soon as possible.

- If this option is not selected, the holiday is not awarded until the actual day of the holiday.

- If this option is selected, the holiday is awarded (entered on employees’ timecards) when it first falls in either the current or next pay period.

- If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s.

Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checks, Enter Third Party Sick PayORMaxing Out Retirementto begin the Guided Walk Through. View your employees’ year-to-date earnings and deductions in the RUN Powered by ADP® or Payroll Plus® platform. Go to the Reports tab, click on Misc Reports and select Employee Summary. If your check date falls on this date, please adjust it to avoid delaying your employees’ direct deposits and delivery of your payroll package. SSNs and TINs will now be truncated on copies of Forms W-2, 1099-MISC and 1099-NEC. This includes copies that are provided to employees to report third party sick pay and group-term life insurance.

All time records need to be turned in and approved by the previous Tuesday at 5 p.m. To view the projected pay cycle in a calendar, click the button to the left of the pay cycle name. The closing day of the pay cycle is counted in this number, so entering a “1” means that you can only begin projecting payroll on the last day of the pay period. If your pay period ends on Sunday and you want to begin processing payroll on Wednesday, enter “5.” In the Number of Days to Project column, enter how many days before the end of each pay period you want to begin projecting payroll. This determines the earliest day in the pay cycle on which you can begin processing payroll. The Projected Pay Cycles page displays a list of the pay cycles used by your company.

When a holiday or other company closure occurs near the end of a particular pay cycle, you can override the regularly scheduled projection start date for that particular pay period only. If you need to change the interval between the start of projection and the end of the pay period for every pay period, you can adjust the “Number of Days to Project” setting. If that Tuesday is a federal holiday, then pay day is the next business day.

Payroll Calendar 2021

Log into the RUN Powered by ADP®/Payroll Plus®platform, click your name in the top, right-hand corner and select Settings to begin setup today. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checksto begin the Guided Walk Through. They will not have full visibilityof their SSN/TIN once their tax forms are printed and distributed. Federal legislation requires the reporting of both taxable and non-taxable sick payments made to employees from a third party. As a practitioner, you can change the date on which payroll projection begins for a pay cycle.

You must assign a holiday pay distribution rule to each holiday. This rule specifies which labor charge categories and earnings codes holiday pay is charged to and how many hours of holiday pay employees receive. Like holiday qualification rules, holiday distribution rules are created and maintained for your company by ADP.

If this option is selected, the holiday is awarded (entered on employees’ timecards) when it first falls in either the current or next pay period. If this option is not selected, the holiday is not awarded until the actual day of the holiday. Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party.

As a practitioner, you can enable payroll projection for specific pay cycles and define how many days before the end of each pay period projection should begin. You and employees (with Employee Access®) will be able to view your W-2s and 1099s on or around January 4, 2021. Please review online or via Employee Self Service prior to receiving the package with the physical forms. Ensuring information is accurate before January 15 will help you avoid amendment and reprint fees if forms need to be re-printed.

If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s. It is important that you obtain this information from the appropriate third party provider as soon as possible. These entries must be processed on or before your last payroll of the year to ensure that your Form 941 and W-2 reports are accurate. Terminated employees, who are registered on EA, can access, view and download their pay and tax statements. They also have the option to select and receive paperless W-2 tax statements.

If you are unsure which rule to select, contact your ADP Time & Attendance Representative. To view the payroll projection schedule for a pay cycle in a calendar, click the button to the left of the pay cycle name.