Configuring Holiday Programs Overview

Content

Once you have exported the normal working hours and any regular paid vacation or sick time, you will need to run a separate report for the new Families First leave rules. This report will provide all Family First leave hours taken during a specified time range. The FFCRA is far from the only new paid leave law responding to Covid-19. Several, several state and local governments have enacted their own laws that provide additional paid leave for Covid-19 purposes. For example, the City of Los Angeles recently enacted a law that almost mirrors the FFCRA but extends it to large employers with 500 or more employees.

This process saves a lot of time and limits mistakes due to data entry errors. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input.

Employers also need to be aware of any advance notice requirements. This requirement may be satisfied by displaying a poster containing the information in a conspicuous place, accessible to employees, at the employer’s place of business. Some states may supply the required poster or notice, or provide samples for employers to use. Paid sick leave laws pose a compliance challenge to employers. There are pros and cons for each option that need to be carefully considered before making a decision.

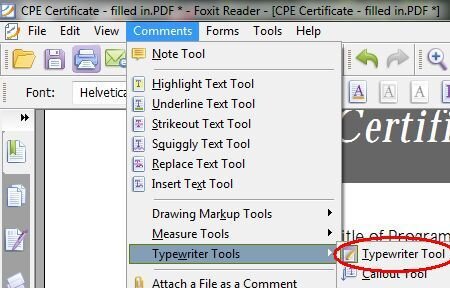

- Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

- Then click “Enter Paydata” and select “Paydata” from the popup menu.

- Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

Your ADP Time & Attendance Representative has created holiday qualification rules that reflect your company’s holiday policies. You cannot edit these rules, but you must assign every holiday you create to a holiday qualification rule. Employees can log in to the system and enter their timecard information, hours and any other relevant payroll information. You can get into the system and manually correct or adjust any data as needed.

Set Up The Leave Balance Sync

This step allows you to verify the accuracy of the payroll once it’s been calculated. In the Payroll Cycle window, click on the “Preview Results” icon. You can review total payroll information for the entire company. Also, you can drill down to verify payroll information by department or for individual employees.If you find incorrect information, click “Make Corrections” and edit the payroll batch. Then you will have to go back to the previous step and recalculate the payroll, and then run “Preview Results” function to verify the payroll once more. Hours.” Enter the number of regular hours each employee worked.

For employers with employees in multiple jurisdictions, with varying paid sick leave requirements, having one PTO policy for all types of leave can be an attractive option. Provided it meets the requirements of the most generous paid sick leave law in effect, one PTO policy can govern all employees across various jurisdictions and simplify administration. Each holiday defined within a holiday program is tied to a holiday qualification rule that specifies what conditions an employee must meet in order to be paid for the holiday. For example, your company may elect not to pay employees for a Monday holiday if the employee does not work his/her regularly scheduled shift on the previous Friday.

It does not reflect accrual usage (for example, sick time recorded on an employee’s timecard) or manual adjustments, cash outs, or purchases. Accrual awards are made according to a schedule defined by your company. When determining whether to maintain one PTO policy for all types of leave or to maintain a sick leave policy separately, identify your specific business needs and evaluate the laws that apply to your employees.

Name: Families First Family Care Pay

Be sure to check with your own state and local government for additional paid leave requirements and set them up in your Deputy account. The full details of this act are available from the US Department of Labor.

Company policy and state law dictate how employees accumulate these days. Some companies have PTO days accrue each month based on hours worked, while others give a certain number of days each year based on the number of years at the company. One method to consider is printing the balance of paid sick leave available on the employee’s pay statement when there is paid sick leave available for use.

A holiday program is a series of specific holidays for which your company awards holiday pay. You can create multiple holiday programs to be assigned to different groups of employees . For example, if your company has employees who work in two different countries, you may need to create separate holiday programs that include the national holidays for each country. Only one holiday program can be assigned per pay group, so each holiday program must contain all of the holidays that apply to the pay groups that use that holiday program. Once a holiday program has been created, you can add and deleted specific holidays within that program or make changes to the definition of each holiday.

How To Establish A Pto Donation Program

The system will automatically calculate the gross salary, deductions and net salary for the pay period. Click on the “save” button frequently to save data you have entered. When you are done, click on the “done” button.Enter the number of overtime hours in the “O/T Earnings” column. If your business has more than one company that processes payroll, confirm the correct company code. To change the company code, click on the magnifying glass icon and select the correct company code.If you don’t have more than one company, do nothing.

However, depending on the circumstances, the employee may qualify for leave under a different law. For example, the federal Family and Medical Leave Act and similar state laws require employers to provide unpaid leave to eligible employees for specified family, medical, and military reasons. Some accruals used by your company may be awarded only after an employee has accumulated a certain number of hours or days in specific earnings codes. If your company’s accruals have qualification rules of this type, your ADP Implementation Specialist has also set up accumulators for your company.

Holiday pay is also affected by holiday pay distribution rules that specify which labor charge categories and earnings codes holiday pay is charged to and how many hours of holiday pay employees receive. Like holiday qualification rules, holiday distribution rules are created and maintained for your company by ADP, but you must assign every holiday you create to a holiday distribution rule. As a practitioner, you can create and edit holiday programs for your company.

This button only appears for accruals for which your company allows cash out transactions. The Fair Labor Standards Act does not require employers to provide paid time off for vacation, sick time, or holidays; however, many states do. You can set different vacation allowances based on the number of years of service and on job title/level. For example, managers can receive more vacation time than other employees. This could mean employers would face additional costs paying for unused sick time, if they bundle their sick leave into their PTO. PTO policies give workers the flexibility to use their leave to fit their needs.

At the federal level, President Barack Obama issued Executive Order requiring federal contractors to grant at least seven days of paid sick leave to their employees effective January 1, 2017. This provision must also be included in subcontract agreements. The Order requires the Secretary of Labor to issue regulations by September 30, 2016. Rules such as these only affect government contractors or subcontractors, but are often viewed as a model for broader legislation. Generally, no additional paid sick leave leave is required once an employee exhausts their allotted time.

An accumulator tracks how many hours or days an employee has accumulated in one or more earnings codes. An accrual called 3YR PTO could then be created to automatically award 1 day of PTO to an employee when his/her accumulator’s balance reaches 780 days . Multiple accumulators can be defined to track different types of hours or days. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period. Work with an ADP representative to set up Automatic Pay for these employees.

This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to. Allows you to record cash out transactions, in which an employee elects to receive cash in lieu of a portion of his/her accrued hours. Cash outs recorded using this button are recorded on the employee’s timecard as non-editable payroll adjustments.

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

Also, employees set up for Automatic Pay automatically receive a paycheck. You can manually input these changes in the paydata grid.If an employee is set up for Automatic Pay but you need to change their salary or hours for this pay period, include the employee in the batch. Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period. This is the process for entering data for your salaried and hourly employees who are not set up for Automatic Pay.

The Employee Accrual Balance Detail page displays details about an employee’s accrual balance for a specific accrual. An accrual balance is a measure of time or money that an employee has earned toward various types of paid or unpaid time off. Accruals are commonly used to award and track sick time, vacation time, floating holidays, and PTO . The settings that determine when and how accruals are awarded to employees are configured by ADP according to your company’s policies. As an employer, you will need to review the differences of each law applicable to your workforce and ensure you are providing your employees with the greatest protection called for under the more generous law. There is no federal law that requires private employers to provide paid time off to employees. However, some jurisdictions require employers to provide paid sick leave to full-time and part-time employees.

Review these laws carefully to ensure your policies and practices comply. Absent a specific requirement, employers can determine whether to provide paid time off benefits and how to structure their program.

You enter paydata in batches, which are groups of employees. You can use previously-created batches, or you can create and customize new batches.Click on “Process” in the task bar at the top of the page. In the pop-up menu, under “Payroll,” select “Payroll Cycle.” You will be directed to the Payroll Cycle page. Displays the date on which the employee was last awarded regularly accrued hours for this accrual. The last award date only reflects the accrual awards generated automatically by the Time & Attendance module.

Generally, employers that offer PTO provide it to part-time employees on a pro-rated basis (for example, 10 days for full-time employees and five days for part-timers). The Time & Attendance module Accruals module allows you to view and manage accrual balances for employees who are assigned to security groups to which you have access. An accrual balance usually consists of hours that an employee has earned toward various types of paid or unpaid time off. Accruals can also be used to track monetary awards that are earned or awarded incrementally over time. Indicates the last time the balance for the selected benefit was purged . For example, if your company does not allow employees to carry sick time over from one year to the next, the Sick accrual is purged on December 31st. Many employers now offer a bank of paid time off days that include vacation, personal, and sick days.