Cost, Insurance, And Freight Cif Definition

Content

- How To Record Freight Charges In Accounting

- Learn The Difference In Cost And Freight And Free On Board Liabilities

- Trucking Is Under Capacity Pressure, Rates Soar

- Ex Works Exw Vs Free On Board Fob: What’s The Difference?

- Legality Of A Freight Quote

- What Does Cif Mean In Shipping Terms?

- Two Types Of Freight Cost Accounting Classifications

Cost, insurance, and freight only applies to goods transported via a waterway, sea, or ocean. In a global economy, companies can gain a lot by doing business with firms outside of the United States. When doing so, you need to know what your shipping costs will be. When sending products across the country or overseas, familiarity with certain documents and types of charges can prevent confusion and losses for your company.

- Volvo trucks might be more, their workers in Dublin VA went on strike.

- That means it won’t appear in the cost of goods sold until the related inventory items are eventually sold.

- Managers need to know how to record freight charges in accounting to make accurate financial projections and ongoing business decisions.

- Somebody starting out sounds bad, like those regional air carrier copilots sleeping in lounges because they couldn’t afford a room between flying days a few years back.

- The one time I drove a tractor trailer I was praying that all other traffic chose other places to be and that I would never have to turn or maneuver.

Demurrage/Detention – A penalty charge against shippers or consignees for delaying the carrier’s equipment or vessel beyond the allowed free time. Demurrage applies to cargo; detention applies to equipment. If you store a container at the port beyond free days, then demurrage and detention apply. Only detention applies if you keep a container for too long on any other premise (not on the port’s premises). Ex works is a shipping arrangement in international trade where a seller makes goods available to a buyer, who then pays for transport costs. The seller has the responsibility for paying the cost and freight of shipping the goods to the buyer’s port of destination. Usually, exporters who have direct access to ships will use CIF.

How To Record Freight Charges In Accounting

Not setting your accounting up to record those expenses every time, in the right buckets, can have tax implications for any company. Lojistic can automatically code your shipping costs according to your business rules.

Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. The bill of lading declares the type and quantity of goods you are shipping. It represents the agreement you have with the shipper to transport these items. The bill of lading shows the weight, value, and description of each item, along with shipping and delivery dates. If necessary, you can use bills of lading in a court of law.

Learn The Difference In Cost And Freight And Free On Board Liabilities

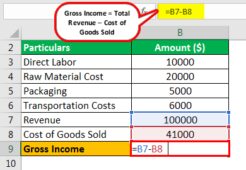

They must record it appropriately in order for their financial books to be accurate. Usually, freight expenses are recorded as other “general expenses.” How the cost is recorded may depend on who is paying the freight cost and whether the cost is included in the asset’s value/price. To learn how to record freight charges in accounting, first determine the classification for the freight charges. For FOB shipping point, the sale occurred at the shipping point – meaning your company’s dock. FOB destination means that the sale will occur when it arrives at the destination – at the buyer’s receiving dock. CIF is an international agreement between a buyer and seller in which the seller has responsibility for the cost, insurance, and freight of a sea or waterway shipment.

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. Remember that YOU are choosing the carrier, so you are entitled to ask them to explain all charges in detail. Don’t get ripped off because you didn’t check and query the charges in advance, and when you do query later, it may be too late. Documentation charges – Charges that may be applicable to prepare import documentation such as Permits, Licenses, and such. If cargo is unpacked directly at the consignee’s premises, then this charge will not be applicable in this contract. Documentation charges – Charges that may be applicable for the preparation of export documentation such as Certificate of Origin, Export Permits, Licenses, and such.

What is freight accounting?

Freight accounting is accounting that tracks the expenses associated with sending goods from one location to another. Sometimes freight is shipped from a manufacturing warehouse to the warehouse of the company selling the items, or items may travel from a company to a retail location or directly to the customer.

We are not a law firm, do not provide any legal services, legal advice or “lawyer referral services” and do not provide or participate in any legal representation. Another issue with freight out is what to do if you re-bill the freight charge to the customer. The choices are to either treat the billing as a form of revenue, or to offset the billing against the freight out expense.

Trucking Is Under Capacity Pressure, Rates Soar

The amount of freight expense charged depends on the mode of transportation used to deliver the cargo. A freight quote is much more than just a sea or train shipping service price list. In the simplest terms, a freight quotation is a summary of charges levied by a carrier for cargo movement from Point A to Point B. CIF is only used when shipping goods via ocean or waterway, meaning CIF cannot be used for air freight. CIF can be easier for buyers who don’t want to go through the trouble of obtaining insurance, paying freight charges, and assuming all of the responsibility for shipping internationally. It’s important to note that there are different types of FOB agreements and the insurance coverage can be negotiated between the buyer and seller.

- Yes, it accelerates expense recognition a bit, but for most companies, the amount of expense involved is pretty small.

- If the freight classification is FOB destination, then the seller records the transportation cost as freight-out, transportation-out or delivery expense.

- The main reason for an immediate charge off is to keep freight in from mucking up the inventory records.

- Cost, insurance, and freight is an international shipping agreement, which represents the charges paid by a seller to cover the costs, insurance, and freight of a buyer’s order while the cargo is in transit.

- FOB stands for “freight on board.” FOB shipping point requires the buyer to pay freight charges.

- Now the Treasury is going to reduce the size of their offering and that should take pressure off yields, keep your eye on that.

Bills of lading are official documents, sometimes used in the court of law, that names the type of item and the number of items being transported. The shipping company or a third-party logistics companyprovides these documents. Bills of lading accurately reflect the weight, value, and description of every item. They must also include information about when the units will be shipped and delivered. A bill of lading represents an agreement between you and the shipper. With FreightCenter’s online freight quote tool, you can compare freight costs across all major carriers in our network. FreightCenter is where top carriers compete for your business.

Ex Works Exw Vs Free On Board Fob: What’s The Difference?

Covers various contingencies such as hydrocarbon spill cleanup costs and other mandated fees. Chassis utilization surcharge – A fee imposed for using a chassis in conjunction with the shipping container to facilitate overland transportation from the shipper’s door to port. Analyze the costs of freight transportation and partnering companies’ performance (primarily because the need for customer-specified delivery remains at an all-time high).

Never forget to include the additional weight of your packaging materials in your information. Today we continue our series on all things freight accounting by addressing when you should be accounting for freight costs. In this kind of collaboration, you are able to work together as a management team and drive the company forward in the most cost effective and efficient manner. Accounting for freight charges is a specific classification in a business’s record books.

Managers need to know how to record freight charges in accounting to make accurate financial projections and ongoing business decisions. Once the goods have been delivered to the buyer’s destination port, the buyer must pay the agreed price for the goods and is responsible for any import fees, taxes, or custom duty charges. Also, any transportation, inspection, and licensing costs as well as the cost to transport the goods to their final location are the buyer’s responsibility. Emerging events such as terrorism, piracy, and a rogue government can result in increased freight costs as shipping companies attempt to recover losses incurred. Costs may also increase due to shippers opting to use longer shipping routes that offer more safety. For example, maritime shipping passing through pirate-prone shipping routes such as Somalia are forced to charge a higher cost to cover the increased risk, higher insurance premiums, and longer shipping routes.

Legality Of A Freight Quote

“We still expect this trend to press higher near-term, as strong freight demand meets shortages of both drivers and trucks,” the report said. The shipper pays for freight and then charges the customer. It is a good option when the shipper and carrier have a positive relationship resulting in good rates. The shipper can often negotiate better deals than the customer could do on his own. The consignee, typically the buyer to whom the freight will be delivered, pays all freight charges upon receipt. The consignee is considered responsible for customs declarations and filing any taxes or forms. Catching mistakes in freight cost accounting is important because of the ramifications.

In other words, there could be an agreement in which the buyer pays the freight charges or cost of delivery but the seller might agree to pay for the marine insurance. The goods are exported to the buyer’s port named in the sales contract. Until the goods are delivered to the buyer’s destination port, the seller bears the costs of any loss or damage to the product. Further, if the product requires additional customs duties, export paperwork, or inspections or rerouting, the seller must cover these expenses. When public and companies get more worried about supply chain shortages and dislocations and high shipping costs, then I suspect trucking industry will move mountains to make automated trucks work in a larger scale. Manufacturers, importers, distributors, retailers, and others have been groaning under surging shipping expenses as freight companies have raised rates, amid bottlenecks and strong demand. But February had already been a record month for freight expenditures.

For many years ahead, I predict the wealthy will keep growing their wealth, unimpeded by competitive forces. The hard-working productive people in the middle will continue to suffer, as they are fed distractions that mask the real causes of their problems. The key is to print just the right amount of money to offset deflationary forces. The common mantra that “stocks eventually go up over time and provide a secure retirement” assumes that the economy is actually growing, as it did for most of the 20th century. For the last 5 or so, it’s been clear that any stock gains will be from multiple expansion, as the economy is no longer growing.

- The seller must deliver the goods to the ship within the agreed-upon timeframe and provide proof of delivery and loading.

- If government decides to pump a trillion into self driving infrastructure they probably can make it happen.

- The exact details of the contract will determine when the liability for the goods transfers from seller to buyer.

- Under CIF, the risk transfer is at a different point than the cost transfer.

- But February had already been a record month for freight expenditures.

- Documentation charges – Charges that may be applicable for the preparation of export documentation such as Certificate of Origin, Export Permits, Licenses, and such.

Although the possession of the shipment transfers to the buyer once the goods have been loaded on the boat or ship, the seller is responsible for any shipping insurance and freight charges. Transportation management depends on historical and real-time data. The supply chain operates on roughly an 18-month cycle.

What Does Cif Mean In Shipping Terms?

That pattern helps companies more accurately predict rates to ensure the budget is not blown out of the water. With the increased demand for freight shipping, more companies set their shipping prices by freight density rather than by weight. They do this because charging by weight limits the amount they can ship and is therefore more expensive, both in terms of money and space. The greater the freight density, the less space it occupies on the carrying vessel. This decreases the transportation costs for each pound shipped. Consider consolidating multiple shipments into a partial or full truckload shipment if they are headed in the same direction rather than breaking them up. Also remember that for carriers that base their freight rates on density and commodity type, packaging materials can drastically alter the cost of freight shipping.

What is LCL vs FCL?

An FCL shipment is used when a shipper bears the cost of the entire container and uses it exclusively for a single shipment, even if they do not have enough goods to fill it up. On the other hand, an LCL shipment means shippers share the containers with other shipments and only need to pay for the space used.

Compared to March last year, just before the sharp decline set in, the Expenditures Index spiked by 27.5%. A third party, typically a professional logistics company, pays all freight charges rather than the shipper or consignee. This option is valuable when the order is more complicated or the consignee—the person or business receiving the shipment—is new to the business. You need to keep track of how and why you’re paying for the freight costs.

CIF means that the seller is responsible for the costs of transporting the cargo and obtaining insurance to protect the buyer from any damages to the goods during transport. However, the buyer assumes responsibility for the goods once the cargo has reached the buyer’s port. Freight costs and budget adherence are among the most important and often overlooked aspects of transportation management.

If you follow that path, some freight in cost may end up being capitalized into the month-end inventory. That means it won’t appear in the cost of goods sold until the related inventory items are eventually sold. That could work if you want to delay expense recognition. You, as a shipper, should take advantage of innovative freight benchmarking companies to compare what rate you should be paying to the carrier and whether the carrier’s quotation is in line with the market. SCS – Abbreviation for “Suez Canal Surcharge.” Used to compensate shipping companies for additional costs incurred due to transiting the Suez Canal.

But if it had been manufactured in the US from US made parts, it would have been a lot more expensive. In terms of flatbed trailers , the average national spot rate in March jumped by 8% from February and by 26% year-over-year to $2.76 per mile. The contract rate jumped 6% for the month and 14% year-over-year to $2.85 a mile. Below are common charges that may be outlined in bills of lading or freight bills. In other words, if what your reports and records are telling you is inaccurate, then you’ll also make inaccurate business decisions. UpCounsel is an interactive online service that makes it faster and easier for businesses to find and hire legal help solely based on their preferences.