Dealership Accounting, Audit, Tax, & Advisory Services

Dealerships should adhere to accounting standards such as Generally Accepted Accounting Principles (GAAP) to ensure uniformity, comparability, and transparency in financial reporting. Dealerships need to adhere to essential accounting principles to maintain financial integrity and accuracy in their operations. With clients in 47 states and counting, Withum can assist you not only by identifying goals but also by developing a roadmap to reach them. Access to real-time data through AutoRaptor CRM allows businesses to make more informed decisions. Companies can react quickly to market changes and competitor activities by analyzing up-to-date information.

Strategies for Efficient Inventory Accounting

This metric helps dealerships assess the profitability of each unit sold, factoring in both new and used vehicles. By analyzing PVR, dealerships can identify trends in customer preferences and adjust their sales strategies accordingly. In conclusion, implementing crucial accounting practices is vital for dealership success. Embracing comprehensive accounting practices positions dealerships for long-term growth and profitability in an ever-evolving industry.

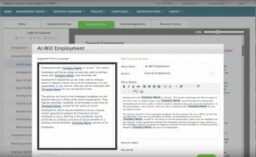

Accounting Software for Auto Dealers

As you read this article, it will ensure on how your car business works in the tough market. Keep reading to find out some smart tricks and easy ways to make your car dealership’s money stuff work better. Car dealer accounting software from FreshBooks has useful resources that will help you create a professional invoice template. Once you’ve customized your template with your branding materials, billing your clients is only a few clicks away.

Comprehensive Accounting Practices for Car Dealerships

The cloud makes the accounting software for car dealers easily accessible on all your mobile devices. You can sign in on your internet browser or on the FreshBooks cloud accounting app to access your business’s info in just a few clicks. Dealerships should stay updated with accounting standards, such as the Financial Accounting Standards Board (FASB) guidelines.

Impact of Streamlining Accounting Practices

By adhering to accounting standards, dealerships can provide reliable financial information that investors and lenders can use to make informed decisions. This transparency also helps in building strong relationships with stakeholders, fostering long-term partnerships. With the help of accounting software and automation, dealerships can efficiently manage their finances, leading to better decision-making and improved overall performance. The use of AutoRaptor CRM can also enhance customer relationships and increase sales opportunities, ultimately contributing to the success of the dealership. Integrating advanced accounting software that specializes in accounting for car dealerships can enhance the accuracy of these forecasts, enabling better resource allocation and financial planning. Overvaluing a trade-in can erode the dealership’s profit margins, while undervaluing it can deter potential buyers.

Revenue Recognition in Car Sales

Help the accounting department transform and initiate the changes in a way that makes all employees feel confident and comfortable. There are challenges to switching to an all-digital process, but they’re worth it to ensure that the accounting department is more foolproof in future processing. With packages starting at just $15 a month, you’ll wonder why you ever considered hiring an accountant. The convenience and affordability of accounting software from FreshBooks certainly makes it the best bookkeeping option on the market. To make sure your business is profitable, use the FreshBooks expense tracking feature to chart your business’s costs.

Car dealerships face several compliance challenges, including those related to sales tax, consumer finance laws, and vehicle registration. Failure to comply can result in significant penalties and damage to the dealership’s reputation. The digital revolution has transformed the accounting landscape, creating opportunities for dealerships to streamline processes and drive efficiency. The FreshBooks accounting software for car dealers does not require an accountant to navigate.

- Understanding the financial health of a car dealership hinges on a few specific metrics that provide insights into various aspects of the business.

- This financing method is essential for maintaining a diverse and appealing inventory without straining the dealership’s cash flow.

- Without regular reconciliation reviewing, errors and fraud can slip through the cracks.

- Free up time in your firm all year by contracting monthly bookkeeping tasks to our platform.

- The use of AutoRaptor CRM can also enhance customer relationships and increase sales opportunities, ultimately contributing to the success of the dealership.

- Create a list of processes that the business is still doing manually and mandate an official process change.

Effective cash flow management maintains the financial health of automotive dealerships. This includes regular monitoring of cash inflows from vehicle sales and outflows from inventory purchases and operating expenses. Accurate bookkeeping and accounting maintain the financial integrity of auto dealerships.

When you carry inventory and handle financing like auto dealers do, double-entry accounting is a must. No need to create all those entries and struggle with debits and credits, FreshBooks takes care of the complex accounting details behind the scenes. Keep a detailed record of how much revenue your business has earned, how much you’ve collected in sales tax and any business expenses so you have all the necessary numbers ready for tax season. Auto dealer accounting software packages from FreshBooks start at only $15 a month.

Transparent communication about how the valuation was determined can build trust and facilitate smoother negotiations. Sales staff should be trained to explain the appraisal process clearly, highlighting the factors that influenced the final offer. This transparency not only enhances customer satisfaction but also increases the likelihood of closing the sale. Incentives and rebates offered by manufacturers also impact revenue recognition. These incentives can take various forms, such as cash rebates, dealer incentives, or volume bonuses.