Depreciation Conventions

Content

- The Best Method Of Calculating Depreciation For Tax Reporting Purposes

- What Records Should I Keep For Tax Purposes?

- Inclusion Amount Worksheet For Leased Listed Property

- What Is The Mid

- Example Of How To Use The Depreciation Tables For Macrs Straight

- Understanding Methods And Assumptions Of Depreciation

- There Are Three Depreciation Conventions:

Under certain circumstances, the general dollar limits on the section 179 deduction may be reduced or increased or there may be additional dollar limits. The general dollar limit is affected by any of the following situations. The term of the lease is less than 50% of the property’s class life. Property used by governmental units or foreign persons or entities, except property used under a lease with a term of less than 6 months.

- If you place property in service in a personal activity, you cannot claim depreciation.

- Figure the inclusion amount by taking into account the average of the business/investment use for both tax years and the applicable percentage for the tax year the lease term begins.

- The business part of the cost of the property is $8,800 (80% × $11,000).

- Bill Nelson is an inspector for Uplift, a construction company with many sites in the local area.

- This is a short tax year of other than 4 or 8 full calendar months, so it must determine the midpoint of each quarter.

- It is assumed that the property being depreciated was placed into service at the midpoint of the year.

Straight line method over an ADS recovery period – Similar to the straight line method over a GDS recovery period, it allows you to deduct the same amount each year except for the year you place the asset in service and the year you dispose of it. In the MACRS Depreciation Methods table you can see what type of property would use this method. GDS using 200% DB – An accelerated depreciation method that will give you a larger tax deduction in the early years of an asset . Refer to the above table for the types of property this method is primarily used for. Keep in mind, the depreciation tables assume 100% business use.

The Best Method Of Calculating Depreciation For Tax Reporting Purposes

An increased section 179 deduction is available to enterprise zone businesses for qualified zone property placed in service during the tax year, in an empowerment zone. For more information, including the definitions of “enterprise zone business” and “qualified zone property,” see sections 1397A, 1397C, and 1397D of the Internal Revenue Code. The amount you can elect to deduct is not affected if you place qualifying property in service in a short tax year or if you place qualifying property in service for only a part of a 12-month tax year.. Generally, you cannot claim a section 179 deduction based on the cost of property you lease to someone else. However, you can claim a section 179 deduction for the cost of the following property.

Mid-month – The mid-month convention assumes that you placed the property in service or stopped using it for your business in the middle of the month. This means that your tax deduction is limited to a half month of depreciation in the month the property was placed in service and in the month you stopped using the property for your business. This convention applies to nonresidential real property, residential real property, and any railroad grading or tunnel bore.

What Records Should I Keep For Tax Purposes?

The cloud-based financing system for accounting firms has grown to include a business term loan option for firms’ small business clients. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Based on the Depreciation Recovery Period table, the machines and furniture have a recovery period of 7 years, and the computer has a 5 year recovery period. No matter which depreciation method is right for your business, you’ll be able to record and track depreciation schedules using QuickBooks Online. New customers can sign up for a free trial or get up to 50% off the purchase of QuickBooks Online. Shipping and delivery costs – Include shipping or delivery charges you paid to get the asset to your place of business. There are nine property classifications for MACRS GDS and ADS.

Do you subtract salvage value double declining balance?

This means that your depreciation rate for double declining depreciation is 40%, making your first year depreciation $40,000. You’ll depreciate the asset until the book value reaches $8,000. … Remember, in straight line depreciation, salvage value is subtracted from the original cost.

You use the calendar year and place nonresidential real property in service in August. You multiply the depreciation for a full year by 4.5/12, or 0.375.

Inclusion Amount Worksheet For Leased Listed Property

The amended return must be filed within the time prescribed by law. It is adjusted for items of income or deduction included in the amount figured in not derived from a trade or business actively conducted by the corporation during the tax year. Jack bought and placed in service $2,590,000 of qualified farm machinery in 2020.

Below is a summary table of 3, 5, and 7 year property classes. If you’d like to learn about other depreciation methods or want to learn more about how depreciation works in general, read our What is Depreciation?

What Is The Mid

The half-year convention is used to calculate depreciation for tax purposes, and states that a fixed asset is assumed to have been in service for one-half of its first year, irrespective of the actual purchase date. The remaining half-year of depreciation is deducted from earnings in the final year of depreciation. Have been in service for one-half of its first year despite when it was actually acquired. This rule is applied by tax authorities to restrict the maximum allowable claim for depreciation to one half of the annual amount.

Reading the headings and descriptions under asset class 30.1, Sam finds that it does not include land improvements. Therefore, Sam uses the recovery period under asset class 00.3.

Example Of How To Use The Depreciation Tables For Macrs Straight

You can depreciate the part of the property’s basis that exceeds its carryover basis (the transferor’s adjusted basis in the property) as newly purchased MACRS property. In January, you bought and placed in service a building for $100,000 that is nonresidential real property with a recovery period of 39 years. You use GDS, the SL method, and the mid-month convention to figure your depreciation. Instead of using the rates in the percentage tables to figure your depreciation deduction, you can figure it yourself. Before making the computation each year, you must reduce your adjusted basis in the property by the depreciation claimed the previous year. The Modified Accelerated Cost Recovery System is used to recover the basis of most business and investment property placed in service after 1986.

This is any building or structure, such as a rental home , if 80% or more of its gross rental income for the tax year is from dwelling units. A dwelling unit is a house or apartment used to provide living accommodations in a building or structure. It does not include a unit in a hotel, motel, or other establishment where more than half the units are used on a transient basis. If you occupy any part of the building or structure for personal use, its gross rental income includes the fair rental value of the part you occupy. If you are required to use ADS to depreciate your property, you cannot claim any special depreciation allowance for the property.

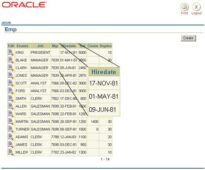

Types Of Depreciation Conventions

Therefore, if you use the property less than 100% for business you must multiply the depreciation allowance shown in the table by the business-use percentage to determine the amount of depreciation you can claim. Each quarter includes the depreciation rates for each year of the asset’s recovery period. If the total cost of business equipment acquired in the last quarter of the year exceeds 40% of the total cost of equipment acquired for the entire year, the mid-quarter convention must be used for all property placed in service in that tax year. In the case of property placed in service by a partnership or an S corporation, the 40-percent test is generally applied at the partnership or corporate level. A way to figure depreciation for property that ratably deducts the same amount for each year in the recovery period. The rate is determined by dividing 1 by the number of years in the recovery period. The original cost of property, plus certain additions and improvements, minus certain deductions such as depreciation allowed or allowable and casualty losses.

Your depreciation deduction is limited to the amount on line 11. Your combined section 179 and depreciation deduction is limited to the amount on line 9. If you have a short tax year, you must reduce the maximum deduction amount by multiplying the maximum amount by a fraction. The numerator of the fraction is the number of months and partial months in the short tax year, and the denominator is 12.. The use of property as pay for services of any person (other than a 5% owner or related person), unless the value of the use is included in that person’s gross income and income tax is withheld on that amount where required. The business-use requirement generally does not apply to any listed property leased or held for leasing by anyone regularly engaged in the business of leasing listed property.

Bonus Depreciation And Depreciation Conventions

A deduction for any vehicle if the deduction is reported on a form other than Schedule C . If you deduct more depreciation than you should, you must reduce your basis by any amount deducted from which you received a tax benefit . If you buy property and assume an existing mortgage or other debt on the property, your basis includes the amount you pay for the property plus the amount of the assumed debt. You must determine whether you are related to another person at the time you acquire the property.

Is mid month convention GAAP?

Mid-Month (MIDM): For IRS Tax depreciation, one half of the normal monthly depreciation is allowed during the month of acquisition. GAAP depreciation methods allow for full normal monthly depreciation when acquired between the 1st-15th of the month.

If you place property in service in a personal activity, you cannot claim depreciation. However, if you change the property’s use to use in a business or income-producing activity, then you can begin to depreciate it at the time of the change. You place the property in service in the business or income-producing activity on the date of the change. You figure your share of the cooperative housing corporation’s depreciation to be $30,000. Your adjusted basis in the stock of the corporation is $50,000. You use one half of your apartment solely for business purposes.

It includes any program designed to cause a computer to perform a desired function. However, a database or similar item is not considered computer software unless it is in the public domain and is incidental to the operation of otherwise qualifying software. A change in the depreciation method, period of recovery, or convention of a depreciable asset. Other basis usually refers to basis that is determined by the way you received the property. For example, your basis is other than cost if you acquired the property in exchange for other property, as payment for services you performed, as a gift, or as an inheritance.

- This is because they must figure the limit as if they were one taxpayer.

- The following example shows how a careful examination of the facts in two similar situations results in different conclusions.

- This chapter explains how to determine which MACRS depreciation system applies to your property.

- Instead of using the 200% declining balance method over the GDS recovery period for property in the 3-, 5-, 7-, or 10-year property class, you can elect to use the 150% declining balance method.

- The allowance applies only for the first year you place the property in service.

Table 4-1 lists the types of property you can depreciate under each method. It also gives a brief explanation of the method, including any benefits that may apply. MACRS provides three depreciation methods under GDS and one depreciation method under ADS. It is placed in service in connection with the active conduct of a trade or business within a reservation.

There Are Three Depreciation Conventions:

To figure your MACRS depreciation deduction for the short tax year, you must first determine the depreciation for a full tax year. You do this by multiplying your basis in the property by the applicable depreciation rate. Do this by multiplying the depreciation for a full tax year by a fraction. The numerator of the fraction is the number of months the property is treated as in service during the tax year . See Depreciation After a Short Tax Year, later, for information on how to figure depreciation in later years. You must depreciate MACRS property acquired by a corporation or partnership in certain nontaxable transfers over the property’s remaining recovery period in the transferor’s hands, as if the transfer had not occurred. You must continue to use the same depreciation method and convention as the transferor.