Digital Payroll Solutions To Keep Up With The Future Of Work

Content

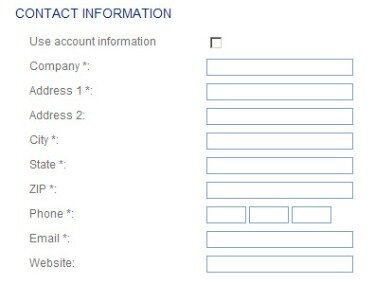

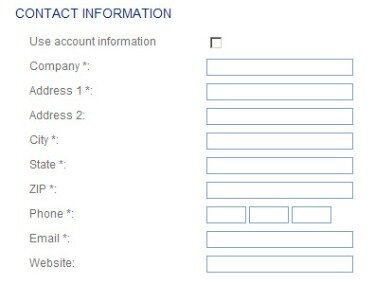

Avoid being accusatory; it may not have been an issue on her part. One reason your pay may be late is because you are new or have switched accounts. If that is the case, it may take a pay cycle or two for changes to take effect. When you reach a consultant, you’ll be asked for your business’s name, location, phone number, email, employee count and current payroll process.

Can I transfer money from ADP to bank account?

Yes. You may transfer your full available balance from your ALINE Card to a U.S. bank account that belongs to you and is in your name at mycard.adp.com.

As a business owner or a human resource professional, you may be looking for an automated solution for your employee payroll needs. ADP payroll is one of the most popular choices on the market for payroll software. It has several packages and add-on features from which you can choose. Learning how ADP services work will help you decide which services are the best for your business. If your money isn’t where it needs to be, contact your payroll department or bookkeeper — whomever cuts the checks. It might be a problem across the board she is trying to fix, or it could be that somewhere the paperwork got messed up.

The Pros & Cons Of Outsourced Payroll

Lastly, a massive shift toward remote work has had many implications for corporations, one of which is that fewer payroll specialists to go into offices in-person to fill out and mail checks. Freelancers are expected to account for 43% of the labor force by 2023, as workers gravitate toward the flexibility and faster payments that freelancing offers.

What do I do if my direct deposit doesn’t go through?

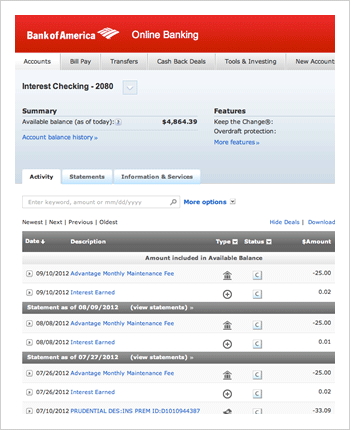

If you discover a scheduled direct deposit doesn’t appear in your bank account, don’t panic. Instead, contact the responsible people at your bank and employer’s payroll department. Banks normally have reliable direct deposit systems that make payments and banking convenient.

ADP is a payroll service used by many businesses to handle the payment of their employees and remains a popular method of such electronic fund transfers. The form must be signed in order for it to be considered a legal document containing the necessary authorization for such transfers. The most common methods of payroll payments to employees are direct deposit, prepaid debit cards or paper check.

What Types Of Payment Can An Employer Use To Pay Employees?

In the fourth quarter, before December 31, you must update missing totals for your employees and run any bonus payrolls. If you have to run an Off-Cycle Payroll after the last day of the quarter, government agencies may charge you with penalties and interest based on their deposit and filing deadlines for taxes. If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date. Any fringe benefit your company provides is taxable and must be included in the employee’s pay unless the law specifically excludes it. The benefit is subject to taxes and must be reported on the employee’s W-2.

These additional benefits have proven to attract strong talent and drive employee productivity. Employers put wages onto a reloadable card instead of cutting a paper check or making a direct deposit to an employee’s bank account.

The company also offers a bonus of two free months of service for new clients. Since a company’s needs are based on its size as well as on the structure of its HR department, ADP services differ from company to company. Every business needs to purchase what it truly needs or wants. The ADP payroll service also includes quarterly and annual tax reporting, as well as filing taxes on your behalf. If you have questions, the company’s professional payroll staff is available 24/7 to provide answers.

Payroll Process For Adp

Both trends offer opportunities for businesses to implement safe and secure digital payroll solutions. But payroll cards are being used by more than just the traditional demographic of the unbanked. In fact, 85% of payroll cardholders have a checking account, using their payroll card for budgetary purposes, spending, and other value propositions rather than as a replacement for a bank card.

Prenoting is a feature I manually select within the Pay Profile when I modify a direct deposit. When you offer pay cards, it’s a major financial benefit for employees who don’t have a checking account. Otherwise, they could be paying $5 or more to cash each paycheck. Employees also won’t have to waste time going to a check cashing service. “Rather than spending their lunch hour running out to cash their check, they can go eat with their coworkers and pick up the bill with the pay card,” says Mavrantzas.

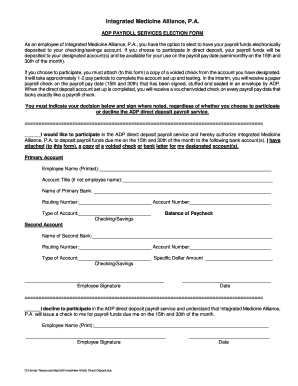

- ADP is a payroll service used by many businesses to handle the payment of their employees and remains a popular method of such electronic fund transfers.

- The form must be signed in order for it to be considered a legal document containing the necessary authorization for such transfers.

- The most common methods of payroll payments to employees are direct deposit, prepaid debit cards or paper check.

- Physical checks can be handwritten or printed and require only that your business have a checking account with a bank.

- The below form, which we have made fillable, can be used to allow the employee in question to authorize Full Service Direct Deposit of all income owed.

- ADP is one of the largest HR and outsourcing services in the world which provides, among many other things, a cloud-based payroll platform.

Physical checks can be handwritten or printed and require only that your business have a checking account with a bank. ADP is one of the largest HR and outsourcing services in the world which provides, among many other things, a cloud-based payroll platform. The below form, which we have made fillable, can be used to allow the employee in question to authorize Full Service Direct Deposit of all income owed. Along with the payee’s signature, they must attach a voided check to the form in order for it to be considered valid. Relying solely on the issuance of paper checks is an inefficient, expensive, and outdated payroll method that fails to meet the needs of today’s workers. As an alternative to check and even bank accounts, a paycard can offer a number of financial wellness tools to help employees manage their money the way they need.

The employee can spend the money straight from the card or withdraw cash from certain banks and ATMs. Most payroll cards don’t require an employee to have a bank account. ADP Payroll services also enable employees to access all of the company data via the mobile app, providing a green solution for companies, as well as a cost savings, by reducing paperwork. Department managers can also easily view basic information for employees in their work group, and can then message them via the app.

How Community Banks Can Prepare For A Likely Increase In Delinquent Payments

Not long ago, physical checks or cash were the only options for paying employees. But today’s employers have many more options to choose from. Before you report costs in the payroll platform, you must first calculate the taxable portion of coverage that exceeds $50,000. To determine this amount, please review Publication 15-B, The Employer’s Tax Guide to Fringe Benefits , as prepared by the IRS, or speak with your company’s accountant. Now I run payroll at a bank, so I don’t prenote because I can see both the ADP account and routing numbers and the employee’s bank account information directly.

“You can’t just give employees pay cards and hope they will figure everything out on their own,” says Mavrantzas. “If an employee makes a mistake and gets hit with an unexpected fee, they might switch back to paper checks, even if the pay card was an overall better option.” U.S. workforce trends have become instrumental in shaping the future of payments. The proportion of financially vulnerable individuals is growing and has accelerated in the wake of increasing unemployment due to COVID-19. For the financially vulnerable that have been able to secure employment, payroll cards can be a valuable alternative to receiving pay via a paper check. After all, direct deposit may not be an option for many workers as 25% of households are unbanked or underbanked. Be sure to report any changes with your first payroll of 2021.

Christmas Day is Friday, December 25 and New Year’s Day is Friday, January 1. If your check dates fall on either of these dates, please adjust them to avoid delaying your employees’ direct deposits and delivery of your payroll package. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checksto begin the Guided Walk Through.

By default, you can enter bank account details for existing banks and branches on the Personal Payment Methods page. Similarly payroll managers, payroll administrators, and payroll coordinators can only enter account details for the employees they handle. If you are considering using the ADP payroll service, but you want to see the program in action before you purchase it, the company offers basic demos of the various packages on its website. You can also get a free quote, based on the package, and a selection of services that you may want to use.

Digital Payroll Solutions To Keep Up With The Future Of Work

Please have this information handy when you call, so we can make more specific recommendations regarding services. You probably already have a checking account, which many would consider their basic “day to day” bank account. You can easily take money out of it to pay bills , and easily put money into it by having paychecks deposited on a regular basis or by making your other deposits.

Wisely™ Pay Paycard is a modern pay solution that helps you move to 100% paperless pay while also providing employees with a flexible paycard or reloadable account pay option. Pay cards are already an attractive option compared to checking accounts, and will only get better as this pay card functionality improves. If you make this payment option available, you may be surprised by just how many employees take you up on the offer. If you set up pay cards, don’t forget about employee training.

In this new environment, giving employees the option to receive their money through pay cards makes a lot of sense. We spoke with George Mavrantzas, Vice President of Strategy and Thought Leadership at ADP, about the benefits of pay cards and how they can replace checking accounts.

Click here for a list of fringe benefit earnings and where they appear on your employees’ W-2s. Federal legislation requires the reporting of both taxable and non-taxable sick payments made to employees from a third party. Taxes withheld on those payments must also be reported. Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party. If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checks, Enter Third Party Sick PayORMaxing Out Retirementto begin the Guided Walk Through. If your check date falls on this date, please adjust it to avoid delaying your employees’ direct deposits and delivery of your payroll package.