Direct Cost Overview, Examples, Tax Implications

Content

If your company develops software and needs specific assets, such as purchased frameworks or development applications, those are direct costs. Because direct costs can be specifically traced to a product, direct costs do not need to be allocated to a product, department, or other cost objects. Items that are not direct costs are pooled and allocated based on cost drivers. Direct costs take many shapes and forms in accounting and managerial discussions. Some examples of direct costs can include the parts and labor needed to build a smartphone or the equipment needed for an assembly line.

![]()

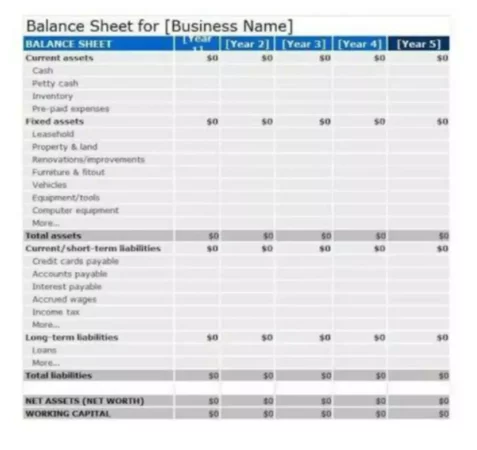

However, the indirect product costs could be direct production department costs. To better understand direct costs, one must thoroughly understand the difference between what constitutes a direct or an indirect cost. The table below can help us to better understand the difference, and how they are, in fact, in many ways similar. Labor and direct materials constitute the majority of direct costs. For example, to create a product, an appliance-maker requires steel, electronic components and other raw materials. Two popular ways of tracking these costs, depending on when your company uses materials in production, are first-in, first-out and last-in, first-out, also known as FIFO and LIFO.

Examples of Direct Costs

Typically, an employee’s wages do not increase or decrease in direct relation to the number of products produced. In order to avoid possible double-charging of Federal awards, the University is required to be consistent in its treatment of each item of cost incurred for the same purpose in like circumstances. However, an expense that would normally be charged as indirect or Facilities and Administrative (F&A) cost can sometimes be charged as a direct cost, depending on circumstances. Direct cost is an accounting term that describes any type of expenditure that can be directly attributable to a cost object. Cost objects can take many different forms, which we will analyze below. More information about the most commonly used types of direct costs can be accessed by following the links to their separate pages in the website navigation.

- Direct costs take many shapes and forms in accounting and managerial discussions.

- A notable exception is direct labor costs, which usually remain constant throughout the year.

- As the item is being manufactured, the component piece’s price must be directly traced to the item.

- When a company accepts government funds, the funding agency may also have several strict mandates in place regarding the maximum indirect cost rate and which expenses qualify as indirect costs.

- Thus, when in doubt, assume that a cost is an indirect cost, rather than a direct cost.

- Costs incurred for the same purpose in like circumstances must be treated consistently as either direct or indirect (F&A) costs.

While direct costs are easily traced to a product, indirect costs are not. Direct cost is a relatively simplistic term and can better be understood by doing a comparative analysis with indirect costs so that we may better understand the difference between the two. By also knowing what constitutes an indirect cost, an elimination process can be performed to determine the direct costs.

How direct costs and indirect costs impact funding for your small business

For example, the cost of an essential component of an item being manufactured may change over time. As the item is being manufactured, the component piece’s price must be directly traced to the item. The other costs of producing the furniture are indirect product costs, since they must be allocated to the furniture based on labor hours, machine hours, or some other activities.

It is almost always used to create a model to answer a question about what actions management should take. It is not a costing methodology for constructing financial statements – in fact, accounting standards specifically exclude direct costing from financial statement reporting. Thus, it does not fill the role of a standard costing, process costing, or job costing system, which contribute to actual changes in the accounting records.

Tracking each type of cost separately can help small businesses understand their cash flow, price their items properly and attain the maximum allowable tax deductions. If you need assistance with breaking down your business’s expenses, contact a professional accountant or choose accounting software that can support your business. Indirect costs include supplies, utilities, office equipment rental, desktop computers and cell phones.

Direct Costs in the Real World: Tangible Examples

LIFO can be helpful if the costs of your materials fluctuate in the course of production. Direct costs are easily traceable to the project or product that they are attributed to. Thus, they are often charged to the product on an item-by-item basis. It makes direct costs easy to categorize and examine for accountants and business professionals alike. For example, if an employee is hired to work on a project, either exclusively or for an assigned number of hours, their labor on that project is a direct cost.

- This cost may be directly attributed to the project and relates to a fixed dollar amount.

- Materials that were used to build the product, such as wood or gasoline, might be directly traced but do not contain a fixed dollar amount.

- A seasonal business, for example, will need to plan to have cash on hand for the busy time of the year.

Fixed indirect costs include expenses such as rent; variable indirect costs include fluctuating expenses such as electricity and gas. You also need to know the difference between direct and indirect costs when filing your taxes. Examples of tax-deductible direct costs include repairs to your business equipment, such as your production line. Tax-deductible indirect costs may include rent payments, utilities and certain insurance costs. It’s important to know the difference between the types of costs because it gives you a greater understanding of your product or service, thus leading to more competitive pricing.

What are direct costs?

The most important thing is to settle on a definition that works for your business, and then apply it consistently. The preceding discussion should clarify that the typical business has very few direct costs. The most common ones are direct materials, freight in and freight out, commissions, and consumable supplies. Smartphone hardware, for example, is a direct, variable cost because its production depends on the number of units ordered. A notable exception is direct labor costs, which usually remain constant throughout the year.

An example is the salary of a supervisor that worked on a single project. This cost may be directly attributed to the project and relates to a fixed dollar amount. Materials that were used to build the product, such as wood or gasoline, might be directly traced but do not contain a fixed dollar amount. This is because the quantity of the supervisor’s salary is known, while the unit production levels are variable based upon sales. Businesses may have different views about whether or not to count workshop or factory expenses as direct costs. They may also disagree about whether or not to count freight and warehousing.

Although the electricity expense can be tied to the facility, it can’t be directly tied to a specific unit and is, therefore, classified as indirect. Direct cost analysis can also be used outside the production department. Based on this information, management may decide that some customers are unprofitable, and should be dropped. Other costs that are not direct costs include rent, production salaries, maintenance costs, insurance, depreciation, interest, and all types of utilities. Thus, when in doubt, assume that a cost is an indirect cost, rather than a direct cost. Indirect costs extend beyond the expenses you incur when creating a product; they include the costs involved with maintaining and running a company.

Often, funding for a specific project will largely support direct costs. Certain government agencies might allow you to explain why indirect costs should be funded, too, but the decision to grant funding is at their discretion. In cases of government grants or other forms of external funding, identifying direct and indirect costs becomes extra important. Grant rules are often strict about what constitutes a direct or an indirect cost and may allocate a specific amount of funding to each classification.

These overhead costs are the ones left over after direct costs have been computed. The following decisions all involve the use of direct costs as inputs to decision models. They contain no allocations of overhead, which are not only irrelevant for many short-term decisions, but which can be difficult to explain to someone not trained in accounting. When a company accepts government funds, the funding agency may also have several strict mandates in place regarding the maximum indirect cost rate and which expenses qualify as indirect costs. For-profit businesses also generally treat “fringe benefits,” including paid time off and the use of a company car, as indirect costs. Using direct costs requires strict management of inventory valuation when inventory is purchased at different dollar amounts.

It’s important to understand how sales create a knock-on increase in costs. A seasonal business, for example, will need to plan to have cash on hand for the busy time of the year. Similarly, a business that’s planning a big sales push will need to ensure they can afford to meet the increased demand. For most small businesses, a direct cost is also the cost of goods sold (COGS) or cost of sales (COS). Understanding your costs will help you effectively price your products for optimal sales. For example, in the construction of a building, a company may have purchased a window for $500 and another window for $600.

The examples show that direct costs can vary based upon the level of analysis. For example, if you are reviewing the direct cost of a single product, the only direct cost may be the materials used in its construction. However, if you are contemplating shutting down an entire company, the direct costs are all costs incurred by that company – including all of its production and administrative costs. The main point to remember is that a direct cost is any cost that changes as the result of either a decision or a change in volume. Direct and indirect costs are the major costs involved in the production of a good or service.