Employee Classification Options

Content

When a company does not retain the right to control and supervise the individual’s time, work performance, method of work, job activities and working conditions, there usually is no employment relationship. In determining the independent contractor issue, courts also often look at whether the individual is truly in business for himself or whether as a matter of economic reality, he or she is solely dependent on the company. Statutory employees are special kinds of workers whose wages are not subject to federal income tax withholding. However, they are subject to Social Security and Medicare and unemployment taxes .

What is the difference between being an independent contractor and an employee?

What’s the Difference Between an Independent Contractor and an Employee? For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes. Employment and labor laws also do not apply to independent contractors.

Worker misclassification is the unlawful practice of labeling employees as independent contractors. Misclassification is cheating because it allows employers to avoid paying benefits , liability insurance, unemployment insurance, and withhold taxes. Most federal and state laws protecting employees do not apply to self-employed, independent contractors.

What Is A 1099 Worker?

A workers compensation classification system is intended to distribute the cost of insurance equitably among employers. The system ensures that employers with high risks of worker injuries pay more for insurance than employers with low risks. If such systems did not exist, all employers would pay the same rate for workers compensation coverage. Employers with low risks of injuries would subsidize those with high risks. Determine your company’s financial ability to hire an employee or a contractor. Employees will be a greater, long-term investment because you will pay for their training, Social Security tax, unemployment tax and the employers’ contribution to their benefits package. Contractors will only cost you the price of the completed job they are hired to do for you.

For example, employees who install roofs are subject to injuries caused by falls, burns, sun exposure, and lifting heavy objects. The types of injuries these workers sustain are relatively consistent from one roofer to another. Thus, all employers whose business consists of roofing installation are assigned to the same workers compensation classification. An employee of an agency, leasing, or staffing company that provides temporary personnel is not normally considered an employee of the worksite employer. However, there are many occasions when the worksite employer is considered a “joint employer” who is indeed responsible for discriminatory or other wrongful acts committed by its supervisors against such employees. Earns wages based on the amount of hours the employee works & earns overtime pay when applicable.

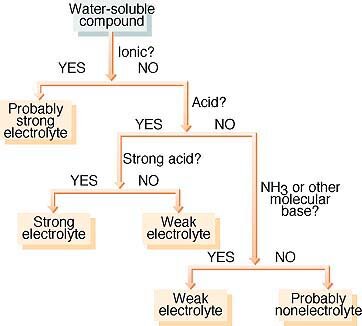

Worker classification determines whether or not the employer has legal obligations under the law for unemployment insurance, worker’s compensation, wage payments, work hours, record keeping and civil rights protections. There are consequences for misclassifying or attempting to misclassify a worker as an independent contractor. The process of assessing whether a worker is an independent contractor or an employee depends on the applicable federal and state laws and the specific context. Failing to follow the appropriate test and misclassifying an employee as an independent contractor can result in violations of wage and hour laws, including minimum wage and overtime regulations.

Businesses normally do not have to withhold or pay any taxes onpaymentstoindependent contractors. The earnings of a person working as an independent contractor are subject toself-employment tax. The Internal Revenue Service reminds small businesses of the importance of understanding and correctly applying the rules forclassifyinga worker as an employee or an independent contractor. For federal employment tax purposes, a business must examine the relationship between it and the worker.

Health And Safety Concerns On The Job

Here are tips on how to classify your employees to ensure fair compensation and avoid pay-related issues. Classification systems are based on the idea that workers employed by similar businesses are prone to similar types of injuries.

A workers compensation classification represents a group of employers that conduct similar types of businesses. Examples of classifications are Dairy Farm and Beauty Supply Store – Wholesale.

Classifying Workers: A Taxing Situation

The company prorates the benefits of regular and temporary part-time employees based on their regularly scheduled hours. Depending on your state, you may need to take into account local laws when determining whether an employee is exempt or non-exempt. Indeed, last year, the California Supreme Court adopted the ABC test, which presumes workers in “gig economy” jobs are employees. On the other hand, statutory non-employees aren’t subject to the same statutes. That means they’re not subject to federal income withholding tax, nor do they qualify for FICA or FUTA taxes. In most cases, employers can treat them as independent contractors for tax purposes.

Like full-time employees, you can pay part-time workers on a salaried or per-hour basis. In most cases, you’ll stick to the same rate of pay for both classifications, but pay part-time employees on a prorated basis. This means that a part-time employee working three hours a week will earn 60% of what you’d pay a full-time employee with the same workload. Not withholding taxes and benefits doesn’t just put an undue burden on employees and contractors. If you “misclassify” a worker and don’t correctly withhold or pay the required amounts, the IRS may flag your business and come after any money owed. If a worker is classified as an independent contractor, you aren’t required to do as much legwork. Independent contractors arrange and pay their own income tax quarterly, aren’t given any benefits, and aren’t eligible for things like unemployment insurance.

Workers who believe an employerimproperly classifiedthem as independent contractors can useForm 8919to figure and report the employee’s share of uncollected Social Security and Medicare taxes due on their compensation. In addition, theVoluntary Classification Settlement Program offers certain eligible businesses the option to reclassify their workers as employees with partial relief from federal employment taxes. Businesses providingemployee-type benefits, such as insurance, a pension plan, vacation pay or sick pay have employees. Businesses generally do not grant these benefits to independent contractors. An employee is generally guaranteed a regular wage amount for an hourly, weekly, or other period of time even when supplemented by a commission.

Making Payroll Is Going To Be Tough For Some Businesses We’re Doing Our Part To Make That A Little Easier.

However, independent contractors are most oftenpaidfor the job by a flat fee. RPT employees can enjoy all the benefit plans of their employers if they meet the requirements.

The IRS Small Business and Self-EmployedTax Centeron the IRS website offers helpful resources. When classifying employees, it is important that the classification in their employment contract tallies with their work duties. If you classify the employee as a full-time staff on paper and their job duties is that of an independent contractor, tax authorities will go with the nature of their work. Making sure employment contracts and duties match can help you avoid job misclassification and potential penalties.

What are employee selection methods?

The methods for selecting employees include preliminary screening, phone interviews, face-to-face meetings, and HR functions to determine whether a candidate is indeed suitable for the job. Small businesses, even if staff resources are limited, should use these steps to choose the right candidate.

The workers don’t have the protection of labor and employment laws or access to employee benefits. However, employers that misclassify either group can be legally penalized. To distinguish employees from contingent workers and their status under the tax code, the guide references the U.S. In a labor market that’s become more complex, employers could have as many as six or seven classifications of workers onboard at any given time. Working alongside full-time, part-time and temporary workers are seasonal and contingent workers. Worker classificationis important because it determines if an employer must withhold income taxes and pay Social Security, Medicare taxes and unemployment tax on wages paid to anemployee.

Independent Contractor Vs Employee: What’s The Difference?

All employers assigned to the same classification pay an identical rate . Under the FLSA, an exempt classification means the employer is not obligated to pay overtime when the employee works more than 40 hours in a workweek. Most employees are classified non-exempt, which means they must be paid minimum wage and are eligible for overtime at one and one-half times their regular rate of pay. Some of the differences between employees and contingent workers remain somewhat unclear. But making an effort to classify both correctly based on the IRS and FLSA’s criteria is a good business practice that can minimize employers’ risk for penalties.

Employment classifications allow companies to compensate employees according to the duties, responsibilities and difficulty of their roles. It is also important for staff discipline, benefits and policy formulation. Proper employee classification can promote good relationships between employers and their staff and help companies abide by labor laws.

Classifying an employee as an independent contractor with no reasonable basis for doing so makes employers liable for employment taxes. Certain employers that can provide a reasonable basis for not treating a worker as an employee may have the opportunity to avoid paying employment taxes. SeePublication 1976PDF, Section 530, Employment Tax Relief Requirements for more information. Your workers compensation premium is calculated by multiplying a rate times your payroll and dividing the result by 100. The rates you pay depend on the classifications assigned to your business and the state in which you operate.

- Failing to follow the appropriate test and misclassifying an employee as an independent contractor can result in violations of wage and hour laws, including minimum wage and overtime regulations.

- There are consequences for misclassifying or attempting to misclassify a worker as an independent contractor.

- Worker classification determines whether or not the employer has legal obligations under the law for unemployment insurance, worker’s compensation, wage payments, work hours, record keeping and civil rights protections.

- Misclassification is cheating because it allows employers to avoid paying benefits , liability insurance, unemployment insurance, and withhold taxes.

- The process of assessing whether a worker is an independent contractor or an employee depends on the applicable federal and state laws and the specific context.

Again, this guide follows federal standards, and wage and hour divisions in state labor departments’ may affect how workers are classified. For instance, California recently passed legislation that enacted the new ABC contractor law. Employees might hire these workers for a set length of time or for a specific task or project. Employers that hire and pay them directly, as opposed to going through an agency, must withhold taxes from their wages or pay a penalty. Temporary employees are entitled to unemployment and Social Security benefits.

Technically, these workers are independent contractors, but special statutes mean they can avoid paying federal income tax. Depending on the position, the employer may also need to provide the newly designated employee with their rightful benefits. While this guide follows federal worker classification standards, wage and hour divisions in state labor departments’ might further stipulate how worker classifications are determined. Therefore, employers also must understand their obligations under their states’ labor laws. Employee misclassification generates substantial losses to the federal government and state governments in the form of lower tax revenues, as well as to state unemployment insurance and workers’ compensation funds. They typically don’t qualify for benefits, although some employers are doing so to attract and retain workers. However, employers must pay the same taxes for employing them as if they worked full time.