Employer Responsibilities In Payroll Under Covid

Content

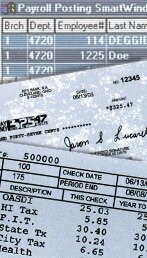

Their advice for me as a self employed and Sole proprietor of my business in Connecticut, was to place myself on payroll and pay CT’s labor taxes. This went on for 2 and a half years until I moved out of the state on 12/31/2019 and had to close my business. Furthermore, ADP was supposed to do my quarterly filings for the year 2019 which they only did the first quarter. I got charged late fees from CT for not filing and in one occasion had my account garnished.As if that wasn’t bad enough, ADP had submitted my SS number incorrectly since the beginning. By the middle of 2019 when I figured out my SS # was incorrect, they tried to charge me to fix it. After proving that my paperwork was correct and the error had come on their end they said “we will take care of it”. Well, they did change my SS # on my paperwork, but they never went back to the previous year and a half to fix their error.

If you owe but don’t pay federal taxes, eventually the Internal Revenue Service will notice. According to NOLO, unlike other creditors, the IRS does not have to get a court order to garnish your wages; instead they may start taking money without a court order, and at a higher percentage than other creditors.

What Is Adp? Breaking Down The Vendors Many Solutions

ADP Workforce Now is designed for businesses with 50–1,000 employees. This product offers a variety of core features beyond just payroll, as well as additional add-on features. When you sign up you can work with an ADP representative to select the features you need, and remove the features you don’t. Among the core payroll features are online processing, automated tax services, new-hire reporting, employee self-service, payroll reporting tools, wage garnishment assistance, and a mobile app. ADP is known to be major payroll service provider in the world but under covered debt collector. There is a lot of manipulation going with court order.

Now I have to prove to CT that my SS is the one I claim it is.I paid a few thousand dollars to this company to run the side of my business I didn’t want to (and didn’t know how to) run. Martin Brook focuses his practice on representation of employers before state and federal courts and administrative agencies and advising employers on litigation avoidance and positive employee relations. For these reasons, it makes a lot of sense to find a good small business payroll serviceprovider to help you manage your payroll. Payroll software is capable of automating a lot of the tasks required for payroll, including calculating payments, withholding taxes, and depositing wages into your employees’ bank accounts. Unlike child support orders, student loan garnishments have been put on pause pursuant to a U.S. Department of Education directive effective March 13, 2020, which authorizes immediate suspension of garnishments for federal student loans for at least 60 days.

This plan comes with ADP’s core payroll processing features, including tax calculations, withholdings, and filings. You’ll also get check delivery, access to reporting features, integration options, new-hire reporting tools, yearly W-2 and 1099 delivery, and account access for your employees to view their paychecks and update tax information. Once all this information is entered, you are ready to begin processing payroll.

Adp Payroll Top Alternatives

It has taken a week to receive a response to emails, difficult to reach our sales person unless you call or text them directly. Many times I have been on hold for 30 minutes and my employees too, to get a question answered. They even canceled one of my employees health benefits for turning in FMLA paperwork late – the guy was in a coma due to COVID, he couldn’t fill out the paperwork. Everything is done via email and some of our employees are not overly computer savvy. We were quoted $179.86 monthly for 11 employees for payroll and HR Plus; that is a $10 per-employee fee in addition to payroll fees. (The company charges a fee each time you run payroll with ADP software.) There is also a $25 setup fee that is usually waived with a contract. All quotes are customized per your business location, number of employees, frequency of running payroll, etc.

The order will require the employer to withhold and send the amounts deducted to Fiscal Service for payment to the federal agency. I have used ADP Run for years and it’s very easy to use and have had no issues until COVID and then it involved being on hold for long periods of time to get a question answered from customer service. Workforce Now is cumbersome and very difficult to use. Previously using ADP Run it would take me about 15 minutes to process payroll. Using Workforce Now it usually take me an entire day.

Wage Garnishments Integrated With Your Existing Payroll Systems

If you have massive debt, one way the court gets the money you owe is wage garnishment. In this case, the court orders a certain amount of money to be removed from your paycheck – before you get it – for a variety of reasons, whether to pay back taxes, for child support or for other reasons. In these situations, it’s best to have legal representation to know your rights and options. ADP helps companies manage payroll, employee benefits, taxes, retirement and other services. The company has solutions for small, medium, large and multinational businesses. Its specialists work with businesses to reduce costs and develop human resources strategies that align with the business’s goals.

How long does it take for a garnishment to stop?

A garnishment judgment will stay on your credit reports for up to seven years, affecting your credit score. But there a few easy ways to bolster your credit, both during and after wage garnishment.

However, before garnishment, the IRS will offer a variety of options to allow you to pay off your debt. When that misfortune involves financial difficulties, things become complicated.

When the next pay period comes, log into your account dashboard and select the “Run Payroll” option. From here you can view employee time cards and make any manual adjustments. Each employee’s pay should calculate automatically based on the information provided in their profile. The software also calculates deductions for things like tax, health benefits, and retirement contributions.

Does automatic stay stop garnishment?

However, you should be aware that bankruptcy will not help stop garnishment of child support or other non-dischargeable debts. Once you file for bankruptcy, an automatic stay will go into effect. This stops most collection activities, including wage garnishments, as long as the stay is in effect.

Wage garnishment is the name given to the legal proceedings in which an employer is required by court order to withhold a portion of an employee’s wages in order to pay back a debt. Wages may be garnished for debts including child support payments, unpaid income taxes, defaulted student loans, credit card debt, outstanding medical debt, etc. In addition to wages, commissions, bonuses, and retirement or pension income may also be subject to garnishment. Employers can face a difficult and sometimes uncomfortable task complying with wage garnishment mandates while balancing sensitivity around challenging circumstances affecting your employees. Paycor helps you navigate these complex circumstances and ensure compliance with our online payroll platform and wage garnishment processing service that creates, calculates, deducts and disburses garnishments on your behalf. Wage garnishments are court-ordered deductions taken from an employee’s pay to satisfy a debt or legal obligation.

All churches were forced to use ADP for payroll services in January 2018. ADP continually charges fees for services not provided such as courier services and unexplained services . They charge $200 in late fees if payroll is submitted after 3pm even if payroll turned in 7 days early. Fees are automatically taken out of our checking account without review and agreement of fees being accurate.

Explain Hris Payroll Systems

The directive further instructs private collections agencies to halt proactive collective activities, which could encompass issuing new administrative wage orders for garnishment. In a set offrequently asked questions, the DOE advised employees to contact their employers’ human resources departments if an employee’s wages continue to be garnished after March 13, 2020. After the initial 60-day hiatus, according to the FAQs, the DOE may extend the order, informing that the loan service provider will communicate with the borrower about resuming payments after the period ends. Tax Debts – The second largest reason for wage garnishments, according to ADP, is tax debt.

In both cases, ADP garnished my wage without my knowledge using unverified court documents. Now I am learning that ADP does Debt collection without employee knowledge regardless of any authenticity. There is conflict of interest doing payroll services and debt collection under the same company by the name of ADP garnishment. This is heads up for employer and victim employees by ADP payroll services. I suggest employer to try different alternatives in order to retain employees. As a small business owner, paying ADP for advice and payroll services was the worst decision of my entrepreneurship. From a Small business owner I would like to warn other new entrepreneurs to avoid this company.

I have opened multiple tickets for review and resolution, and it’s to no avail. I can’t understand how a payroll company and the archdiocese can agree to giving direct access to a church’s bank account to allow and support billing errors. Our company chooses to use ADP to complete payroll services, with the new update we have experienced numerous issues. Every time that support is contacted to resolve these issues the representatives are very sarcastic and rude. It seems pretty clear that they do not care about their customers OR how they speak to them.

- When you sign up you can work with an ADP representative to select the features you need, and remove the features you don’t.

- This product offers a variety of core features beyond just payroll, as well as additional add-on features.

- ADP is known to be major payroll service provider in the world but under covered debt collector.

- Among the core payroll features are online processing, automated tax services, new-hire reporting, employee self-service, payroll reporting tools, wage garnishment assistance, and a mobile app.

- ADP Workforce Now is designed for businesses with 50–1,000 employees.

- There is a lot of manipulation going with court order.

If everything looks good, select “Approve” to run payroll. Fiscal Service, on behalf of a federal agency, may issue a wage garnishment order to a non-federal employer to collect a delinquent federal non-tax debt.

Child support, unpaid taxes or credit card debt, defaulted student loans, medical bills and outstanding court fees are common causes for wage garnishments. Garnishments are typically a percentage of an employee’s compensation rather than a set dollar amount. Square Payroll offers a suite of payroll and tax administration features for your business. Square Payroll lets you to pay a variety of workers, from contractors to employees, while allowing for benefits distribution, direct deposit, timecard syncing with the Square POS software, and tips distribution. It can be a flexible solution for your business, and customers frequently praise it for being user-friendly. Essential Payroll is ADP’s basic payroll solution for small business.