[2020] Families First Coronavirus Response Act And Adp Run 2020

Content

Employees can log in to the system and enter their timecard information, hours and any other relevant payroll information. This data is automatically uploaded to your paydata grid. You can get into the system and manually correct or adjust any data as needed. This process saves a lot of time and limits mistakes due to data entry errors. Add additional checks for bonuses, commissions, retroactive pay or advance pay. Select the employee for whom you want to create the additional check.

If you are unsure which rule to select, contact your ADP Time & Attendance Representative. If the employee’s payroll company code needs to be changed or added, click the button next to the Payroll Company Code field, and then select the appropriate payroll company code. If no labor charge field values are selected, each employee’s default values are used. If you want to assign a specific earnings code to the Row 1 time pair, click the button in the Earnings Code field and select the appropriate code from the lookup window. If no code is selected, each employee’s assigned earnings code is used. Like holiday qualification rules, holiday distribution rules are created and maintained for your company by ADP, but you must assign every holiday you create to a holiday distribution rule.

Click on the “save” button frequently to save data you have entered. When you are done, click on the “done” button.Enter the number of overtime hours in the “O/T Earnings” column. Your place of business and where your employees perform services also play a factor in payroll deductions because not every state collects income tax. If the employee’s wage rate program needs to be changed or defined, click the button next to the Wage Rate Program field, and then select the appropriate wage rate program. If the employee’s payroll ID needs to be changed or defined, delete the current ID in the field from the Payroll ID field and enter a new ID. Your payroll processing program uses this ID to identify the employee.

If this option is selected, the holiday is awarded (entered on employees’ timecards) when it first falls in either the current or next pay period. If this option is not selected, the holiday is not awarded until the actual day of the holiday. This step allows you to verify the accuracy of the payroll once it’s been calculated. In the Payroll Cycle window, click on the “Preview Results” icon.

If you do not enter a wage rate in this field, the application uses the wage rate program defined in the employee’s pay class. ezLaborManager always attempts to use the wage rate program that you enter in this Wage Rate Program field first. If you do not define a wage rate in this field, the application then uses the wage rate program defined in the employee’s pay group.

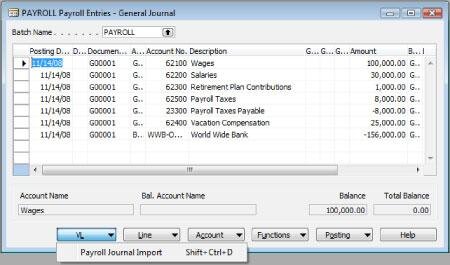

Run Powered By Adp®: A New Integration With Payroll And Quickbooks Online

You will enter the rate for the payroll adjustment below. Each holiday defined within a holiday program is tied to a holiday qualification rule that specifies what conditions an employee must meet in order to be paid for the holiday. For example, your company may elect not to pay employees for a Monday holiday if the employee does not work his/her regularly scheduled shift on the previous Friday. Your ADP Time & Attendance Representative has created holiday qualification rules that reflect your company’s holiday policies. You cannot edit these rules, but you must assign every holiday you create to a holiday qualification rule. As a practitioner, you can create and edit holiday programs for your company. A holiday program is a series of specific holidays for which your company awards holiday pay.

The calculations can be done manually or you can automate the process using a payroll service provider. Many businesses choose automation because it reduces errors and ensures that payments are filed with the proper authorities on time. To add or change the employee’s payroll company code,click the button next to the Payroll Company Code field then select the appropriate payroll company code. If your company uses wage rate programs, click the button next to the Wage Rate Program field, and then select the employee’s wage rate program. If you want to assign a specific lunch plan to the Row 1 time pair, click the button in the Lunch Plan field and select the appropriate plan from the lookup window. If no lunch plan is selected, each employee’s assigned lunch plan is used. Payroll adjustments never use rates defined in the employee record, earnings code, job rate, or other areas of the application.

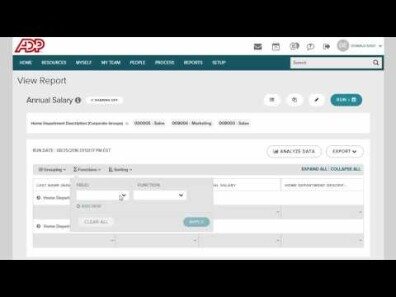

Automating Paydata Entry

You also associate the holiday with a holiday qualification rule and a holiday pay distribution rule. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period. Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your employees or a court order.

- Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

- You must assign a holiday pay distribution rule to each holiday.

- Then click “Enter Paydata” and select “Paydata” from the popup menu.

- Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements. You must assign a holiday pay distribution rule to each holiday.

The Time & Attendance module always attempts to use the wage rate program that you enter in this Wage Rate Program field first. If your company pays premiums for certain shifts, click the button next to the Shift Rule field, and then select the employee’s shift rule. Lunch plans are configured and assigned to employees by ADP ezLaborManager representative according to your company’s lunch policies. If you are uncertain whether a lunch plan should be specified, or if you do not know which plan to select, contact your payroll administrator or ADP ezLaborManager representative. you can create recurring schedule templates for your company. A recurring schedule template is a predictable, repeating, weekly or multi-week schedule that administrators and supervisors can use to quickly assign employees to common schedules. At a minimum, a recurring schedule template defines employee in and out times for each day during the recurring schedule.

Payroll Deduction Faqs

Also, employees set up for Automatic Pay automatically receive a paycheck. However, sometimes you need to make one-time changes. Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period. Hours.” Enter the number of regular hours each employee worked. The system will automatically calculate the gross salary, deductions and net salary for the pay period.

If your business has more than one company that processes payroll, confirm the correct company code. To change the company code, click on the magnifying glass icon and select the correct company code.If you don’t have more than one company, do nothing. There are many different payroll software companies you can use to process payroll but ADP does an exceptional job at helping your company process payroll. ADP can help payroll professionals grow along with company changes. They can also help payroll professionals stand out as people that employees, managers and department heads trust to get their pay checks right.

Information for that employee’s regular pay for this pay period is already entered. Now, enter a second row for that employee to create a new check. Click on “insert” and select “new row.” A second row will appear with the same employee name. Now you can enter paydata for the additional check.Enter the tax frequency information, which calculates taxes based on the type of pay. For example, bonuses are taxed at different rates than regular pay. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input.

A recurring schedule template can also specify an earnings code, lunch plan, shift rule, and up to two labor charge category values for each regularly scheduled time pair in the template. The Hours field will be calculated automatically. If the adjustment is to correct an overpayment, enter a negative value in the Dollars field. The payroll adjustment does not use the rate from the earnings code to calculate the amount of the adjustment. The earnings code you select is only used for record-keeping purposes.

Post-tax LTD deductions, on the other hand, result in employees receiving slightly less take home pay each pay period, but their benefits aren’t subject to any further tax if they use them. Short-term disability is often taxed in the same manner. If your employees are unionized, they’ll likely have to pay for their membership and any taxable benefits offered through the union. Other types of job expenses that can be deducted from payroll include uniforms, meals and travel. Some states, however, may prohibit these kinds of deductions. Statutory deductions are mandated by government agencies to pay for public programs and services.

The long-term disability deduction covers a percentage of wages for employees who are injured or too sick to work for an extended period of time. When LTD is deducted pre-tax, employees pay slightly less for premiums, but are charged federal income tax on any benefits received.

As a practitioner, you can add holidays to existing holiday programs. When you add a holiday, you define how the date of the holiday is determined and when the holiday is awarded.

This rule specifies which labor charge categories and earnings codes holiday pay is charged to and how many hours of holiday pay employees receive. Like holiday qualification rules, holiday distribution rules are created and maintained for your company by ADP.

This is ADP’s time management and attendance software. You can purchase it with your ADP software package.

If you enter a value only in the Dollars field, a flat monetary adjustment is made without using a rate. Payroll adjustments can have negative or positive values. They are positive if you are correcting an underpayment and negative if you are correcting an overpayment. To create a negative payroll adjustment, enter a negative value in the Hours or Dollars field.

You can create multiple holiday programs to be assigned to different groups of employees . For example, if your company has employees who work in two different countries, you may need to create separate holiday programs that include the national holidays for each country. Only one holiday program can be assigned per pay group, so each holiday program must contain all of the holidays that apply to the pay groups that use that holiday program. Once a holiday program has been created, you can add and deleted specific holidays within that program or make changes to the definition of each holiday. In the Holiday Pay Distribution field, click the button and select the appropriate holiday pay distribution rule from the lookup window.

You can review total payroll information for the entire company. Also, you can drill down to verify payroll information by department or for individual employees.If you find incorrect information, click “Make Corrections” and edit the payroll batch. Then you will have to go back to the previous step and recalculate the payroll, and then run “Preview Results” function to verify the payroll once more. This is the process for entering data for your salaried and hourly employees who are not set up for Automatic Pay. You enter paydata in batches, which are groups of employees. You can use previously-created batches, or you can create and customize new batches.Click on “Process” in the task bar at the top of the page. In the pop-up menu, under “Payroll,” select “Payroll Cycle.” You will be directed to the Payroll Cycle page.

![[2020] Families First Coronavirus Response Act And Adp Run 2020](https://adprun.net/wp-content/themes/adp/img/logo.jpg)