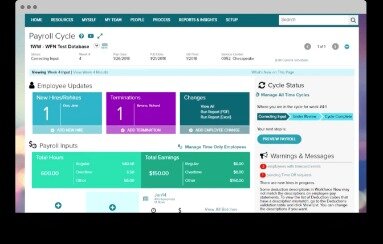

Adp Workforce Now Reviews & Ratings

In many cases, payroll is handled by the accounting department of a business. Small-business owners may also choose for payroll to be managed directly in-house or by an associate. Mid-sized companies and larger may benefit from additional services. Its time and attendance option includes basic tools for full workforce management. For talent management, it offers recruiting, hiring, management and growth services. Its employee benefits packages include benefits administration, retirement, group […]