Film Industry Music Broadcasting

In addition to budgeting software, production accountants will often have to know entertainment payroll softwares, like Wrapbook. Technically, a production accountant is an entertainment accountant by nature, but the reality is that there’s a huge variety of accounting jobs in the entertainment industry as it exists today. Statement 53, titled “Financial Reporting by Producers and Distributors of Motion Picture Films,” was issued in December 1981.

Accounting and Budgeting Software

Financial reporting consolidation is crucial for success in any of these scenarios because it improves operational management. Anousha Sakoui is a former entertainment industry writer for the Los Angeles Times who covered topics such as labor and litigation in Hollywood. She has been a journalist for over 20 years, having joined The Times in 2019 and reported for the Financial Times, Wall Street Journal and Dow Jones Newswires, Bloomberg News and Businessweek Magazine. Times your questions about breaking into and working in the entertainment industry.

Payroll Estimator

Technological advancements introduce new distribution models and constantly changing consumer preferences and behaviors. Balancing digital production, strict deadlines, and digital privacy against an unpredictable market is crucial. Professional entertainment industry accounting and advisory services can keep you ahead of the curve if you aim to manage your company’s finances efficiently and effectively.

Projected Revenue Accounting

We work closely with you and your representation to manage your ongoing financial responsibilities and achieve your goals. This includes paying bills, managing cash flow, budgeting, bookkeeping, tax planning and preparation, administering payroll, wealth management and more. During film production, accountants generate several important financial reports. These include budget-to-actual analyses, cash flow statements, cost reports, and final cost projections.

Consider pursuing a bachelor’s degree in one of these fields to gain the necessary knowledge and skills. A chart of accounts for accountancy for entertainment industries is a list of all the financial statements like assets, liabilities, income and expenses of production, venue rental, and rehearsal in a company’s general ledger. The Chart of accounts for accountancy for the entertainment industry is a management tool that breaks down a company’s financial transactions into smaller, more manageable chunks throughout a particular accounting period. In the fast-paced world of the entertainment industry, businesses face new and daunting challenges.

- It’s paramount that a production accountant be familiar with both the process of bookkeeping and the underlying theory of accounting, but they don’t need to learn about either one in a formal classroom setting.

- The next step is first assistant accountant, who tracks and manages daily spending on such things as labor, petty cash and per diem expenses, while also dealing with vendor costs, such as for materials, locations and stages.

- Film production is a complicated process that requires a lot of moving parts to come together very quickly and, later, break apart just as fast.

- The same film production company carries out the second level of accounting and pertains to production costs.

- Their presence offers a clear benefit to any crew and, in a perfect world, no production would be without one.

- We work closely with you and your representation to manage your ongoing financial responsibilities and achieve your goals.

Skills Required for a Career in Film Production Accounting

The same film production company carries out the second level of accounting and pertains to production costs. It’s crucial to keep these expenses distinct from the rest of the budget when assessing the financial trajectory of your film project. We also assist with certification applications and post-wrap reporting, including preparing tax returns and supporting documentation to claim tax credits. In today’s digital age, accounting software specifically designed for the film industry simplifies and streamlines the accounting process. These software solutions help manage budgets, track expenses, generate financial reports, and facilitate collaboration among the production team.

In any professional field, an accountant is an individual hired to maintain and communicate financial records. And while that description may sound simple, it implies a huge range of potential tasks that might include anything from basic small business bookkeeping to auditing the many income streams of a major corporation. In this post, we’re diving deep to get the answers you need, as we break down the 21 most asked questions about production accountants.

By collaborating with department heads and producers, accountants contribute to the efficient allocation of resources and help maintain financial discipline throughout production. Film producers will tell you that there’s no typical day in the job — and there’s no single path to becoming a producer. But there are traits you can develop and entertainment industry paths to follow that will set you up for a career in Hollywood. Typically, the assistants supporting the production accountants start at approximately $1,000 per week and can earn up to $3,000 per week, according to Wagner. The next step is first assistant accountant, who tracks and manages daily spending on such things as labor, petty cash and per diem expenses, while also dealing with vendor costs, such as for materials, locations and stages. It includes courses that teach basic accounting principles and an introduction to the different needed skills, including how to do budgeting and scheduling for the movies.

A production accountant may need to coordinate with studio representatives, payroll companies, and even other department heads on occasion. In the initial year, a film production company usually cannot write off the cost of production. Hence, these entities employ projected revenue accounting, where assets that the IRS identifies as suitable are considered. Such intellectual property includes book patents, copyrights, movies, videotapes, and sound recordings.

Outside of Room Tone, the professional organization that every production accountant should check out is the National Association of Production Accountants. The truth is that, like nearly every job in the entertainment industry, there is no straightforward path to entry. You have to acquire the basic skills any way that you can (whether it be in a class or on the job), then demonstrate them publicly any way you can (usually, on the job). Accounting jobs in the entertainment industry are some of the only entertainment jobs anywhere that don’t necessarily require CPA status.

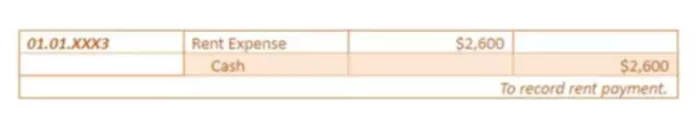

Accounting services customized for the entertainment industry including royalty tracking and tour accounting. According to double-entry accounting, each expense entry must have a debit and a credit and may pay for business costs with cash or a credit card. Any written reports must have invoices, account receivables information, or other payment documentation. The paperwork must also include the transaction’s date, the account’s number, title, purchase price, and a short outline. Debits are therefore listed first, followed by payments, in decreasing order of balance. These are costs paid to actors, directors, producers, and others who have negotiated contracts that allow them to participate in a film’s profits.

Learning the inner workings of each department on a film set is an important foundation for a production accountant. So opportunities abound for people with an interest in and an aptitude for budgets and filmmaking. And the good news is, you don’t need to be a certified public accountant to get into this lucrative role. Efficiently manage your finances and increase wealth with our accounting solutions for actors.

Beauty may be in the eye of the beholder, but even the blindest of beholders could see why the right kind of person might be attracted to the role of a production accountant. A far cry from the dry, number-crunching slog that many envision, production accounting can be a gig with high pay, high importance, and its own brand of thrills and chills. Every production and its corresponding accountant will have its own tried and true accounting software. Many accountants use Quickbooks, in which you can easily add accounting codes to every line item expense and realize budgets.