Find Transposition Errors Before They Turn into a Bigger Issue

You will now investigate every ledger account balance in which the difference between the first and second digits of the balance is X. Mistakes happen, especially when it comes to recording transactions in your books. One type of accounting mistake that’s easy to make transposition errors is a transposition error. Read on to learn what is transposition error and how it can affect your accounting books. However, software like QuickBooks has made it much easier for business owners to keep track of their entries, making reconciliation much more painless.

If anything from the bookkeeping basics sticks with you, it’s that accounting is all about debits and credits. Every transaction must have at least one debit and one credit, and the sum of debits and credits must always be equal. A trial balance lists all of your account balances to prove that your debits equal credits.

Double Entry Bookkeeping

They are usually made unintentionally (intentional errors can lead to criminal investigation). You should perform reconciliations on a monthly and yearly basis, depending on the type of reconciliation. Bank reconciliations can be done at month end while fixed asset reconciliations can be done at year end. Now let’s pretend you go to invoice the customer for the Accounts Receivable above.

Then ask, “Is it part of accrued revenue, accrued expense, deferred (unearned) revenue, or deferred (prepaid) expense? ” Once those steps have been discovered, an adjusted journal entry is created to fix it. After I finish processing all the invoices, I produce an accounts payable aging report for your review. Being the diligent business owner you are, you check my work before paying bills. You notice the energy bill says $105, but the aging report reads $150. The following example shows how to tell if there is a transposition error.

Entry Reversal error

After a week’s vacation, I come back to see a pile of bills on my desk that I need to process immediately. In my fatigued stupor, I open the accounting software and start charging through the bills. I get through them as fast as possible because my coworker said there are powdered doughnuts in the kitchen.

- This is common when there are many invoices from vendors that need to be recorded, and the invoice gets lost or not recorded properly.

- An error of original entry is when the wrong amount is posted to an account.

- Look for these warning signs when searching for transposition errors in your books.

- Rounding a number off seems like it shouldn’t matter but it can throw off your accounting, resulting in a snowball effect of errors.

- Compensation errors, while uncommon with automated tools like QuickBooks, do happen.

- Entry reversal has the potential to turn your checks and balances upside down.

A bank reconciliation is a comparison of a company’s internal financial records and transactions to the bank’s statement records for the company. Bank reconciliations help you identify transposition errors before they cause further problems for your business. A bank reconciliation compares your accounting records to your bank statement. During the process, match every transaction to source documents, such as receipts and invoices. A trial balance is a report businesses use to catch accounting errors. If they are unequal, you can go back to your journal entries to find where the error originates from.

Error signs

It allows you to validate all the information on your books, sort of like a double-check before closing. Making any changes to this data after the close date could result in major problems for future closing and your financial statements. For example, posting a new transaction on your books after the closing date requires you to repeat the closing process again. Usually, this mistake isn’t found until you do your bank reconciliation.

It goes without saying that over or under-compensation doesn’t look good on the books, but it’s also not good for rapport within your organization. Employees want to trust they will be paid correctly and on time from your company. Too many incidents like this may create distrust in your accounting system. In fact, a survey by QuickBooks showed that 1 in 6 small business employees said a single inaccurate paycheck would make them quit their job.

Error of Entry Reversal

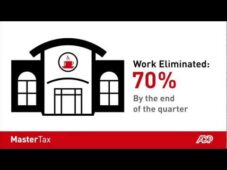

The trial balance is a type of worksheet that accountants use to record the debit and credit entries. The totals from the trial balance are later carried over onto the financial statements at the end of the reporting period. However, there are instances where accounting errors exist, but the trial balance is not out of balance, which can be more difficult to identify and fix the errors. Monthly bank reconciliation can help to catch errors before the reporting period at the end of the quarter or fiscal year.

- The error of principle can take some investigation to discover, but it can often be found right before the release of the final financial statements for the quarter.

- There are numerous types of accounting errors, and some of the most common mistakes are listed below.

- Error of duplication is when an accounting entry is duplicated, meaning it’s debited or credited twice for the same entry.

- Let’s say you reverse the numbers of an employee’s hourly rate while entering information into your payroll software.

For example is cash received of 3,000 from Customer A is credited to the account of Customer B the correcting entry would be. To correct an erroneous transaction, you’ll need to record an additional transaction involving the same accounts. Find the difference between total debits and credits, add 1 to the first digit of the difference, and you have an amount we will call X.