For Painters: Accurate Bookkeeping and Accounting

In the business world, a company or enterprise that’s not growing and it’s stagnant can be considered a dying business. This means that you need to be on top of your bookkeeping to avoid the recipesand other paperwork from piling up, ultimately forcing you to spend days inputting the data onto your books. This means that you need to be on top of your bookkeeping to avoid the receipts and other paperwork from piling up, ultimately forcing you to spend days inputting the data into your books.

Tax Reduction & Preparation

Two of the most common are single-entry bookkeeping and double-entry bookkeeping. PCA is the only trade association dedicated to the success of painting contractors. PCA offers its members many opportunities to develop and grow through participation in educational programs, attendance at networking meetings, use of PCA Industry Standards and much more. In conclusion, bookkeeping may not be as glamorous as wielding a paintbrush, but it’s just as crucial to the success of your painting business. For those who’d rather focus on their artistry, we’ll discuss when it’s time to bring in a professional bookkeeper to manage your finances. We’ll keep in touch consistently with accounting updates tailored for your painting business.

Job Costing

This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable. Please consult with a tax professional or bookkeeper to make sure you are taking advantage of all possible deductions. At Bookkeeping For Painters, we’re committed to providing unparalleled quality when it comes to every aspect of our services. Because of this, it is extremely important to us that we pay our employees a living wage. We believe that by paying our employees well, we lay down a foundation of mutual respect. We assign a Dedicated Account Manager to every client to ensure personalized service and attention.

Perform A Thorough Business Analysis

This section explores how to categorize and track your income and expenses efficiently. This allows us to attract and retain top-notch talent so that we can always provide an unmatched level of service. We are real people that take care of our team so that they can focus on taking care of you. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals. If you’re organized and enjoy working with numbers, a job as a bookkeeper could be a good fit. In this article, you’ll learn more about what bookkeepers do, why they’re important to a business, and how much they earn.

Senior Software Engineer jobs

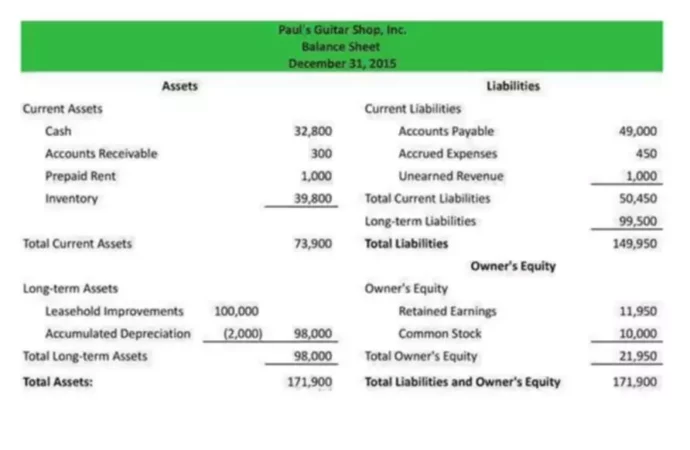

Bench is well-versed in the nuances of the painting industry—making it an ideal partner for painters looking to focus more on their craft and less on managing their books. We grasp the complexities of income from contracts and the proper categorization of materials and labor costs—allowing you to rest easy knowing you’re compliant with IRS guidelines. Painters, like other small businesses, need accurate profit and loss statements, balance sheet reports, and other types of financial statements to steer their businesses, particulary in the off-season. We also ensure that your expenses are categorized properly to maximize your tax deductions—ultimately aiding you save money. We make painting business bookkeeping and tax stress-free, leaving you with ample time to focus on bringing an added pop of color into your clients’ lives. Also, it is good to know that Less Accounting offers a simple accounting software too.

- Do not let any of these important dates catch you by surprise, that way you can continue running your business without any major hiccups.

- Two of the most common are single-entry bookkeeping and double-entry bookkeeping.

- While bookkeepers used to keep track of this information in physical books, much of the process is now done on digital software.

- When the time of filing taxes arrives, small businesses that have organized books containing everything that is happening in the business can manage their taxes effortlessly.

- You can benefit from both services at once to focus more deeply on your painting business, rather than worrying about myriad bookkeeping tasks.

Bookkeeping For Painters has solid client relationships and industry-specific knowledge that painting business owners need to succeed. We provide accounting, bookkeeping, as well as tax and advisory services for painting business owners. Bookkeeping is the process of keeping track of a business’s financial transactions. These services include recording what money comes into and flows out of a business, such as payments from customers and payments made to vendors. While bookkeepers used to keep track of this information in physical books, much of the process is now done on digital software.

You need to keep an eye on the cash flow constantly to maintain the healthy financial status of the painting business. Sending invoices allows the bookkeepers to bill the customers fast for the work that has been done for them. You should try to manage the process of sending invoices efficiently, as the faster you send invoices to your customers, the sooner you can receive your money to cover expenses. In this article, we are going to learn about some bookkeeping tips a painting business owner needs to know to avoid financial mistakes and enhance the profitability of their business.

Remember that the right bookkeeping software can be a valuable asset in managing your painting business’s finances efficiently and accurately. Before we dive into the intricacies of bookkeeping for painters, let’s define what bookkeeping is. Bookkeeping is essentially the art of recording and organizing your financial transactions. As a painting business bookkeeper, one of your major tasks is to record and classify every transaction that your business makes. You need to have confidence in knowing meticulously where the money is flowing toward your company bank accounts, and where this money is being used for.

Our team of Enrolled Agents has expert knowledge of both tax code and painting businesses to maximize your tax deductions. Bookkeepers manage a company’s financial accounts, ensuring they are accurate and easy to review. Their work plays an important role in the operation of a successful business, which can have very many transactions in a single day, let alone a week, month, fiscal quarter, or year. Discover strategies to maintain a healthy cash flow and keep your business solvent. It involves keeping a detailed record of all the money that flows into and out of your painting business.

Remember, your painter’s ledger is not just a financial record, but a tool to help you make informed business decisions. By setting it up correctly and maintaining it diligently, you’ll have a clear picture of your financial health and be better equipped to steer your painting business towards success. Sometimes it is tempting to use your personal bank account for your painting business too, but it is always suggested that you keep your personal and business money separated. Our platform enables painters to automate data inputs from most major suppliers, helping to prevent common errors. We collaborate with vendors like Gusto, Stripe, Shopify, and Square—ensuring your financial records are always precise.

Bookkeepers are integral to ensuring that businesses keep their finances organized. If you’re interested in a career as a bookkeeper, consider taking a cost-effective, flexible course through Coursera. At the end of the course, you’ll receive a professional certificate, which you can put on your resume to demonstrate your skills and accomplishments to potential employers. An accountant can certainly perform bookkeeping tasks, but the title generally involves other responsibilities as well.

Be aware of tax and other business-oriented deadlines so you can plan accordingly. Do not let any of these important dates catch you by surprise, that way you can continue running your business without any major hiccups. Making sure that you have the funds to pay for taxes, whether you are doing it quarterly or yearly, is a really smart plan. This will help you not get caught by surprise when you need to pay taxes and you don’t have the money to cover them. Keeping your books organized and in good standings make audits easier, not only for you, but for the entity performing the audit.