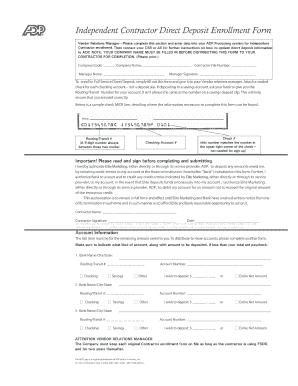

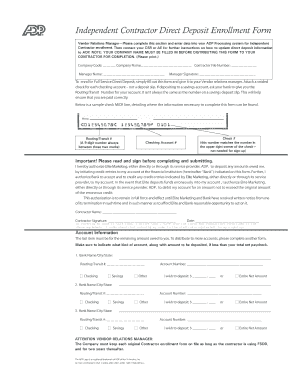

Free Adp Direct Deposit Authorization Form

Content

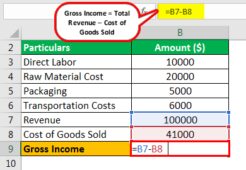

Setting up direct deposit for an employee’s final wages tends to be easier than arranging for the employee to pick up his/her final paycheck or mailing it. The time and money spent on printing, mailing, reconciling, and reissuing paper paychecks can add up. Going paperless eliminates the need to hand out paper checks or wait for payroll delivery. As long as you transmit your payroll 2 banking days prior to the paycheck date, direct deposits are made available to the receiving bank as of 5 pm PT on the paycheck date. However, if the paycheck date falls on a non-banking day, direct deposit paychecks will be posted on the next banking day. SignNow’s web-based service is specifically created to simplify the management of workflow and enhance the entire process of proficient document management. Use this step-by-step guide to complete the Adp direct deposit form 2017 promptly and with perfect accuracy.

Due to the fact that many businesses have already gone paperless, the majority of are sent through email. That goes for agreements and contracts, tax forms and almost any other document that requires a signature. The question arises ‘How can I e-sign the adp direct deposit form 2017 I received right from my Gmail without any third-party platforms? ’ The answer is simple – use the signNow Chrome extension.

The form must be signed in order for it to be considered a legal document containing the necessary authorization for such transfers. Department managers can also easily view basic information for employees in their work group, and can then message them via the app. Direct deposit allows employers to electronically transfer employees’ net pay into their bank accounts. This eliminates the need for employees to receive a paper check and can help employers save money. But, can you require employees to enroll in direct deposit? Below we answer this and other common questions about direct deposit.

If you have questions, the company’s professional payroll staff is available 24/7 to provide answers. Direct-deposit payments are handled electronically. Paper checks will be delivered to your office for delivery on the next pay day. To run payroll, start by reviewing all of your employee hours. If you utilize the Time and Attendance component, employees can log in from their smartphones, and the data will automatically be added to the company’s payroll files. As a cloud-based program, there is no physical software to purchase and install on your system.

Now I run payroll at a bank, so I don’t prenote because I can see both the ADP account and routing numbers and the employee’s bank account information directly. Prenoting is a feature I manually select within the Pay Profile when I modify a direct deposit. At our company we always do no prenote so the responsibility is on the employee to input their direct deposit information correctly. If they put their direct deposit in wrong, then they get paid a few days late via a paper check and we ask them to fix their direct deposit. It’s good to call your bank and let it know what’s going on.

With signNow, it is possible to e-sign as many papers in a day as you need at an affordable price. Start automating your signature workflows right now. Mobile devices like smartphones and tablets are in fact a ready business alternative to desktop and laptop computers. You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. Therefore, the signNow web application is a must-have for completing and signing adp direct deposit form 2017 on the go. In a matter of seconds, receive an electronic document with a legally-binding e-signature.

About Direct Deposit

An accumulated credit amount will appear on your ADP invoice. You must be in good standing and actively processing with ADP to receive the credit. ADP reserves the right to discontinue the Loyalty Credit at any time without notice and no further credits will be due.

Explain the situation, and ask if this has happened to anyone else, or if the bank has any idea what could have gone wrong. It may be that the money has arrived but hasn’t hit your account yet. Or it could be that you bank only gets electronic funds at a certain time of day, and your employer missed the first cutoff.

How To Create An Electronic Signature For Your Adp Direct Deposit Form 2017 Online

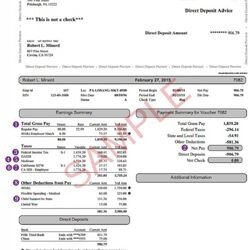

Step 5– Print off the form, provide your signature, and give the document along with a voided check to your payroll manager. They must then complete the topmost fields which include the company code, company name, your file number, their name, and their signature. A prenote is a test to validate the employee bank account information. Prenotes are sent from ADP to the employee’s bank account and verified before direct deposit payroll can be processed.

What are the direct deposit processing times using ADP to send direct deposit payments to Canadian employees? They offer payroll in Canada as well, so I need to find out. Canadian payroll was entirely separate and funded from a Canadian bank account in Vancouver. Once the bank or CU have the funds they will post it to your accounts. Most banks it is at the end of night processing and the funds should be available morning of due date. Credit unions will post the deposit on the due date as their banking systems run 7/24 and have no need to pre-post. ADP is a payroll service used by many businesses to handle the payment of their employees and remains a popular method of such electronic fund transfers.

During the payroll cycle when ADP is verifying your banking information, you will be sent a live paper check. It will be mailed from headquarters in Durham, NC via US mail on the Thursday before the pay date to the address on file for you in ADP. Since a company’s needs are based on its size as well as on the structure of its HR department, ADP services differ from company to company. Every business needs to purchase what it truly needs or wants. As a business owner or a human resource professional, you may be looking for an automated solution for your employee payroll needs. ADP payroll is one of the most popular choices on the market for payroll software.

Employee Direct Deposit Enrollment Form

Simply log in into your ADP account online and begin setting up your payroll information. The service can be accessed from your computer or via the ADP mobile app on a smartphone or mobile device. The basic idea behind the ADP experience is simplicity and automation. Once the initial data is entered into the system, payroll can be processed easily with a few clicks. Rather than manually inputting an employee’s worked hours, pay rates, tax rates and deductions into a spreadsheet, the ADP software performs each step quickly and automatically. HR managers can review the payroll before processing it and can then approve the payroll for payment. prenotetest transaction gets sent to the bank to make sure that the provided employee account information is valid before setting up a direct deposit transfer to pay the employee.

Does direct deposit take a few days?

One of the biggest benefits of direct deposit is that it happens very quickly, usually one to three days but sometimes up to five business days. This varies depending on who is actually sending the funds and may even get faster in the future. (Learn more about transferring money from one bank to another.)

For example, accounts such as savings, checking, money markets, IRAs, and others. A company’s setup controls how many Direct Deposits can be configured for an employee. For example, a company’s setup might allow employees to add up to three Direct Deposits or up to 500 Direct Deposits. If you own an iOS device like an iPhone or iPad, easily create electronic signatures for signing a adp direct deposit form 2017 in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field. As a result, you can download the signed adp direct deposit form 2017 to your device or share it with other parties involved with a link or by email.

How To Track Vacation & Sick Time

The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, etc.) for a much better signing experience. Google Chrome’s browser has gained its worldwide popularity due to its number of useful features, extensions and integrations. For instance, browser extensions make it possible to keep all the tools you need a click away. With the collaboration between signNow and Chrome, easily find its extension in the Web Store and use it to e-sign adp direct deposit form 2017 right in your browser.

ADP is one of the largest HR and outsourcing services in the world which provides, among many other things, a cloud-based payroll platform. The below form, which we have made fillable, can be used to allow the employee in question to authorize Full Service Direct Deposit of all income owed. Along with the payee’s signature, they must attach a voided check to the form in order for it to be considered valid. If you need to share the adp direct deposit form 2017 with other people, you can easily send it by electronic mail.

After that, your adp direct deposit form 2017 is ready. All you have to do is download it or send it via email. signNow makes e-signing easier and more convenient since it provides users with a number of extra features like Merge Documents, Invite to Sign, Add Fields, and many others. And due to its multi-platform nature, signNow works well on any device, desktop or mobile, regardless of the OS. Are you looking for a one-size-fits-all solution to e-sign adp direct deposit form 2017? signNow combines ease of use, affordability and security in one online tool, all without forcing extra software on you. All you need is smooth internet connection and a device to work on.

How long does account verification take for direct deposit ADP?

We originally sent two pre-notes, so it would be the 4th week of employment before you’d get your first direct deposit. Other companies may have different policies. In your case, it might be two weeks if they pre-note. It could be even longer if you’re paid bi-weekly and they pre-note.

An alternative payment solution to paper checks for payroll disbursements that allow employers to maximize direct deposit participation by directing payments to a prepaid card. Save time and money over paper paychecks with electronic payroll. Want a simpler way to pay your employees or tax agencies? You can also get a free quote, based on the package, and a selection of services that you may want to use. The company also offers a bonus of two free months of service for new clients. The ADP payroll service also includes quarterly and annual tax reporting, as well as filing taxes on your behalf.

It has several packages and add-on features from which you can choose. Learning how ADP services work will help you decide which services are the best for your business. When an employee’s banking information is updated, prenote is restarted, usually for five days. The employee will receive a negotiable paycheck during this time. Direct deposit is included in all RUN Powered by ADP® payroll bundles. Pricing is the same regardless of whether the employee elects a paper check or direct deposit.

Avoid being accusatory; it may not have been an issue on her part. One reason your pay may be late is because you are new or have switched accounts. If that is the case, it may take a pay cycle or two for changes to take effect. Allows employees to conveniently distribute their paycheck into multiple accounts, such as checking, savings, and retirement accounts. Make use of the Sign Tool to create and add your electronic signature to signNow the Adp direct deposit form 2017. To qualify for the 5% Loyalty Credit, you must be a new RUN Powered by ADP® client and maintain a U.S.

Due to the prenote process, changes made to a Direct Deposit normally take one or two payroll cycles to be executed. Direct deposit is a banking feature, enabling your employees to have their entire paychecks or a portion of their paychecks deposited automatically into one or more bank accounts.

- Canadian payroll was entirely separate and funded from a Canadian bank account in Vancouver.

- They offer payroll in Canada as well, so I need to find out.

- Once the bank or CU have the funds they will post it to your accounts.

- What are the direct deposit processing times using ADP to send direct deposit payments to Canadian employees?

The bank might be able to help you pinpoint and solve the problem. If your money isn’t where it needs to be, contact your payroll department or bookkeeper — whomever cuts the checks. It might be a problem across the board she is trying to fix, or it could be that somewhere the paperwork got messed up.

Because of its cross-platform nature, signNow works on any device and any OS. Use our e-signature solution and forget about the old days with efficiency, security and affordability. Despite iPhones being very popular among mobile users, the market share of Android gadgets is much bigger. Therefore, signNow offers a separate application for mobiles working on Android. Easily find the app in the Play Market and install it for e-signing your adp direct deposit form 2017.

Most states require employers to provide a wage statement to employees each pay period, regardless of whether wages are paid by paper check or electronically. In the absence of a specific requirement, it is a best practice to provide a wage statement each pay period. When employees leave the company, providing their final wages via direct deposit can be easier than providing a paper paycheck. This is especially true for employees who quit without notice, or who work in states that require final pay immediately upon separation.

The sigNow extension was developed to help busy people like you to reduce the burden of putting your signature on papers. Once you’ve finished signing your adp direct deposit form 2017, decide what you wish to do after that – download it or share the doc with other people.

We partner with industry experts to make payroll processing and direct deposit faster and easier for businesses. Our services also help take the guesswork out of hiring and managing employees. Prenotification is when a bank tests new Direct Deposit accounts before actual deposits are made. This is to make sure that the funds are deposited into the correct account. During prenote, the bank will notify the employer if an invalid routing number or account number was used. The employees will continue to receive a negotiable paycheck during prenote. After prenote, Direct Deposits are made automatically.