Fsa Vs Hsa

Content

After turning 65 you can use your HSA funds for non-qualified expenses, like a boat or an exotic vacation. You’ll pay ordinary income tax on those funds, but the 20% tax penalty no longer applies. As you’re planning for the future, your HSA can ease your mind and prepare you for retirement by saving money income tax-free. HSAstands for “health savings account,” and like an FSA plan, this is a pretax benefit. HSAs are different in that they are only available in conjunction with high-deductible health plans . So if your individual or family deductible for medical insurance is lower than $1,350 or $2,700 , you will not be able to enroll in an HSA.

It goes hand in hand with a qualified high deductible health plan to help you plan, save and pay for your personal well-being. See how you can save money on health care expenses and get exclusive discounts with CVS Health® on eligible health care items with a health savings account . EffectiveJune 1, 2005, clients may select HSA-compatible high deductible healthplans as part of the comprehensive suite of health benefitsoffered by ADP TotalSource, Inc. The best part about your WageWorks HSA is that you can earn money while saving money.

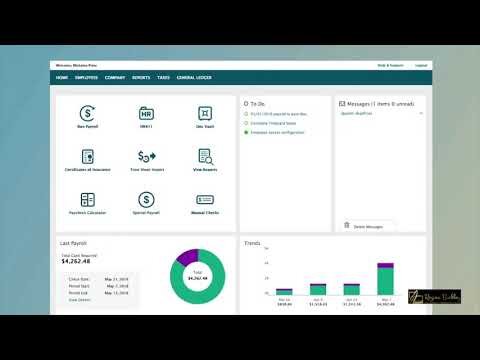

FSAis the acronym for a “flexible spending account” (sometimes called a “flexible spending arrangement”). This benefit allows you to set aside pretax dollars from your paycheck for reimbursement for qualified expenses. FSAs are broken down into three categories — health, dependent care and limited purpose. Our mission is to provide affordable, quality health care to Georgia’s teachers, state employees, public school employees and retirees. No more waiting for the delivery of your employees’ payroll and no need to hand out pay statements. If you want to provide a year-end bonus to your employees, you may want to run an Off-Cycle Payroll after you run your regular payroll.

Adp Totalsource Introduces Health Savings Accounts Through Jpmorgan Chase

And for health savings accounts , you can see the power of investing. Streamline your payroll services with useful features such as time-tracking and new-employee reporting, while also gaining access to our dedicated team of experts who can provide ongoing assistance. Flexible spending accounts and health reimbursement accounts are administered by OptumHealth Financial Services and are subject to eligibility and restrictions. The content on this website is not intended as legal or tax advice. Federal and state laws and regulations are subject to change.

A health savings account allows an individual to contribute amounts each calendar year to pay for qualified medical expenses. In 2015, $3,350 per individual and $6,650 per family can be contributed to a health savings account. These contributions are not subject to U.S. federal income tax. In addition, if the contributions are pre-tax through a cafeteria plan, they are not subject to social security or Medicare taxes. An HSA is an account that helps you save on qualified health care expenses with tax-free money.

An HSA is used to save for qualified medical expenses for you and your eligible dependents, both now and in the future. HSAs, which were authorized by the Medicare Prescription Drug,Improvement and Modernization Act of 2003, are portable health savingsaccounts that individuals can use to pay for qualified medicalexpenses. Withdraw funds directly from your account to pay for eligible expenses. This option works just like an ATM, but without the ATM fees.

Health Coverage

WageWorks has partnered with a trusted and FDIC-insured bank, BNY Mellon as your HSA custodian. You get competitive interest rates, low fees, and attractive investment options to grow your healthcare nest egg according to your own needs and risk tolerance.

For example, voluntary deductions are automatically included.By following the Off-Cycle Payroll template, your bonus payroll will be updated to reflect the applicable deductions indicated. Make sure to validate this information when you are brought to the payroll screens. Heritage Rockwell Collins employees can visit UltiPro to view earlier pay statements. Collins Aerospace provides a variety of web based resources for employees. These tools allow you to access information and capabilities 24 hours a day, seven days a week, and across time zones. Health benefits and health insurance plans contain exclusions and limitations. You’re enrolled in a qualified high-deductible health plan and your employer doesn’t offer an HSA.

Employers who encourage their employees to open a health savings account can benefit by potentially saving as much as 7.65 percent in employer tax costs. For example, if an employee puts $1,000 into an HSA, they can save taxes at their own marginal rate, and the client can save as much as $76.50 on those contributions. In addition to the financial wins, there is the additional win of getting the employees even more engaged in managing their health care expenses. Unlike Flexible Savings Accounts , where money that is setaside for medical expenses for the year but not used is forfeited, HSAbalances accumulate over time. Health savings accounts were implemented in 2004 in the U.S. to provide a medical savings account for individuals who were enrolled in a high-deductible health plan, or HDHP.

Even better, after age 65 you can withdraw for any reason and pay no taxes. You don’t even have to pay taxes on interest and dividends.

What happens to your HSA when you leave a job?

What happens to my HSA if I leave my job? It is yours to keep, even if you resign, are terminated, retire from, or change your job. You keep your HSA and all the money in it, but keep in mind that there may be nominal bank fees if you are no longer enrolled in your HSA through your employer.

Unlike Flexible Spending Accounts, HSA balances can be rolled over and saved, tax-deferred, until age 65 when they can be withdrawn, similar to a 401 plan. This is why an HSA is often referred to as a “401 for health care.” Employees can save HSA funds and withdraw them in retirement when health care expenses are likely to be needed the most. Check out the list of common eligible health care expenses. Or you can click on the column headers in the table to see which are eligible, eligible with a Letter of Medical Necessity , or not eligible.

Healthcare Benefits

That means that all of the money they spent came out of their own pockets, and their insurance provider was not involved in most of those events. The amount is subject to federal taxes only.Box 1 Box 3 and 5Dependent ER HC St/Loc TxblThe amount that the employer contributes to the healthcare plan of an employee’s over-age dependent. A fringe benefit is a form of compensation for the performance of services. Any fringe benefit your company provides is taxable and must be included in the employee’s pay unless the law specifically excludes it. Use this chart to understand the types of fringe benefits and where they are reported on your W-2s.

Fordependent care, your FSA can help you pay for the non-medical care of children under the age of 13 with pretax earnings. The maximum amount you can save annually for a dependent care FSA is $2,500. If you’re married and your spouse has access to a dependent care FSA plan through their employer, you can both save for child care, with a hard total of $5,000 combined.

If you lose your job and elect to retain your high-deductible health plan under COBRA, you may even pay the COBRA premiums from your HSA. The money in your account always rolls over year to year—there’s no “use it or lose it” risk. It is possible to enroll in both products, but there are restrictions, according to theFinance Buff. If you don’t have an HSA, you can use your FSA to cover many of the medical expenses a health savings account would cover. You won’t pay taxes on the cash you contribute nor on money you withdraw for qualified medical expenses.

You can contribute money to your HSA at any time as long as you are enrolled in a qualified high deductible health plan. If you have an individual HSA from PayFlex®, you can add money from a linked bank account or send in a check. If you have an employer-sponsored HSA from PayFlex, you may be able to have money from your paycheck deposited into your HSA. At PayFlex, we go beyond traditional health care accounts. Employer-sponsored incentives and rewards help boost household budgets with more ways to pay for eligible products and services. An HSA is a great tool to help you prepare for future health care costs and retirement.

Health Savings Account

Lively provides employers and employees a paperless and digital way to manage their health savings account this includes simple easy sign up , payroll syncing, and transparent pricing. Depending on your employer’s plan, you may use the convenient WageWorks Healthcare Card associated with your account to pay for hundreds of eligible healthcare products and services. If you have more than one WageWorks healthcare benefit account, this smart debit card knows which account to draw money from first. With UMB you get a leading provider of healthcare payment solutions including health savings accounts , healthcare spending accounts and payments technology. As your partner, our goal is to provide you with the healthcare solutions, products and customer service you need to reach your goals.

To streamline HR activities at your business from payroll and tax management to time, labor, and benefits. You can use your HSA to pay for the qualified medical expenses of anyone you claim on your taxes, even if you’re only enrolled with single coverage. This is a great way to plan for unexpected medical expenses, from your deductible to an ER visit, for the whole family. An HSA is designed to work with a qualifying high-deductible health plan . The money goes in tax-free, grows income tax-free and comes out income tax-free when you use it for qualified medical expenses. With a WageWorks HSA, you can take your healthcare nest egg with you wherever your career takes you. Unlike a Healthcare Flexible Spending Account, your HSA is yours to keep, even if you change jobs, switch healthcare plans, or retire.

You may also have HSA funds directly deposited into your bank account or a check mailed to you. Arrange for convenient direct payments to your healthcare provider. Simply log into your WageWorks account and fill out a form to have eligible expenses paid directly from your account. Simply decide how much you want to contribute to your WageWorks HSA each year, and funds are automatically withdrawn from your paycheck for deposit into your account before taxes are deducted. All figures in this table are estimates and based on an annual salary of $60,000 and maximum contribution limits to the benefit account. Your salary, tax rate, healthcare expenses, and tax savings may be different.

Can husband and wife have separate HSA accounts?

The IRS mandates that Health Savings Accounts (HSAs) are for individuals only. Therefore, joint HSAs between spouses cannot legally exist. Both spouses may contribute to their individual accounts via payroll deduction, and funds from either spouse’s HSA can be used to pay for the other spouse’s eligible expenses.

It’s yours to keep, even if you change jobs or health plans. And it’s yours to use as you like — whether you choose to save or spend your funds. Maximise your employee engagement by offering a range of innovative services, such as goal management, compensation planning, and performance reviews. Zenefits will push employer contributions to synced payroll in one of two ways, depending on the payroll provider. Life has its surprises but with an Optum Bank HSA, paying for qualified medical expenses won’t be one of them. This communication is not intended as legal or tax advice. Arrange for account funds to be directly deposited into your bank account or a check to be mailed to reimburse you for eligible expenses you’ve already paid.

You can choose from several high-, moderate-, or low-risk investment vehicles to maximize your savings as your financial situation changes over time. And your WageWorks HSA is supported by a full-featured technology platform with wealth planning tools. Healthcare is changing fast, and there are new ways for you to benefit.

- Employers who encourage their employees to open a health savings account can benefit by potentially saving as much as 7.65 percent in employer tax costs.

- Unlike Flexible Savings Accounts , where money that is setaside for medical expenses for the year but not used is forfeited, HSAbalances accumulate over time.

- For example, if an employee puts $1,000 into an HSA, they can save taxes at their own marginal rate, and the client can save as much as $76.50 on those contributions.

- In addition to the financial wins, there is the additional win of getting the employees even more engaged in managing their health care expenses.

- Health savings accounts were implemented in 2004 in the U.S. to provide a medical savings account for individuals who were enrolled in a high-deductible health plan, or HDHP.

- A health savings account allows an individual to contribute amounts each calendar year to pay for qualified medical expenses.

The decision to enroll in an FSA vs. HSA is personal and completely dependent on your medical and life situation. For example, if you have a family and pay high child care costs out of pocket, a dependent care FSA will allow you to save pretax money directly from your earnings to offset the cost of child care. FSA plans make for an excellent short-term savings option if you anticipate significant spending in the year ahead. In 2014, 72 percent of U.S. employees enrolled in HDHPs did not spend enough on health care to meet their deductible.

If you do have an HDHP, an HSA allows you to put aside pretax earnings for qualified medical expenses. TheIRSallows you to put aside $3,450 a year if you have an individual plan and $6,900 for a family plan. Clearly, a lot of people see the potential benefits of HSAs. Your Gateway allows you to access health savings account , savings plan, and life insurance information including enrollment actions and updates. I mentioned this briefly above, but it’s an important point that bears repeating.

A WageWorks® Health Savings Account is like a 401 for healthcare. Combined with your company’s high-deductible health plan, a WageWorks HSA gives you an easy, safe way to lower your healthcare costs today while saving money for future healthcare expenses. We provide payroll, global HCM and outsourcing services in more than 140 countries. Whether you operate in multiple countries or just one, we can provide local expertise to support your global workforce strategy. Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries. This option should be used to process your normal scheduled payroll.This option should be used when processing a payroll that is separate from your regular scheduled payroll.

Money you take out to pay for eligible health care expense is never taxed. 3Savings estimates assume annual IRS FSA and HSA contribution limits or your total expenses, whichever is less. Talk with your employer to learn the exact limits for your plan. For this calculation, we used a savings of 21% to assume federal, state and social security taxes you may avoid with pretax contributions. Ask your tax advisor to find out how much you might save by making pretax contributions. Some of these include state and local tax rates, your tax bracket and the FICA tax rate. Our tools can help you decide how much to contribute and estimate your savings.

Just like a traditional savings account, the money in your HSA earns interest in an FDIC-insured account from which you withdraw funds at any time. You can keep some money liquid in your account to pay for today’s healthcare expenses as they arise. And you can invest the remainder of your balance to save for future healthcare expenses. Forhealth care, money can be used to pay for qualified medical expenses, such as prescriptions, eyeglasses, dental work and even acupuncture. Check out this list of eligible expenses from theIRSto help you decide whether to enroll. Currently, the annual maximum you can save for a health care FSA is $2,600. The full goal amount is available for claims from the first day of the plan year.