GL Account Number

Content

For example, if you sell color and black-and-white print ads, you can designate the third numeral of your code to be 1 for color ads and 2 for black and white ads. If you used four-numeral codes, your code for color print ads would be 1210 and your code for black-and-white ads would be 1220. This lets you quickly determine your total print sales and break out how much came from color ads. The simplest way to assign general ledger codes is to start with a numeral, such as 100, assigning each subsequent credit or debit category a numerals that adds one more numeral to the number. In this instance, your first five codes would be 100, 101, 102, 103 and 104.

- In accounting, a General Ledger (GL) is a record of all past transactions of a company, organized by accounts.

- He has been published in print publications such as Entrepreneur, Tennis, SI for Kids, Chicago Tribune, Sacramento Bee, and on websites such Smart-Healthy-Living.net, SmartyCents and Youthletic.

- In addition, they include detailed information about each transaction, such as the date, description, amount, and may also include some descriptive information on what the transaction was.

- Each account is a unique record summarizing a specific type of asset, liability, equity, revenue or expense.

At any time, you can sort your document by ledger code to see how much you’ve paid for phones or utilities. However, in recent decades they have been automated using enterprise accounting software and in enterprise resource planning applications. These tools integrate core accounting functions with modules for managing related business processes. Other GL accounts summarize transactions for asset categories, such as physical plants and equipment, and liabilities, such as accounts payable, notes or loans.

General ledgers and double-entry bookkeeping

In accounting, a general ledger is used to record a company’s ongoing transactions. Within a general ledger, transactional data is organized into assets, liabilities, revenues, expenses, and owner’s equity. After each sub-ledger has been closed out, the accountant prepares the trial balance. This data from the trial balance is then used to create the company’s financial statements, such as its balance sheet, income statement, statement of cash flows, and other financial reports. A general ledger represents the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. It provides a record of each financial transaction that takes place during the life of an operating company and holds account information that is needed to prepare the company’s financial statements.

He has worked in the corporate and nonprofit arenas as a C-Suite executive, serving on several nonprofit boards. He is an internationally traveled sport science writer and lecturer. He has been published in print publications such as Entrepreneur, Tennis, SI for Kids, Chicago Tribune, Sacramento Bee, and on websites such Smart-Healthy-Living.net, SmartyCents and Youthletic.

They are sometimes broken down into departments such as sales and service, and related expenses. The expense side of the income statement might be based on GL accounts for interest expenses and advertising expenses. A general ledger (GL) is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports. Each account is a unique record summarizing a specific type of asset, liability, equity, revenue or expense. A chart of accounts lists all of the accounts in the general ledger.

What is a general ledger (GL)?

The totals calculated in the general ledger are then entered into other key financial reports, notably the balance sheet — sometimes called the statement of financial position. The balance sheet records assets and liabilities, as well as the income statement, which shows revenues and expenses. In accounting software, a general ledger sorts all transaction information through the accounts. Also, it is the primary source for generating the company’s trial balance and financial statements. The ledger’s accuracy is validated by a trial balance, which confirms that the sum of all debit accounts is equal to the sum of all credit accounts. A company’s GL is the basis of its financial reporting and the source of the information used therein.

For example, if journal entries for a debit and its corresponding credit were never recorded, the totals in the trial balance would still match and not suggest an error. In contrast, the accounts that feed into the balance sheet are permanent accounts used to track the ongoing financial health of the business. In accounting, a General Ledger (GL) is a record of all past transactions of a company, organized by accounts. General Ledger (GL) accounts contain all debit and credit transactions affecting them. In addition, they include detailed information about each transaction, such as the date, description, amount, and may also include some descriptive information on what the transaction was. In accounting, the terms debit and credit differ from their commonplace meanings.

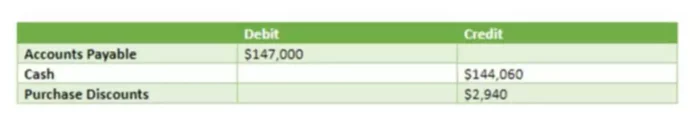

When expenses spike in a given period, or a company records other transactions that affect its revenues, net income, or other key financial metrics, the financial statement data often doesn’t tell the whole story. In the case of certain types of accounting errors, it becomes necessary to go back to the general ledger and dig into the detail of each recorded transaction to locate the issue. At times this can involve reviewing dozens of journal entries, but it is imperative to maintain reliably error-free and credible company financial statements. Double-entry transactions, called “journal entries,” are posted in two columns, with debit entries on the left and credit entries on the right, and the total of all debit and credit entries must balance.

Why do companies use general ledger accounts?

Instead, they show actual amounts spent or received and not merely projected in a budget. Click Print to print a list of all of the GL accounts that are configured in NLS. Therefore, everyone within the company network can access the ledger at any point and make a personal copy of the ledger, making it a self-regulated system.

Following the accounting equation, any debit added to a GL account will have a corresponding and equal credit entry in another account, and vice versa. The income statement will also account for other expenses, such as selling, general and administrative expenses, depreciation, interest, and income taxes. The difference between these inflows and outflows is the company’s net income for the reporting period. When in doubt about your ability to set up a ledger code system, consider hiring a bookkeeper or accountant on a temporary basis to set up your bookkeeping system or software. Maintenance of an existing system is generally easier than building from the ground up.

Accordingly, Sage does not provide advice per the information included. These articles and related content is not a substitute for the guidance of a lawyer (and especially for questions related to GDPR), tax, or compliance professional. When in doubt, please consult your lawyer tax, or compliance professional for counsel. Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content.

Is a General Ledger Part of the Double-Entry Bookkeeping Method?

Consider the following example where a company receives a $1,000 payment from a client for its services. The accountant would then increase the asset column by $1,000 and subtract $1,000 from accounts receivable. The equation remains in balance, as the equivalent increase and decrease affect one side—the asset side—of the accounting equation.

- Your first two debit codes might be 100 and 101, and your first two credit codes would be 200 and 201.

- A subsidiary ledger (sub-ledger) is a sub-account related to a GL account that traces the transactions corresponding to a specific company, purchase, property, etc.

- The transactions are related to various accounting elements, including assets, liabilities, equity, revenues, expenses, gains, and losses.

- After each sub-ledger has been closed out, the accountant prepares the trial balance.

- Unlike a budget sheet that lists your expected income and expenses, or a receivables or payables report that shows what you owe or are owed, a ledger records transactions only as they happen.

- For example, if you sell color and black-and-white print ads, you can designate the third numeral of your code to be 1 for color ads and 2 for black and white ads.

In some areas of accounting and finance, blockchain technology is used in the reconciliation process to make it faster and cheaper. General Ledger Accounts (GLs) are account numbers used to categorize types of financial transactions. A “chart of accounts” is a complete listing of every account in an accounting system. The income statement follows its own formula, which works as follows. When a company receives payment from a client for the sale of a product, the cash received is tabulated in net sales along with the receipts from other sales and returns. The cost of sales is subtracted from that sum to yield the gross profit for that reporting period.

In accounting software, the transactions will instead typically be recorded in subledgers or modules. General ledger accounts are assigned unique identifying account numbers. These numbers may range from a simple three-digit code to a more complex version that identifies individual departments and subsidiaries.

The trial balance is checked for errors and adjusted by posting additional necessary entries, and then the adjusted trial balance is used to generate the financial statements. For example, the GL code for an accounts receivable might be account #105. GL codes aren’t substitutes for descriptive account names, but they’re a useful tool for rapid data entry and effective organization. In this instance, one asset account (cash) is increased by $200, while another asset account (accounts receivable) is reduced by $200. The net result is that both the increase and the decrease only affect one side of the accounting equation. However, the trial balance does not serve as proof that the other records are free of errors.

This mitigates the risks that Centralized General Ledgers have from having one source control the ledger. The image below is a great illustration of how the blockchain distributed ledger works. For example, a CPA might use a T-account — named because of its physical layout in the shape of a T — to track just the debits and credits in a particular general ledger account.

Account numbers within the general ledger are typically configured so that all accounts summarizing into the balance sheet are listed prior to all accounts summarizing into the income statement. The general ledger contains a debit and credit entry for every transaction recorded within it, so that the total of all debit balances in the general ledger should always match the total of all credit balances. If they do not match, the general ledger is said to be out of balance, and must be corrected before reliable financial statements can be compiled from it. The set of 3-financial statements is the backbone of accounting, as discussed in our Accounting Fundamentals Course. A general ledger account (GL account) is a primary component of a general ledger. The transactions are related to various accounting elements, including assets, liabilities, equity, revenues, expenses, gains, and losses.

A general ledger summarizes all the transactions entered through the double-entry bookkeeping method. Under this method, each transaction affects at least two accounts; one account is debited, while another is credited. The total debit amount must always be equal to the total credit amount. The transactions are then closed out or summarized in the general ledger, and the accountant generates a trial balance, which serves as a report of each ledger account’s balance.

The list of GL accounts may be viewed on the GL Account Number sub-category on the Loan Setup window. General Ledger account numbers are automatically generated when Loan groups are defined. These articles and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”). Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage. These articles and related content is provided as a general guidance for informational purposes only.