Global Payroll Week Survey Reveals Challenges In Global Payroll

Content

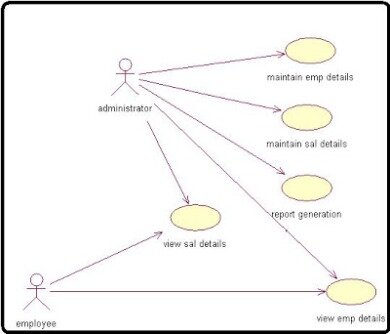

We reviewed the payroll services offered by Globalization Partners and rated it a 4.3 out of 5 stars for the best international payroll services. While it offers a payroll platform with admin and employee features, its most valuable offer may be its local partners. The service can find local candidates, hire and interview applicants, onboard new employees, manage payroll compliance issues, and assist with tax filing. As a Global Payroll provider, our payroll and taxation services may be tailored to the specific requirements of each country, and delivered by knowledgeable, established experts who can interface with local regulatory bodies. Our Global Payroll solutions include local support for employees, both in their local language and culture, along with central reporting and integration with the client’s ERP systems. Companies that cannot justify the large cost of an in-house ERP with a international payroll solution can instead outsource some, or all, of their payroll functions to local vendors.

If you do not have a local entity and require additional management, why not visit our Global Employment Outsourcing page? We can support you with employee contracts, benefits administration, visa processing as well as global payroll solutions. Global visibility to workforce spend data is another value-add feature that only a centralized global payroll service provider can offer. Neeyamo’s global payroll solution is a powerful blend of technology and service excellence that is tailor-made uniquely for the requirements of each customer. NeeyamoWorks Pay™ (formerly PayNComp™) – Neeyamo’s global payroll platform is a holistic solution for all your global payroll challenges.

What time do payroll checks get deposited?

Most employees can expect payroll direct deposit to arrive in their account at midnight the day prior to the pay date. You may receive your money well before you arrive at work on payday.

It has nearly every feature we were looking for and earned 4.49 out of 5 stars in our evaluation. If your company is already an ADP customer, it may be simple to add a global payroll service to your existing payroll processes. This international payroll service offers full PEO services and has compliance and HR professionals located in key countries.

One Team, One Global Payroll Solution

Under this model, previously decentralized payroll functions now all roll up under one central management structure. Often such centralization goes hand in hand with collocating the team members in global or regional hubs. However, real operational synergies are not achieved by merely redrawing organizational reporting lines or collocating the resources (that is often referred to as “pseudo” shared services). If you truly want to achieve the benefits of a shared services structure, you have to enable the shared service organization with standardized tools and processes. This calls for the rollout of a global payroll solution which gives the shared services teams a consistent way of working and consistent tools to get their work done efficiently. Over the past few years, an increasing number of multinational companies has chosen to implement integrated global payroll solutions that provide integration and aggregation of their payroll environments across countries.

Whilst these can lower costs, having to manage and administer all the compliance, data aggregation, technology, and security requires resources too. Global workforce management can be conducted on a multiple outsource solution, but the contracted service level agreements and the aggregation needed to centralize the global payroll functions, can often prove demanding and inefficient.

It helps companies with compliance and legal issues in other countries and provides HR support to hire, onboard, and manage employees. Insightful reporting options and automated payroll functions are available as well. SAP reports that it can help companies avoid the high costs associated with non-compliance. International payroll services, then, include the typical processes necessary for paying employees, but also a set of strategies for monitoring and responding to changing international business requirements. They include an ongoing process of understanding other cultures as well as systematic, data-driven processes that make international payroll expenses predictable, timely, and error-free. Neeyamo has its core focus on your organization’s non-core business functions.

Beyond payroll and local tax and compliance assistance, it also offers talent management, workforce management, and analytics and reporting tools. To help large companies manage global workforces, it provides advanced admin features to help companies view worldwide payroll in a single record, in addition to per country or location. Payroll always requires dedicated staff, established processes, and clear expectations from companies and their employees, but these requirements get more complicated as companies expand internationally. Each country has its own tax laws and may have additional legal requirements for compensation, benefits, and pensions. When managing international payroll, aglobal HR team must make sure a variety of legal and logistical benchmarks are met, while ensuring payroll to global employees is delivered on time. In certain countries, if international payroll is missed or late, the consequences can be severe, including a suspension or permanent loss of a business license.

- The idea is to create a repeatable, cookie-cutter way of adding new countries by plugging into a proven, reliable global payroll network.

- As you’d expect, ADP is compatible with other ADP solutions, such as its human capital management solution and its payroll software, which your company may already be using.

- Even small companies are now looking to take advantage of global markets and workforces, and international payroll services can help businesses process payroll for workers located in other countries.

- Most also provide or connect companies looking to hire abroad with professional employment organizations to hire, onboard, and manage foreign employees onsite.

- Using these services, you can be assured that your company complies with local tax and hiring laws.

These solutions help to streamline and standardize payroll processes, provide better visibility and controls over local payroll execution and help to simplify the reporting and data integration with 3rd party systems. International payroll services can help businesses that are expanding their global workforce. Services also help keep companies out of legal trouble by ensuring that local tax and employment laws are followed. If needed, these services will also provide PEO and outsourced HR services locally. SAP Success Factors HR and Payroll is a popular international payroll service, and it earned 4.14 of 5 stars in our comparisons. If your company already uses SAP, it may be simple to add global payroll services as your company expands into other countries, as SAP provides full localization services in more than 45 countries.

Unmatched Analytics, Data

Considering the potential damage to a company’s reputation, employee trust and audit risk, international payroll processing should be high on a company’s agenda but all too often isn’t. For many companies, global workforce management is carried out in-house. ERP solutions are largely conducted in-house, but they can be costly and inefficient to implement in countries where an organization has just a handful of employees. Especially when you are operating across lots of different countries, it is hard to keep up with changing requirements in local legislation. Local compliance obligations are constantly getting more demanding and we see increased requirements for more detailed, real-time reporting (e.g. Gender Pay Gap reporting requirements in the UK and other countries).

A global payroll service eliminates many of the past inefficiencies that plagued international payroll in the past, improving the relationships between employers and their international workforce. When it comes to international payroll outsourcing, your success hinges on finding a partner who can support your unique needs and requirements. Here are some important characteristics to look for in a global payroll service provider. The service provided by our knowledgeable implementation, payroll processing, treasury services and support teams helps minimize the complexity of global payroll in more than 130 countries. At the most basic level, centralized global payroll enables improved accuracy and timeliness of payroll processing. By enabling comprehensive payroll data to be accessible as needed and in real time, such solutions eliminate wait times and facilitate faster processing. However, at this point in payroll’s evolution, these benefits should be considered table stakes.

What Is International Payroll Outsourcing?

The idea is to create a repeatable, cookie-cutter way of adding new countries by plugging into a proven, reliable global payroll network. Even small companies are now looking to take advantage of global markets and workforces, and international payroll services can help businesses process payroll for workers located in other countries. Using these services, you can be assured that your company complies with local tax and hiring laws. Most also provide or connect companies looking to hire abroad with professional employment organizations to hire, onboard, and manage foreign employees onsite. ADP provides payroll services in over 140 countries and is most suitable for large companies with over 1,000 global employees. As you’d expect, ADP is compatible with other ADP solutions, such as its human capital management solution and its payroll software, which your company may already be using.

Unlike traditional payroll applications, NeeyamoWorks Pay™ was developed using Neeyamo’s proprietary Cloud First, World First© design philosophy. Built ground up, it incorporates next-generation technological capabilities including bots’, artificial intelligence and advanced analytics. Its layered architecture supports extended payroll capabilities covering the upstream and downstream activities on a single platform. Another key area in which service providers assist global payroll professionals is when setting up payments and managing low employee populations, often referred to as long-tail countries. According to the findings, 45% of respondents use two to five providers and an additional 20% depend on six or more to process their payrolls internationally. Rippling offers payroll services, as well as HR and IT support, for more than 100 countries. However, its international tools are somewhat limited, which explains why it earned 4.06 of 5 stars compared to the top international payroll services.

Companies that have employees in more than one country face a unique set of payroll challenges. Complying with each country’s requirements while delivering a consistent, reliable payroll experience for all employees—in multiple languages—can be costly and time-consuming. To help streamline the process and reduce errors, many companies purchase global payroll coveragefrom a payroll service provider. However, given the local complexity and the lack of a single global payroll solution, payroll sits outside of that global HR solution and continues to operate in lots of different local systems. At the same time, there is a compelling need to integrate data flows between the global HR solution and the local payroll systems – HR data needs to feed into payroll systems and vice versa.

Some businesses opt for Global Payroll solutions using established, country-specific processes – but this approach can be disjointed, overlook critical compliance issues, and ultimately have a negative effect on profitability. A Global Payroll service provider can help you avoid these expansion pitfalls by developing a more efficient, more compliant payroll system for both your domestic and international needs. All of this needs to be done at pace, while also accounting for country specific nuances such as local tax regulations or other legal implications. Add into the mix local currencies, time zone differences and languages, you are left with a lot of moving parts. This means there is large scope for things to go wrong if multinationals do not pay enough attention to global payroll processing. This is a business-critical department, and it must be supported with the right tools to ensure that it is ready to help with the scaling process. Many companies have started to centralize their back-offices in shared services or center of excellence structures that typically align similar roles and functions in one central organizational structure.

Services For Family Business Wealth

Understanding of the global payroll process is an important part of preparing a company for scaling activity. If the global payroll department is being tasked with paying the new employees into new countries, then there needs to be a clear understanding of all the operational dependencies associated with it. And secondly, a well-planned scalable global payroll model where employers can scale the actual process of payroll instead of the manhours needed to deliver it. Our global and proximity delivery centers across the globe along with our wide-spread network ensures we provide a standardized global solution with localized payroll processing. Neeyamo has a robust service delivery organization that is powered by certified payroll professionals who work round the clock to support our customer requirements.

Businesses that don’t have a full overseas workforce find it more useful, as they can usually hire and pay workers as contractors, which leaves the taxes up to each individual. This multi-country payroll service scored 4.55 out of 5 stars using our testing method. It provides nearly any type of foreign payroll services your business may need, including in-country HR and onboarding support. It can help with challenging tasks, like paying taxes and complying with local tax and employment laws. Papaya Global also offers numerous automation tools and advanced reporting options. Happy employees, of course, are employees who are paid in a timely fashion.

Overall, Papaya Global scored the highest, barely outscoring the well-known payroll company ADP, as Papaya Global provides payroll and PEO services in over 140 countries. It supports all types of workers, including contract workers, and workers are paid in their local currency, featuring pay slips in their language. This international payroll service is associated with numerous partners that can help employers provide benefits to foreign employees. There are many challenges to running timely and compliant international payroll services. A global PEO like Globalization Partners is well-positioned to help companies establish and maintain effective payroll for international employees. Globalization Partners has a payroll solution to fit any company with any number of overseas employees, whether that’s one person in a single country or several people spread across the world.

Add to that further requirement around the protection of personal data in your payroll processes under the new GDPR rules. A global payroll solution will help you to keep track of all your local compliance obligations and to validate that you have fulfilled these obligations. It will also help pull together the data required for reporting quickly in an automated manner. Furthermore, a proper global payroll solution will enforce consistent processes and put in place technology-enabled controls to protect your employees’ data and ensure GDPR compliance. If you are looking to outsource your internal payroll processing, IRIS FMP can set your company up with outsourcing payroll in a choice of many countries.

Our global payroll solution is a combination of advanced technology, extensive global compliance knowledge and service expertise that covers 150+ countries. Over the years Neeyamo has studied and addressed the most complex global payroll challenges faced by several multinational organizations. Neeyamo has accomplished this leveraging our single proprietary global payroll platform – NeeyamoWorks Pay™ (formerlyPayNComp™) unifying input, processing, and delivery of an innovative technological solution.

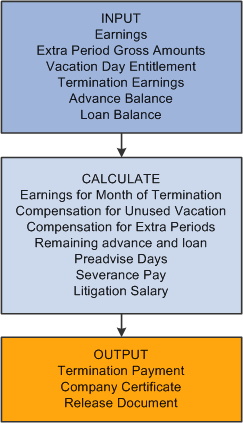

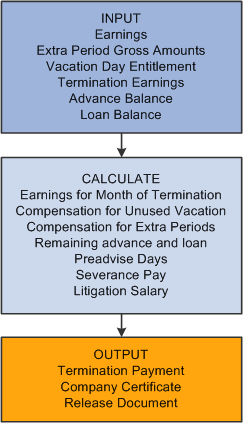

How do I manually calculate payroll?

Your manual payroll calculations are based on the pay frequency and their hourly wage. So, for someone who is full time making $11 an hour on a biweekly pay schedule, the calculation would look like this: 40 hours x 2 weeks = 80 hours x $11/hour = $880 (gross regular pay).

It can help with HR support to ensure you are complying with local tax and employment laws and assist you in starting international operations even if your company is small. Over 1,300 localized product experts support SAP global payroll services to ensure that nearly 100 million people worldwide get paid.

Globalization Partners deals with businesses on a global scale every day — our Global Employer of Record model, accessible through our industry-leading SaaS platform and app, allows us to process payroll in187 countries. Running in-house international payroll can be a time-consuming, expensive process filled with unexpected challenges. That’s why it’s common for companies to contract out all or part of their international payroll processes to external vendors. Typically, companies contract with a different payroll company for each country or region in which they have an established market. Sometimes they use third-party platforms to recruit, manage, or pay international employees. International expansion brings opportunities and challenges for organisations of any size, but managing payroll should be among the most important considerations.