Gross Pay Calculator

Content

Salary paycheck calculators aren’t the most foolproof way to calculate employees’ take-home pay. After all, since you’re entering numbers by hand, you can’t rule out the possibility of typos and miscalculations. We partner with industry experts to make payroll processing and direct deposit faster and easier for businesses. Our services also help take the guesswork out of hiring and managing employees. Enable limited access for your employees to save your time and theirs. The employee payroll login includes a paycheck calculator and instant access to employee handbooks, and benefits calculators. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states.

This free salary paycheck calculator can help you determine how much to send your employees home with at the end of the day—and how much to remit to the IRS each quarter. You can also get a free quote, based on the package, and a selection of services that you may want to use. The company also offers a bonus of two free months of service for new clients. To run payroll, start by reviewing all of your employee hours. If you utilize the Time and Attendance component, employees can log in from their smartphones, and the data will automatically be added to the company’s payroll files. The basic idea behind the ADP experience is simplicity and automation.

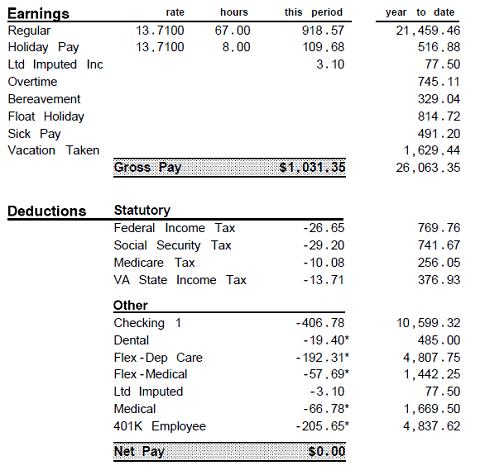

- For instance, a paycheck calculator can calculate your employees’ gross earnings, federal income tax withholding, Medicare and Social Security tax, and final take-home pay.

- No one would call payroll taxes the easiest part of paying employees, but the right tools can make the process a little less, shall we say, taxing.

- You should feel confident that your payroll is accurate without having to spend countless hours checking it.

- ADP allows you to easily add employees and review their data in a centralized dashboard.

- If you need to calculate an employee’s take-home pay in a jiffy, our paycheck calculator can help you out.

Very few employees qualify for these exemptions, so you probably won’t have to worry about it. But if your employees do qualify, just enter yes when the calculator asks if your employees are exempt or not. Since a company’s needs are based on its size as well as on the structure of its HR department, ADP services differ from company to company. Every business needs to purchase what it truly needs or wants. The ADP payroll service also includes quarterly and annual tax reporting, as well as filing taxes on your behalf. If you have questions, the company’s professional payroll staff is available 24/7 to provide answers. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for California residents only.

Create Your Own Adp Tax, Payroll, Hourly Paycheck Calculator App

It is not a substitute for the advice of an accountant or other tax professional. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. By using the Paycheck Calculator, you waive any rights or claims you may have against Gusto in connection with its use. Use Gusto’s salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California. Most people want a bigger paycheck, and you can certainly take steps toward that – for instance, by asking for a raise or by working extra hours . But while it’s always nice to increase your earnings, there are times when it might be smart to shrink your actual paycheck.

If you need to calculate an employee’s take-home pay in a jiffy, our paycheck calculator can help you out. No one would call payroll taxes the easiest part of paying employees, but the right tools can make the process a little less, shall we say, taxing. For instance, a paycheck calculator can calculate your employees’ gross earnings, federal income tax withholding, Medicare and Social Security tax, and final take-home pay.

If you elect to put more money into a pre-tax retirement account like a 401 or 403, for instance, you will save for the future while lowering your taxable income. So, while you will receive a smaller paycheck each month, you will actually get to keep more of your salary this way. If you’re an employee in Newark, it’s important to know that while the city has a 1% payroll tax, it applies to employers, not workers. Federal income taxes are also withheld from each of your paychecks. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period.

Paycard Savings Calculator

Your New Jersey employer is responsible for withholding FICA taxes and federal income taxes from your paychecks. Medicare and Social Security taxes together make up FICA taxes.

It has several packages and add-on features from which you can choose. Learning how ADP services work will help you decide which services are the best for your business. Both you and your employees also need to pay a variety of federal payroll taxes. You’ll need to pay FICA and FUTA, and your employees will need to pay FICA, federal income tax, and possibly the Additional Medicare tax.

Using take-home pay, calculate the gross that must be used when calculating payroll taxes. Use the free payroll calculators below to estimate federal and state withholdings on wages and bonuses,”gross up” wages based on net pay, or calculate take-home pay based on hourly wages. These calculators provide general guidance and estimates about the payroll process and should not be relied upon to calculate exact taxes, payroll or other financial data. If you have questions about tax withholdings or filing, contact your professional advisor or accountant.

This lowers your administrative burden by streamlining payroll, time and labor, and benefits. Running a small business is challenging and ADP is here to help you succeed. Outside of payroll, taxes, HR, and benefits, there are many other obstacles to climb. Gross-Up Calculator Use the gross up pay calculator to “gross up” wages based on net pay.

Starting A Business?

Your employer will withhold 1.45% of your wages for Medicare taxes each pay period and 6.2% in Social Security taxes. Your employer matches your Medicare and Social Security contributions, so the total payment is doubled. Any wages you earn in excess of $200,000 is subject to a 0.9% Medicare surtax, which is not matched by your company. Our intelligent HR solutions will help you make informed business decisions in less time. You can align performance and incentives with business goals to ensure the company is not overspending and investing resources wisely.

Many employers choose to work with a payroll service provider for help automating paycheck calculations and navigating compliance rules. Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries.

The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. These calculators should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data.

For more information, see our salary paycheck calculator guide. ADP Payroll services also enable employees to access all of the company data via the mobile app, providing a green solution for companies, as well as a cost savings, by reducing paperwork. Department managers can also easily view basic information for employees in their work group, and can then message them via the app. As a business owner or a human resource professional, you may be looking for an automated solution for your employee payroll needs. ADP payroll is one of the most popular choices on the market for payroll software.

A bonus paycheck tax calculator can help you find the right withholding amount for both federal and state taxes. To calculate an hourly employee’s take-home pay for the pay period, use this free calculator for hourly wages. In other words, it’s the amount of money the employee takes home each pay period after the employer withholds taxes and other deductions from their gross wages. With unlimited payroll runs and automatic tax filing, Gusto helps small-business owners worry less about payroll and put more time into growing their business. Some employees might ask you to withhold an additional amount in state income tax. If so, have that information on hand so you can deduct the right amount from your employee’s gross pay. Get an accurate read on your salaried employees’ withholding amounts and net pay using our free paycheck calculator below.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Subtract any deductions and payroll taxes from the gross pay to get net pay. The PaycheckCity salary calculator will do the calculating for you. Just about everyone welcomes extra cash for a job well done, so if you can treat your employees to bonuses to express your gratitude, you probably do. But as an employer, you’re responsible for withholding the right amount in taxes from your employees’ paychecks—and the same thing is true of their bonuses. As an employer, you withhold these taxes from your employees’ wages each pay period and remit them to the IRS quarterly. Finally, some employees are eligible for exemptions from federal and state income taxes and FICA taxes .

You can do that and worry about HR, retirement, and insurance benefits down the road. Our software also seamlessly integrates with many accounting and POS systems so the transition will be smooth. Our free salary paycheck calculator below can help you and your employees estimate their paycheck ahead of time. Simply enter the information into the form, and you’ll get your results.

How do I calculate my biweekly paycheck?

How to calculate biweekly pay 1. Figure out your gross annual salary.

2. Divide that number by 26.

3. That number is the amount you’ll receive biweekly.

4. If you want to know your hourly pay, take your biweekly paycheck and divide by the number of hours worked every two weeks.

More items•

You should feel confident that your payroll is accurate without having to spend countless hours checking it. ADP allows you to easily add employees and review their data in a centralized dashboard. If you have over 49 employees, tax regulations and filings can become more complicated. Our software offers complimentary tax filing and compliance support. Additionally, ADP offers employee and manager self-service to save time. Gusto’s payroll software automates the entire process for you, from filing payroll taxes to direct-depositing your employees’ paychecks each payday.

Neither these calculators nor the providers and affiliates thereof are providing tax or legal advice. You should refer to a professional adviser or accountant regarding any specific requirements or concerns. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider, who can automate paycheck calculations.

Several factors – like your marital status, salary and additional tax withholdings – play a role in how much is taken out from your wages for federal taxes. Use SmartAsset’s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

If you’re interested in the topic of gross pay vs net pay, make sure to check out our upcoming articles.