Health Compliance Solution

Content

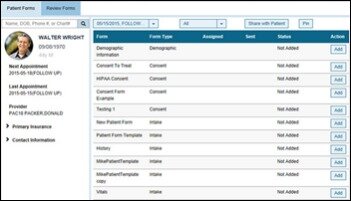

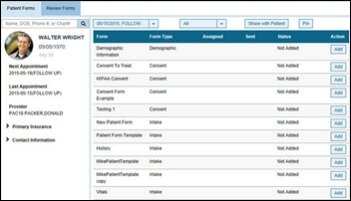

Form 1095-C will identify each employee who was full-time for one or more months, and report for each month the details of any health care coverage offered. The first Forms 1095-C must be furnished to employees by January 31, 2016 , and must be filed with the IRS in accordance with existing deadlines for Forms W-2. ACA reporter has also come to know that the IRS has issued its ‘final’ drafts of instructions for employers with guidelines to report regarding health coverage, which they offered employees last year .

Specifically, at least half of all organizations surveyed indicate they are extending coverage to employees who do not qualify as ACA full-time. Moreover, only a quarter of midsized employers surveyed already either have or are planning to limit the hours of at least some employees.

Starting January 1, 2020, employers may offer employees an ICHRA instead of offering a traditional group health plan to reimburse medical expenses, like monthly premiums and out-of-pocket costs such as copayments and deductibles. An offer of an ICHRA counts as an offer of health coverage under the employer mandate of the Affordable Care Act , is subject to the ACA’s affordability and minimum value requirements, and also affects ACA information reporting. The IRS has not yet published draft 2020 Instructions for Forms 1094-C and 1095-C. Affordable Care Act reporting is the action of filing required information to the Internal Revenue Service and sending copies to recipients/employees. The Affordable Care Act requires employers to file annual information returns with the IRS and furnish statements to employees on healthcare plan coverage information. If employees are not measured correctly, or offered benefits incorrectly, too late, or not at all, there’s the potential for significant penalties. For example, changing an employee’s work location, which is a routine occurrence in today’s environment, could trigger a change in reporting at the state level.

- Things like vacation accrual or potentially stock participation or any of the policies or programs and the designation for regular full-time could be 37 ½ hours or 40 hours a week, whatever a client may have used historically.

- There’s ACA full-time, which applies solely to the ACA requirements related to health care plans and then there’s a full-time designation for everything else.

- In many cases, employers are setting up for example two different designations for full- time employees.

- Time is going to be involved to the extent that if employers have large part-time populations it is going to be critical to be able to manage those people to a true part-time status and as a result, avoid potential problems with other areas of the regulatory environment.

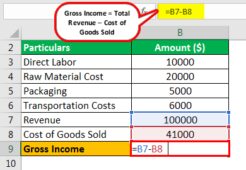

- The payroll is going to be critical in terms of capturing the bulk of hours of service as well as things like month, average monthly salary or Box 1, W-2 values.

- The HR system is going to be potentially one of the systems that’ll be involved.

The HR system is going to be potentially one of the systems that’ll be involved. In many cases, employers are setting up for example two different designations for full- time employees.

Adp Eye On Washington

To determine the monthly employee contribution, an employer may divide the total employee share of the premium for the plan year by the number of months in the plan year to determine the monthly employee contribution for the plan year. This provision is helpful for employers that administer weekly or biweekly payroll periods, because more than four weekly payrolls or more than two biweekly payrolls occasionally fall within a calendar month. Line 15 should only be completed if Code 1B, 1C, 1D, or 1E is entered on Line 14. An ALE is an employer that employed an average of at least 50 full-time employees (including full-time equivalent employees) during the preceding calendar year. Employees are considered full-time in any month that they are credited with at least 30 hours of service per week, on average, or 130 hours of service in the month. On August 7, 2015, the Internal Revenue Service issued drafts of forms and instructions for 2015 Forms 1094-B and 1095-B; and Forms 1094-C and 1095-C. Employers will use the Forms 1094-C and 1095-C to report health insurance coverage offered under employer-sponsored plans in accordance with Section 6056 of the Internal Revenue Code .

While many businesses used to possess the financial wherewithal to absorb penalties, in a challenging economic environment, the impact of a penalty could create severe, long-lasting repercussions. To avoid the employer mandate penalty, full-time employees and their dependents should be offered affordable coverage that provides minimum value no later than the first day of the fourth full calendar month of employment. If you hire seasonal and variable-hour employees, you must track their hours using either the look-back measurement method or the monthly measurement method, according to the IRS. Another area in which employers are challenged is how to address affordability requirements under the ACA. The study shows that a significant proportion of employers – who have or are planning to extend health care benefits – report they remain unsure concerning which of the three affordability safe harbors they will utilize for their employees.

Whos In Charge Of Aca Compliance?

Although Forms 1094-C and 1095-C are largely unchanged from prior versions, the instructions included some noteworthy revisions. Those ALE’s which have more than 50 employees hired on full-time basis last year will have to use the 1095 C form to show that they have given their employees the minimum essential coverage and the minimum value threshold too.

Do small employers have to report health insurance on w2 for 2020?

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee’s Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

Nonetheless, if the employee was not offered benefits properly during this time and gains coverage and a tax credit from the exchange, this may translate later into a potential ACA IRS penalty. The Internal Revenue Service released the draft 2020 Forms 1094-C and 1095-C on July 13, 2020. While Form 1094-C remains the same, as expected, there are some changes to IRS Form 1095-C based on the introduction in 2020 of a new type of Health Reimbursement Account , the individual coverage HRA or ICHRA.

Adp Smartcompliance® Health Compliance Module

ICHRAs, pronounced “ick-rahs” by benefits advisors and vendors, and created under regulations the IRS issued in June 2019, allow employers to contribute a set dollar amount each year to each eligible full-time employee, tax-free. ALEs using ICHRAs to provide ACA-compliant health coverage must fund these accounts to allow employees to purchase coverage that meets the ACA’s affordability threshold. This means that for 2020, policy premiums must not have exceeded 9.78 percent of an employee’s income. ALEs—organizations that had, on average, 50 or more full-time equivalent employees during the preceding calendar year—use Form 1095-C to report whether they offered eligible employees that provides minimum essential coverage and meets the minimum value threshold.

ADP’s survey validates just how difficult complying with the ACA’s Employer Mandate can be. For 2015 reporting, the IRS will not impose penalties for incorrect or incomplete information if the filer can show that it made good faith efforts to comply with the information reporting requirements for 2015. No relief is provided for ALEs that fail to timely file or to furnish Forms 1095-C. However, employers may be eligible for penalty relief if the employer can demonstrate reasonable cause under Section 6724. The instructions clarify Form 1095-C Line 15, which reports the employee’s share of the lowest-cost monthly premium for self-only coverage that is offered to the employee.

It simply provided a longer window for individuals without access to coverage to consider options on how to continue coverage. Should an employee gain coverage and be granted a tax credit or subsidy, an employer may see an exchange notice.

Code Generation & Filing Of Forms 1094

More significantly, the study found that employers are beginning to emphasize consumerism into the health care cost equation through revised plan design. The competition to attract talent appears to be the core business reason driving these decisions.

For lowest cost self only coverage, would any full- time employees pay more than 9.5% of current Box 1 W-2 Wages, Rate of pay, or Federal Poverty Level The penalty for not offering coverage is the number of full-time employees (minus 80 in 2015; 30 in 2016) times $2,000 annually. The penalty for failure to offer minimum value and/or affordable coverage is a $3,000 annual penalty that will be due for each full-time employee receiving a subsidy, up to a maximum of the total number of full- time employees (minus 80 in 2015; 30 in 2016) times $2,000. Those employees may be eligible to receive a premium tax credit to buy coverage in the health insurance Marketplace. Did at least one employee receive a premium tax credit or cost-sharing subsidy in a Marketplace/Exchan ge? For self-insured plans, Form 1095-C must also be provided to any individuals who enrolled in qualified coverage, which may include non-full-time employees and any covered spouses and dependents. For calendar year 2020, Forms 1094-C and 1095-C are required to be filed by March 1, 2021 or March 31, 2021, if filing electronically. By now most businesses and insurance companies are familiar with the Patient Protection and Affordable Care Act , sometimes referred to as ACA or ObamaCare.

California Security Firm Easily Expands Into The Public Sector With Smart Hr Tools From Adp Marketplace

These requirements apply whether an ALE offered coverage through a group health plan or funded ICHRAs that employees used to purchase coverage for themselves and their families on an ACA marketplace exchange. Generally speaking, the extended enrollment period does not impact employers as this is part of the established and usual process.

Time is going to be involved to the extent that if employers have large part-time populations it is going to be critical to be able to manage those people to a true part-time status and as a result, avoid potential problems with other areas of the regulatory environment. Of most concern would probably be ERISA Section 510 which prohibits an employer from cutting back an employees’ hours resulting in that employee becoming ineligible for qualified benefits, to which they would otherwise be entitled.

There’s ACA full-time, which applies solely to the ACA requirements related to health care plans and then there’s a full-time designation for everything else. Things like vacation accrual or potentially stock participation or any of the policies or programs and the designation for regular full-time could be 37 ½ hours or 40 hours a week, whatever a client may have used historically. The payroll is going to be critical in terms of capturing the bulk of hours of service as well as things like month, average monthly salary or Box 1, W-2 values.

In addition, the study indicates that nearly 20% of midsized employees and more than a third of large organizations have introduced a low minimum value plan as part of their ACA compliance strategy. Implementing a CDHP with a 60% minimum value would help simplify record keeping and reporting, and could play a role in reducing the Excise Tax penalties – a 40% tax that takes effect in 2018 on high-cost health plans above a certain threshold. According to the ADP RI study, employers are shifting health care-related costs to their employees. About 70% of midsized organizations and 80% of large organizations are increasing the share of costs that they charge their employees in the form of deductibles and co-pays.

We are measuring hours that are worked and are paid; we are also measuring hours that are not worked but which are paid- things like paid vacation or paid leave. Now all of that should come from the payroll system and be pretty straight forward for most employers. But then every employer also has to take into account special types of unpaid leaves and those hours must be included in the calculations of hours of service. Over time, it’s possible that additional types of leaves could be added to this, SO if you don’t have a good absence management system in place, it’s going to be critical that you implement one and begin tracking it. Shared Responsibility Decisions and Potential Penalties Did the employer have, on average, 100 in ACA full-time employees plus full-time equivalent employees in the prior year? Does the employer offer minimum essential coverage to at least 70% in 2015 (95% in 2016) of its ACA full-time employees?

Employers are now compelled according to ACA demands to ensure that the reporting forms of 1095 reach the hands of all employees. If you have fewer than 50 full-time and FTE employees and don’t offer health coverage, you are not subject to these reporting requirements. If you have fewer than 50 full-time and FTE employees and offer a fully insured health plan, your insurer is responsible for filing the required forms with the IRS and furnishing the forms to your employees. Applicable Large Employers are required to file an information return with the Internal Revenue Service and provide statements to full-time eligible employees about health coverage offered. This is used to administer the Employer Mandate and determines an employee’s eligibility for premium tax credit. While 80% of survey respondents may not have received an IRS penalty notice, it doesn’t mean they won’t. The federal agency has been issuing Letter 226J penalty notices to employers identified as having failed to comply with the ACA’s Employer Mandate for the 2016 tax year, and will continue to do so for subsequent tax years.

To comply, employers and insurers are required to file to the IRS and provide copies to recipients. Greatland has three options, designed to fit your budget and business needs, to file Forms 1095-B and 1095-C to the IRS and send copies to your employees. As the leader in W-2 & 1099 reporting, Greatland has many options to help you complete your ACA reporting. Whether you are looking for paper forms or e-file solutions, we’ll help guide you through the filing process.